- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:GRPN

Groupon, Inc. (NASDAQ:GRPN) Stock Rockets 39% As Investors Are Less Pessimistic Than Expected

Groupon, Inc. (NASDAQ:GRPN) shares have continued their recent momentum with a 39% gain in the last month alone. The last month tops off a massive increase of 177% in the last year.

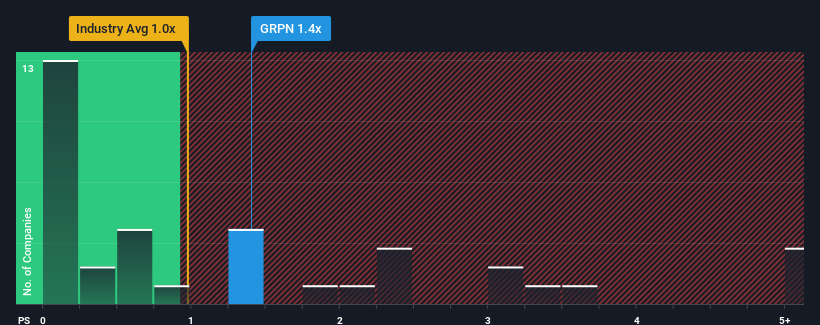

Even after such a large jump in price, it's still not a stretch to say that Groupon's price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" compared to the Multiline Retail industry in the United States, where the median P/S ratio is around 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Groupon

How Groupon Has Been Performing

Groupon could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Groupon's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Groupon?

Groupon's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 22%. The last three years don't look nice either as the company has shrunk revenue by 69% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 6.2% per year over the next three years. With the industry predicted to deliver 13% growth per annum, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Groupon is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Groupon's P/S

Groupon appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that Groupon's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Groupon that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GRPN

Groupon

Operates a marketplace that connects consumers to merchants by offering goods and services at a discount in North America and international.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives