- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

PDD Holdings (NasdaqGS:PDD) Reports CNY 27,447 Million Net Income In Q4

Reviewed by Simply Wall St

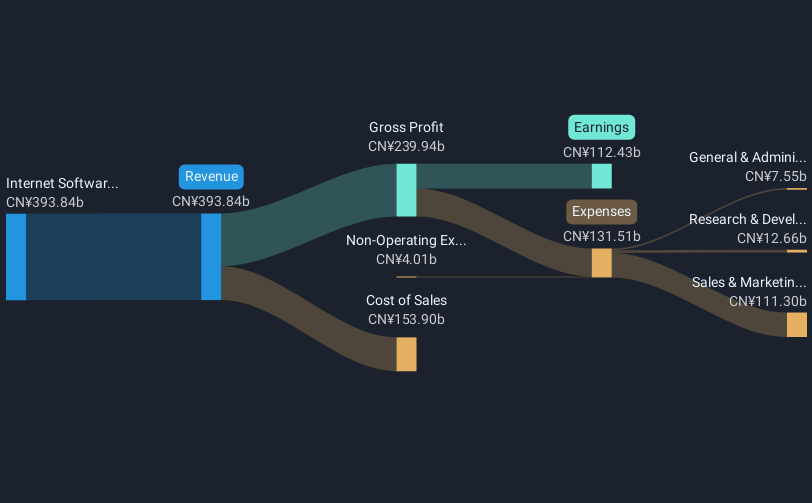

PDD Holdings (NasdaqGS:PDD) recently reported substantial growth in its fourth-quarter sales and net income, with sales rising to CNY 110,610 million and net income reaching CNY 27,447 million. Despite these positive financial indicators, the company's share price experienced a 6% decline over the last quarter. This movement contrasts with a market that has shown a general upward trend, climbing 5.4% in the last week. Although PDD Holdings displayed significant earnings growth, the market's overall positive trajectory suggests external market factors could have buffered earnings-related gains.

Buy, Hold or Sell PDD Holdings? View our complete analysis and fair value estimate and you decide.

The recent financial revelations from PDD Holdings—a reported sales surge to CN¥110.61 billion and net income of CN¥27.45 billion—present a compelling snapshot. Yet, despite these positive financial outcomes, the company's share price slipped 6% in the last quarter. This decline disrupts the company's longer-term robust performance, which saw a total shareholder return of 126.08% over three years. Analyzing this against the broad market, which has generally seen upward momentum, reveals a disconnect that may be influenced by broader market dynamics and not solely on financial metrics.

In the past year, PDD Holdings underperformed against the US market and US Multiline Retail industry, both experiencing returns greater than PDD's own. Still, the multi-year growth view reflects the firm's strong capability in driving shareholder value. The latest price movements, set against the consensus analyst price target of $148.82, indicate that the current share price of $93.98 is at a significant discount to expectations, suggesting potential room for appreciation as market conditions evolve.

Looking ahead, the company's strategic initiatives in supply chain efficiency and ecosystem development have the potential to further elevate revenue and earnings. Analysts expect revenue growth at 16.8% per annum over the next few years, with some disagreement on profit margin forecasts. These numbers are central to analysts' valuations, implying a fair value yet to be fully recognized by the market. As these initiatives mature, they might counterbalance the short-term margin pressures linked to necessary ecosystem and merchant support investments, which could impact profitability if revenue gains are not realized expediently.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade PDD Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group, owns and operates a portfolio of businesses.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives