- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:MELI

MercadoLibre (MELI): Revisiting Valuation After Strong E-Commerce, Fintech Growth and New Strategic Initiatives

Reviewed by Simply Wall St

MercadoLibre (MELI) just layered fresh fuel onto its growth story by launching a new fixed rate senior unsecured notes offering, giving investors a clearer view into how it plans to fund its expanding ecosystem.

See our latest analysis for MercadoLibre.

Those bond proceeds arrive after a choppy stretch, with a 7 day share price return of 4.25 percent and a 90 day share price return of negative 12.31 percent, while the 3 year total shareholder return of 139.73 percent signals that longer term momentum remains powerful.

If MercadoLibre’s trajectory has you thinking about other platform winners in the region, this could be a good moment to discover fast growing stocks with high insider ownership.

With analysts still seeing roughly 30 to 40 percent upside and discounted cash flow models hinting at intrinsic value above today’s share price, is MercadoLibre quietly on sale, or is the market already baking in that future growth?

Most Popular Narrative Narrative: 26% Undervalued

With MercadoLibre last closing at $2,119.83 against a narrative fair value near $2,847, the story leans on powerful growth and margin expansion assumptions.

Cross platform integration of commerce, fintech, and advertising, demonstrated by accelerated ad revenue growth and enhanced tools for sellers, deepens ecosystem stickiness, reinforcing customer lifetime value and delivering operating leverage that can support above consensus net income and earnings growth.

Curious what kind of revenue surge, margin lift, and future earnings power are baked into that fair value, and how ambitious those forecasts really are? Dive in to see the full blueprint behind this valuation narrative.

Result: Fair Value of $2847.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising credit risk in core markets and intensifying e commerce competition could pressure margins and challenge the bullish assumptions behind that fair value.

Find out about the key risks to this MercadoLibre narrative.

Another Angle on Valuation

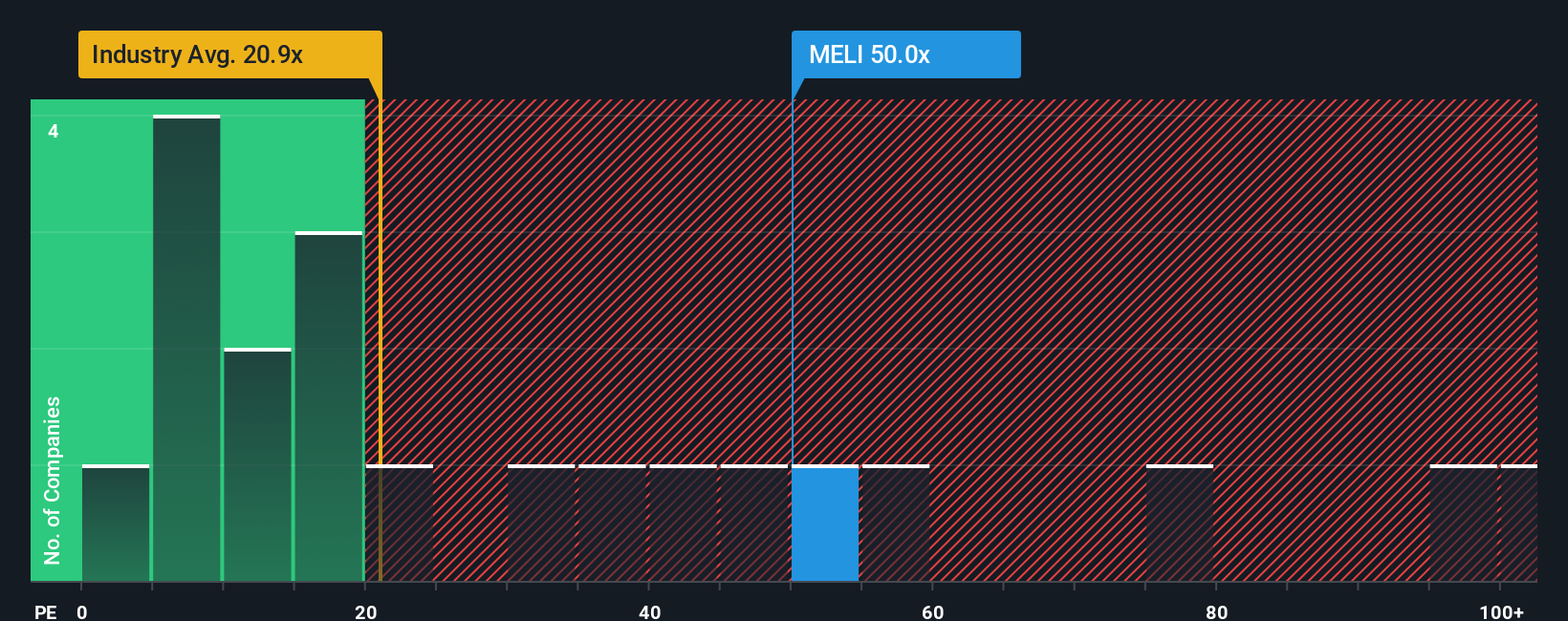

While the narrative and DCF style fair value suggest MercadoLibre is around 27 percent undervalued, the earnings multiple paints a tougher picture. At about 51.7 times earnings versus a 20.1 times industry average and a 34.9 times fair ratio, the stock looks richly priced, raising the question: are you buying growth or paying up for hope?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MercadoLibre Narrative

If this perspective doesn’t quite match your view, or you prefer hands on research, you can create your own narrative in just minutes: Do it your way.

A great starting point for your MercadoLibre research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next edge by scanning fresh opportunities on Simply Wall Street’s Screener, so great setups do not slip past you.

- Capture potential mispricings by targeting companies that look cheap on fundamentals with these 909 undervalued stocks based on cash flows.

- Ride structural trends in automation and machine learning by focusing on these 26 AI penny stocks.

- Strengthen your income stream by zeroing in on these 14 dividend stocks with yields > 3% that can help support long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MELI

MercadoLibre

Operates online commerce platforms in Brazil, Mexico, Argentina, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026