- United States

- /

- Specialty Stores

- /

- NasdaqGS:REAL

RealReal (REAL): Assessing Valuation Following High-Profile Executive Departure

Reviewed by Kshitija Bhandaru

See our latest analysis for RealReal.

While RealReal's shares dipped over 7% in the past week following the executive shakeup, there is still notable momentum in the bigger picture. The stock saw a 1-year total shareholder return of 184% and an 85% 3-month share price gain. In both the short and long term, the stock’s volatility has signaled shifting sentiment, keeping risk-aware investors alert to both the upside and the uncertainty.

If recent shakeups have you reevaluating your next move, it could be an ideal time to broaden your search and discover fast growing stocks with high insider ownership

All of this begs the key question: does the current dip leave RealReal undervalued, or has the market already priced in the company’s future potential? Could there be a true buying opportunity, or is optimism already factored in?

Most Popular Narrative: 12.8% Undervalued

With RealReal's most-followed narrative assigning a fair value of $10.83, compared to a last close of $9.45, market bulls may see an opening. The implied upside in today's price comes from several operational drivers and bold top-line projections.

Continuous investment in AI-driven automation (Athena and other initiatives) is delivering ongoing reductions in processing costs per unit and streamlining authentication. This enables scalable operational efficiencies that lower unit costs and support sustained margin expansion and improved EBITDA.

Want to know the growth blueprint behind this high valuation? This narrative leans heavily on the power of automation, breakthrough margin expansion, and ambitious revenue targets that could reset expectations. Curious how these key ingredients combine to set RealReal apart? Dive in to uncover the forecast assumptions shaping this bullish price target.

Result: Fair Value of $10.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower-than-expected tech adoption or a dip in luxury demand could easily challenge this bullish outlook and change the direction of RealReal’s growth trajectory.

Find out about the key risks to this RealReal narrative.

Another View: What Do the Numbers Really Say?

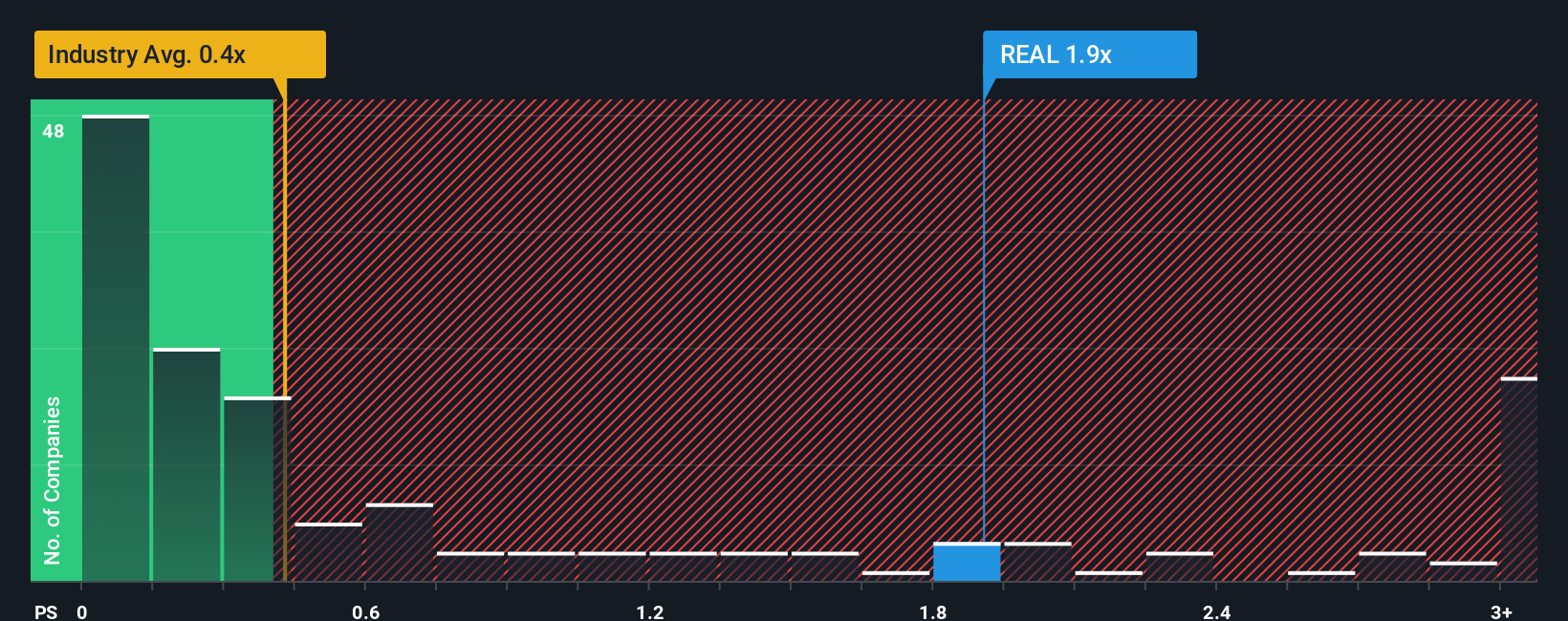

While optimism is high based on fair value projections, a look at the price-to-sales ratio tells a different story. RealReal’s ratio of 1.7x is higher than the peer average of 1.5x and well above the industry’s 0.4x. Even compared to the fair ratio of 1.5x, the stock stands out as expensive. This gap signals less margin for error and could leave investors exposed if growth slows. Are valuations running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RealReal Narrative

If you think there’s another angle to the RealReal story, or you’d rather crunch the numbers yourself, you can quickly create your own perspective in just a few minutes: Do it your way

A great starting point for your RealReal research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Level up your portfolio by targeting the fastest movers and untapped opportunities. The right tools can put you one step ahead in finding your next big winner.

- Capture growth by scanning for promising tech innovators. Start with these 24 AI penny stocks for companies at the forefront of artificial intelligence breakthroughs.

- Earn more from your investments by selecting from these 19 dividend stocks with yields > 3% that deliver reliable income and powerful compounding potential.

- Spot tomorrow’s hidden gems early by uncovering undervalued markets using these 892 undervalued stocks based on cash flows and give your strategy an edge over the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REAL

RealReal

Operates an online marketplace for resale luxury goods worldwide.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives