- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

PDD Holdings (NasdaqGS:PDD) Reports Q4 Sales Growth To ¥110 Billion And Net Income Rising To ¥27 Billion

Reviewed by Simply Wall St

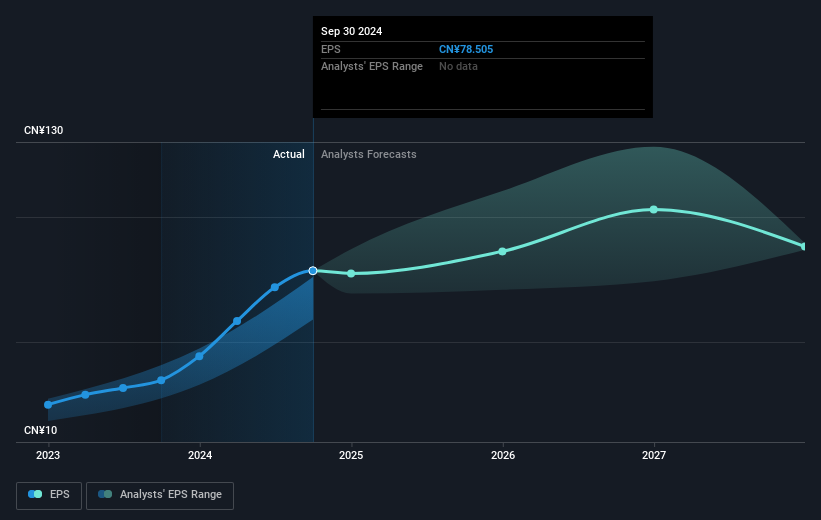

PDD Holdings (NasdaqGS:PDD) recently announced impressive Q4 earnings, reporting a rise in sales to CNY 110,610 million and net income increasing to CNY 27,447 million compared to the previous year. The company's basic and diluted EPS also improved, marking strong profitability. This robust financial performance likely played a significant role in the company's stock price climbing 25% over the last quarter. Despite a broader market environment struggling to maintain a rebound, with major indices like the S&P 500 and Nasdaq showing minor declines, PDD's strong earnings and outlook likely helped it outshine market trends. While the Federal Reserve's steady interest rates and economic expansion projections influenced investor sentiment, PDD's growth stood out. The mixed market performance, including declines in technology stocks, underscored the significance of PDD's positive earnings announcement in driving its stock price advance amidst a mixed economic outlook.

Buy, Hold or Sell PDD Holdings? View our complete analysis and fair value estimate and you decide.

```html

PDD Holdings' shares have seen a substantial 237.95% total return over the last five years, a testament to the company's impressive performance in a mixed economic landscape. During this period, PDD has grown profits consistently, becoming profitable and expanding earnings at a striking 73.1% per year, far outpacing the broader market. This robust growth has been underpinned by the company's capability to maintain high-quality earnings and a Return on Equity of 38.9%, which is considered high. Furthermore, PDD's strong earnings growth of 134.3% over the past year has outperformed the Multiline Retail industry, which grew at 20.4%.

However, the journey hasn't been without hurdles. The past year saw PDD underperform the US Multiline Retail industry by 8.1%, partially influenced by legal challenges such as securities fraud class action lawsuits filed in late 2024. These legal issues, alongside governance changes, including key leadership departures, highlight challenges that have intersected with the company's financial achievements.

```This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group, owns and operates a portfolio of businesses.

Outstanding track record with flawless balance sheet.