- United States

- /

- Banks

- /

- NasdaqGS:GSBC

Uncovering Hidden Opportunities In US With These 3 Undiscovered Gems

Reviewed by Simply Wall St

The United States market remained flat over the last week but has shown a 5.7% increase over the past year, with earnings forecasted to grow by 13% annually. In this environment, uncovering stocks that are not yet widely recognized but have solid fundamentals and growth potential can present unique opportunities for investors seeking to capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 32.14% | 14.78% | 4.37% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

GigaCloud Technology (NasdaqGM:GCT)

Simply Wall St Value Rating: ★★★★★★

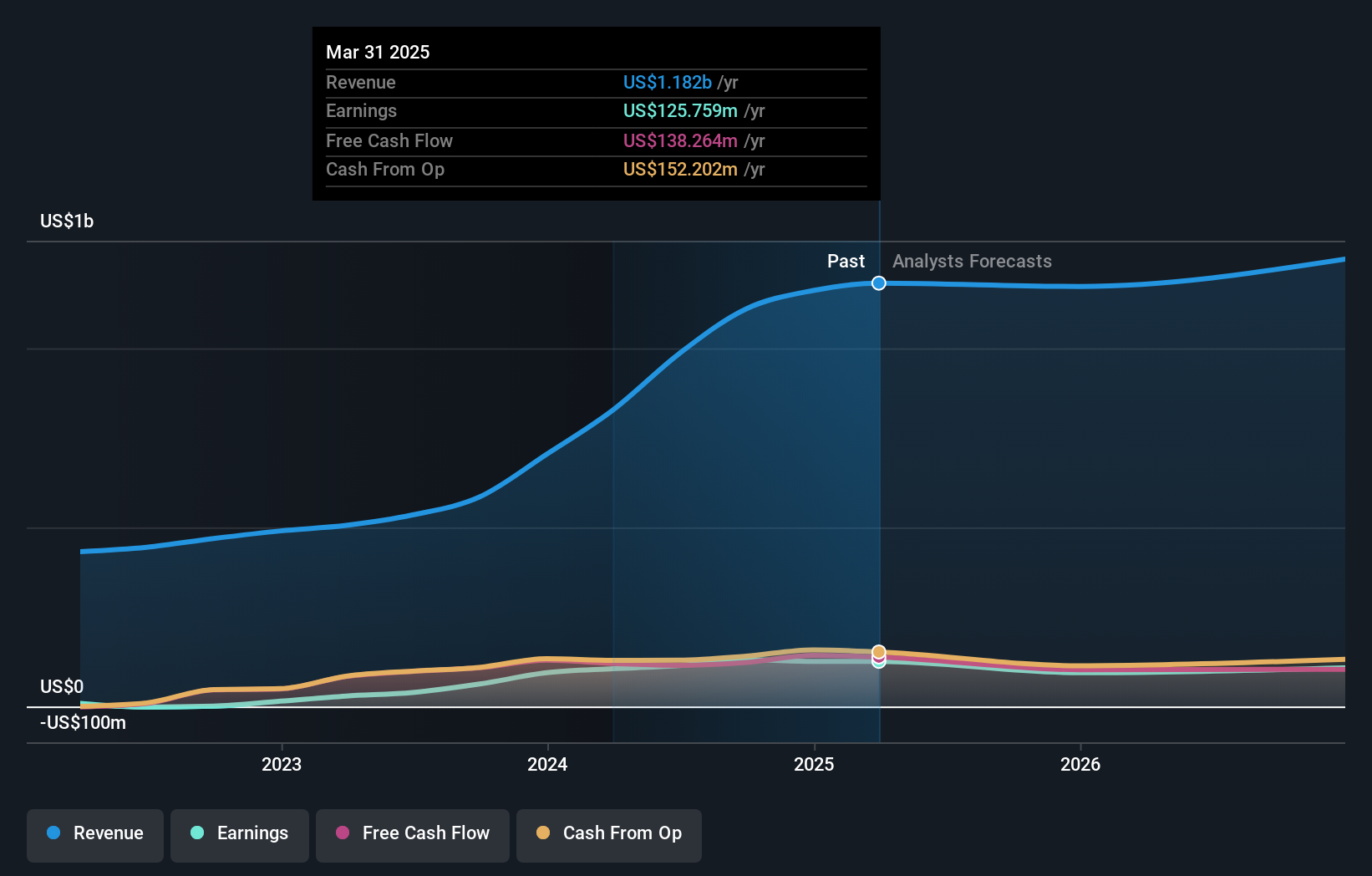

Overview: GigaCloud Technology Inc. offers comprehensive B2B ecommerce solutions for large parcel merchandise across the United States and internationally, with a market cap of approximately $482.80 million.

Operations: GigaCloud Technology Inc. generates revenue primarily from its online retailers segment, which accounts for approximately $1.16 billion. The company's financial performance is highlighted by a focus on large parcel merchandise in the B2B ecommerce space across various regions.

GigaCloud Technology, a dynamic player in the B2B e-commerce space, is making strategic moves with recent expansions and partnerships. The company reported full-year revenue of US$1.16 billion, up from US$703.83 million previously, while net income rose to US$125.81 million from US$94.11 million. Despite these gains, their quarterly net income slipped to US$30.96 million from the prior year's US$35.58 million due to macroeconomic challenges like high interest rates and declining consumer spending on furniture. GigaCloud is debt-free and recently increased its buyback plan by $16 million to $62 million overall, reflecting confidence in its valuation potential amidst market skepticism about future earnings growth prospects.

Great Southern Bancorp (NasdaqGS:GSBC)

Simply Wall St Value Rating: ★★★★★★

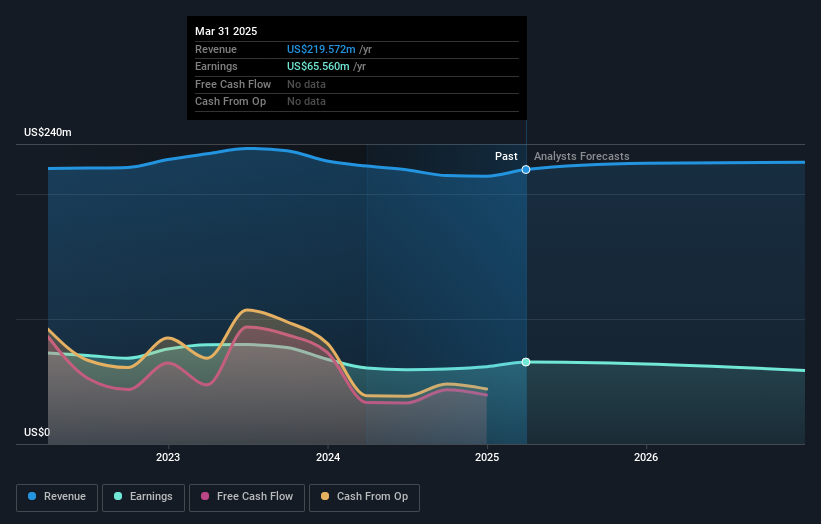

Overview: Great Southern Bancorp, Inc. is a bank holding company for Great Southern Bank, offering a variety of financial services across the United States, with a market cap of $602.55 million.

Operations: Great Southern Bancorp generates revenue primarily through interest income from loans and investments, along with fees for various banking services. The bank's cost structure includes interest expenses on deposits and borrowings, as well as non-interest expenses related to operations. It has reported a net profit margin of 27.43%, reflecting its profitability after accounting for all costs and expenses.

Great Southern Bancorp, a bank holding company, has demonstrated robust earnings growth of 7.9% over the past year, outpacing the industry average. With total assets of US$6 billion and equity of US$613 million, it maintains a strong financial position. The bank's loan portfolio stands at US$4.7 billion with an allowance for bad loans at 0.07%, showcasing prudent risk management. Recent stock repurchases totaling 730,115 shares for US$38.84 million indicate confidence in future performance despite potential challenges from rising funding costs and declining deposits that could impact profitability moving forward.

Liquidity Services (NasdaqGS:LQDT)

Simply Wall St Value Rating: ★★★★★★

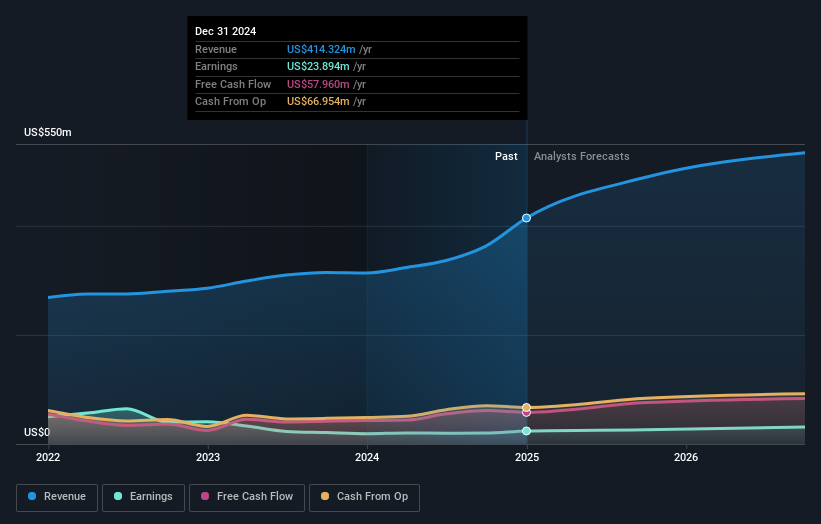

Overview: Liquidity Services, Inc. operates e-commerce marketplaces and offers auction listing tools and value-added services both in the United States and internationally, with a market capitalization of approximately $962.22 million.

Operations: Liquidity Services generates revenue primarily from its Retail Supply Chain Group (RSCG) segment, which contributes $276.96 million, followed by GovDeals at $81.18 million and Capital Assets Group (CAG) at $39.69 million. The Machinio segment adds another $16.57 million to the company's revenue streams.

Liquidity Services, a nimble player in the e-commerce auction space, has shown impressive financial agility. With earnings growth of 26% over the past year, it outpaced its industry peers significantly. The company is debt-free and boasts high-quality earnings, providing a stable foundation for future endeavors. Recent strategic partnerships and acquisitions are set to enhance its market reach and service offerings, particularly in specialized sectors like life sciences. Despite significant insider selling recently, Liquidity Services trades at nearly 60% below estimated fair value, presenting potential upside as it continues to expand its footprint and improve profitability metrics.

Key Takeaways

- Get an in-depth perspective on all 287 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GSBC

Great Southern Bancorp

Operates as a bank holding company for Great Southern Bank that provides a range of financial services in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives