- United States

- /

- Retail Distributors

- /

- NasdaqGS:LKQ

Is LKQ Attractively Priced After a Choppy 2025 and Slowing Auto Demand?

Reviewed by Bailey Pemberton

- Wondering if LKQ is a quietly mispriced opportunity in the auto parts world, or a value trap hiding in plain sight? You are in the right place if you care about what you are actually paying for future cash flows.

- The stock has been choppy, with a 6.2% gain over the last week but still down 2.1% over 30 days, and notably 17.4% lower year to date and 15.5% over the past year, highlighting a long stretch of underperformance.

- Recent headlines have focused on LKQ's ongoing integration efforts from past acquisitions and its push to streamline operations across European and North American markets, reinforcing its role as a major consolidator in the aftermarket auto parts space. At the same time, investors are weighing macro worries such as slowdowns in vehicle sales and repair activity, which can shape expectations for LKQ's long term growth and pricing power.

- Despite that mixed sentiment backdrop, LKQ currently scores a strong 6/6 on our valuation checks. This suggests the market may be overlooking value that different methods, and a more nuanced framework we will get to at the end of this article, are starting to reveal.

Find out why LKQ's -15.5% return over the last year is lagging behind its peers.

Approach 1: LKQ Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and discounting those cash flows back to the present. For LKQ, the model used is a 2 stage Free Cash Flow to Equity approach, based on cash flows available to shareholders.

LKQ generated around $661.7 Million in free cash flow over the last twelve months. Analyst forecasts and extrapolations suggest this could grow to about $1.15 Billion in annual free cash flow by 2035, with intermediate years gradually stepping up from the current level. Simply Wall St uses direct analyst estimates where available and then assumes a moderating growth path in the later years.

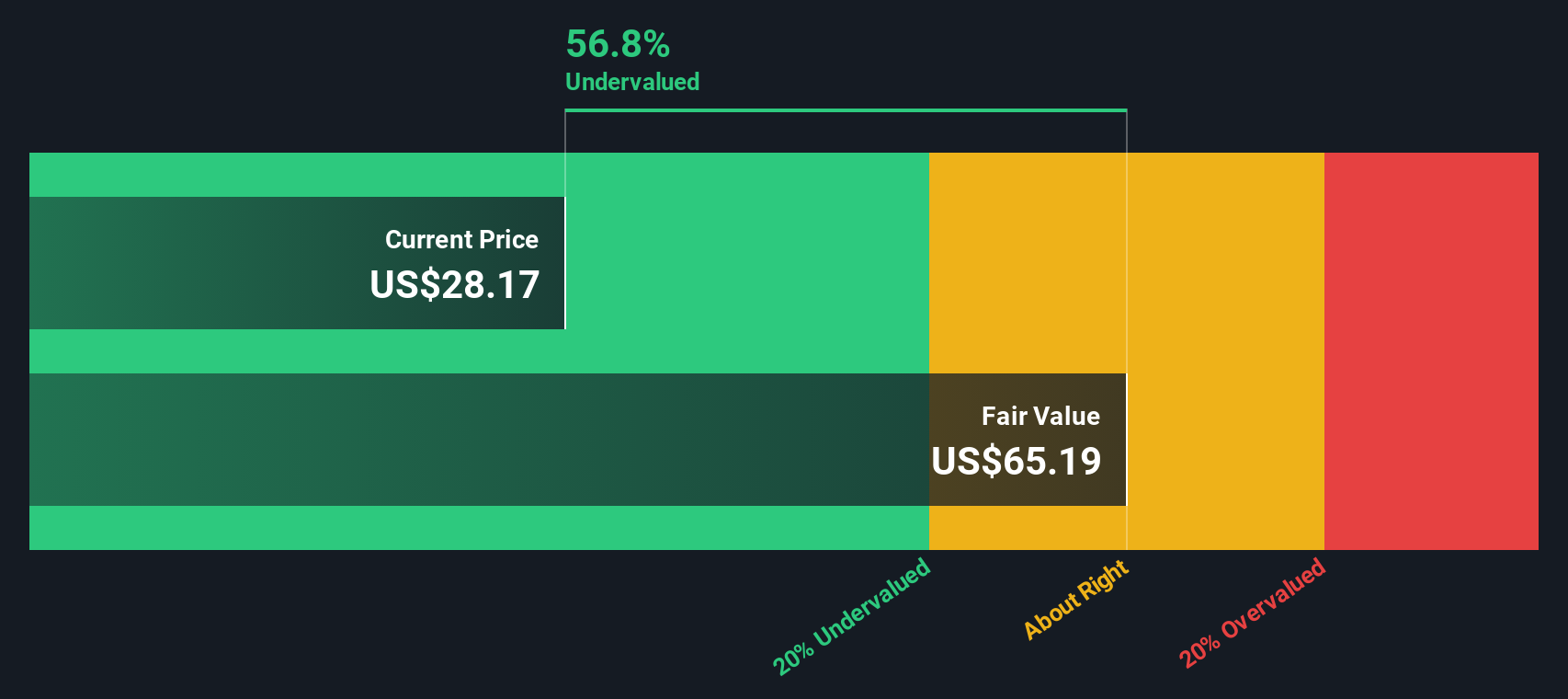

Bringing all those projected cash flows back to today results in an estimated intrinsic value of roughly $66.53 per share. With the DCF implying the stock is about 55.0% undervalued relative to its current trading price, the model indicates a sizeable valuation gap that may not yet be fully appreciated by the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests LKQ is undervalued by 55.0%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: LKQ Price vs Earnings

For profitable companies like LKQ, the price to earnings ratio is a practical way to gauge what investors are paying for each dollar of current earnings. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or elevated risk usually mean the stock should trade on a lower multiple.

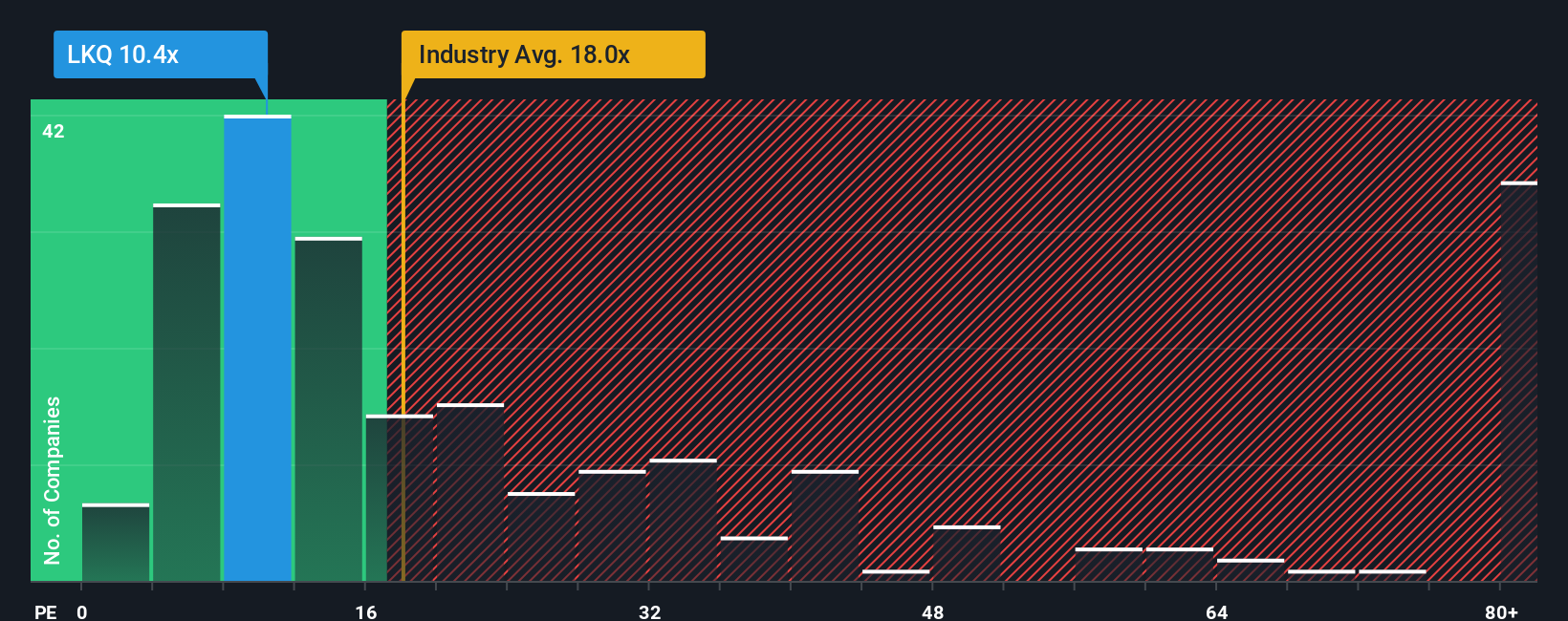

LKQ currently trades on about 11.0x earnings, which is well below the Retail Distributors industry average of roughly 17.9x and far under the broader peer group average of around 40.6x. To go beyond simple comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what LKQ’s PE should be after factoring in its earnings growth outlook, profitability, risk profile, industry positioning and market cap. For LKQ, this Fair Ratio sits at about 16.2x.

Because the Fair Ratio blends company specific fundamentals with its industry and risk characteristics, it offers a more tailored benchmark than raw peer or sector averages. With LKQ’s actual PE of 11.0x sitting notably below the 16.2x Fair Ratio, the multiple based view points to the shares trading at a meaningful discount.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1457 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your LKQ Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple stories that investors create to connect their view of a company with a set of numbers like future revenue, earnings, margins and ultimately a fair value estimate. A Narrative links three things together: what you believe is happening in LKQ’s business, how that translates into a financial forecast, and what price you think is fair compared with today’s market price. On Simply Wall St, Narratives are easy to use and live on the Community page, where millions of investors can share and compare their views, then quickly see whether their Fair Value suggests LKQ is a buy, hold, or sell at the current price. Because Narratives are dynamically updated when new information flows in, such as earnings results or major news, your fair value view evolves automatically rather than staying frozen in time. For example, one LKQ Narrative might assume steady mileage growth and margin expansion to reach a fair value near 52.8 dollars per share, while a more cautious Narrative focused on European challenges and slower growth might land closer to 41.2 dollars per share.

Do you think there's more to the story for LKQ? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LKQ

LKQ

Engages in the distribution of replacement parts, components, and systems used in the repair and maintenance of vehicles and specialty vehicle aftermarket products and accessories.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)