- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

If EPS Growth Is Important To You, PDD Holdings (NASDAQ:PDD) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in PDD Holdings (NASDAQ:PDD). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide PDD Holdings with the means to add long-term value to shareholders.

PDD Holdings' Improving Profits

In the last three years PDD Holdings' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, PDD Holdings' EPS shot from CN¥44.33 to CN¥80.96, over the last year. Year on year growth of 83% is certainly a sight to behold. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

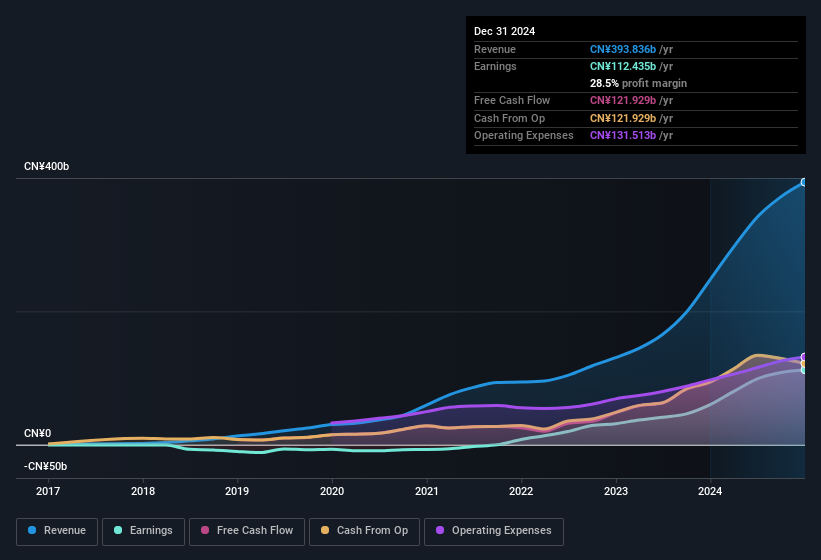

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that PDD Holdings is growing revenues, and EBIT margins improved by 3.8 percentage points to 28%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

See our latest analysis for PDD Holdings

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for PDD Holdings.

Are PDD Holdings Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$144b company like PDD Holdings. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. We note that their impressive stake in the company is worth CN¥46b. That equates to 32% of the company, making insiders powerful and aligned with other shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Should You Add PDD Holdings To Your Watchlist?

PDD Holdings' earnings per share have been soaring, with growth rates sky high. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So at the surface level, PDD Holdings is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Now, you could try to make up your mind on PDD Holdings by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group that owns and operates a portfolio of businesses.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.