- United States

- /

- Semiconductors

- /

- NasdaqGS:PDFS

3 US Growth Companies With High Insider Ownership Seeing Up To 39% Revenue Growth

Reviewed by Simply Wall St

As the U.S. stock market continues its upward trajectory, buoyed by strong earnings reports and investor optimism, major indices like the Dow Jones Industrial Average and the S&P 500 are approaching record highs. In this environment of growth and opportunity, companies with high insider ownership can be particularly appealing as they often signal confidence from those most familiar with their operations, especially when these companies are experiencing significant revenue growth.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 48% |

| Smith Micro Software (NasdaqCM:SMSI) | 23.1% | 85.4% |

| CarGurus (NasdaqGS:CARG) | 16.9% | 42.4% |

| Similarweb (NYSE:SMWB) | 25.4% | 126.3% |

Here's a peek at a few of the choices from the screener.

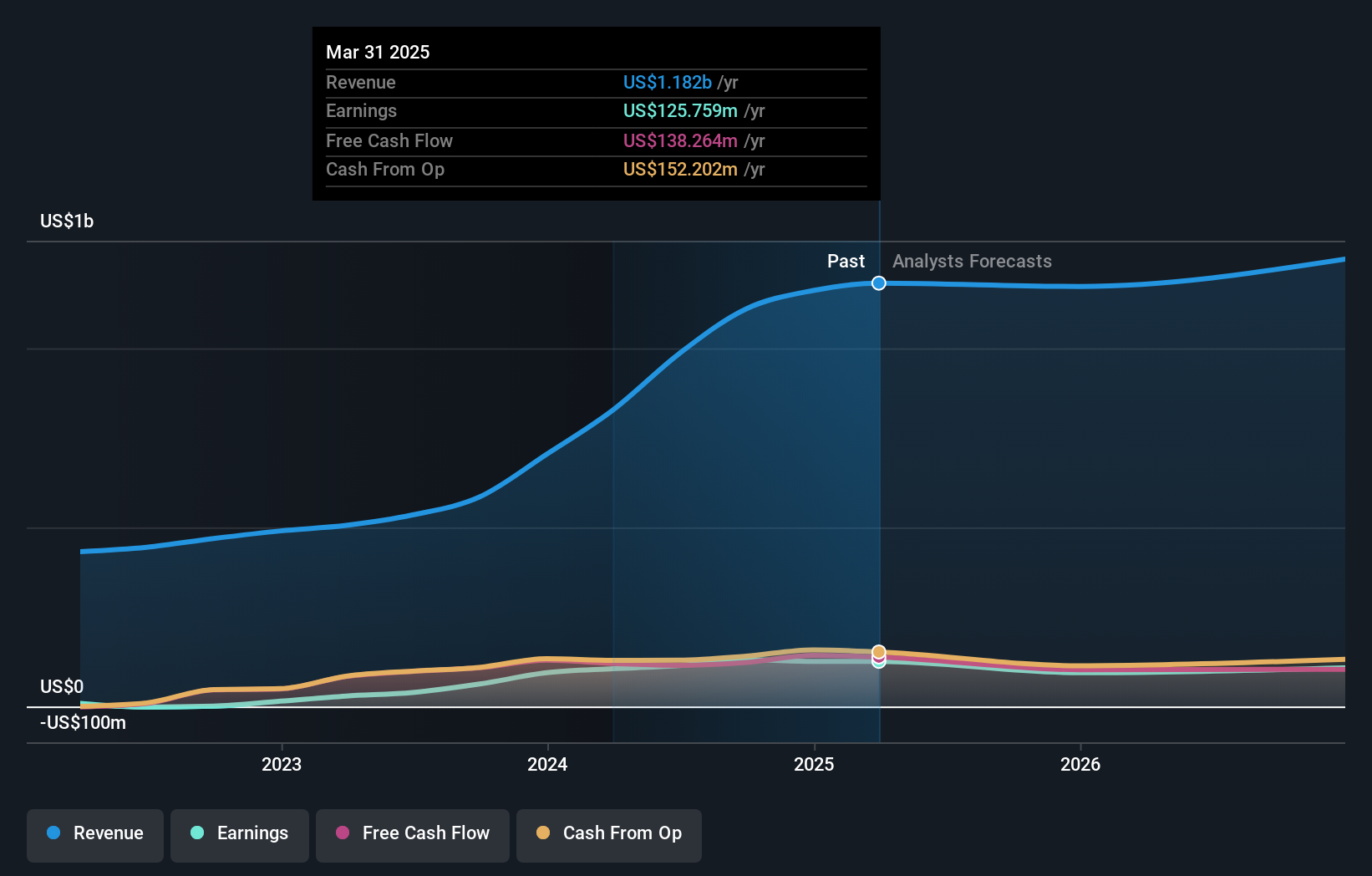

GigaCloud Technology (NasdaqGM:GCT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: GigaCloud Technology Inc. offers comprehensive B2B ecommerce solutions for large parcel merchandise both in the United States and internationally, with a market cap of approximately $812.47 million.

Operations: Revenue from online retailers amounts to approximately $1.11 billion.

Insider Ownership: 27.9%

Revenue Growth Forecast: 16.5% p.a.

GigaCloud Technology, with significant insider ownership, is experiencing robust earnings growth, forecasted at 22% annually—outpacing the US market. Despite a volatile share price recently, insiders have shown confidence by purchasing more shares than selling in the past three months. The company trades at a good value compared to peers and is 76% below its estimated fair value. Recent board changes and strong Q3 results underscore its strategic positioning in the technology sector.

- Dive into the specifics of GigaCloud Technology here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that GigaCloud Technology is priced lower than what may be justified by its financials.

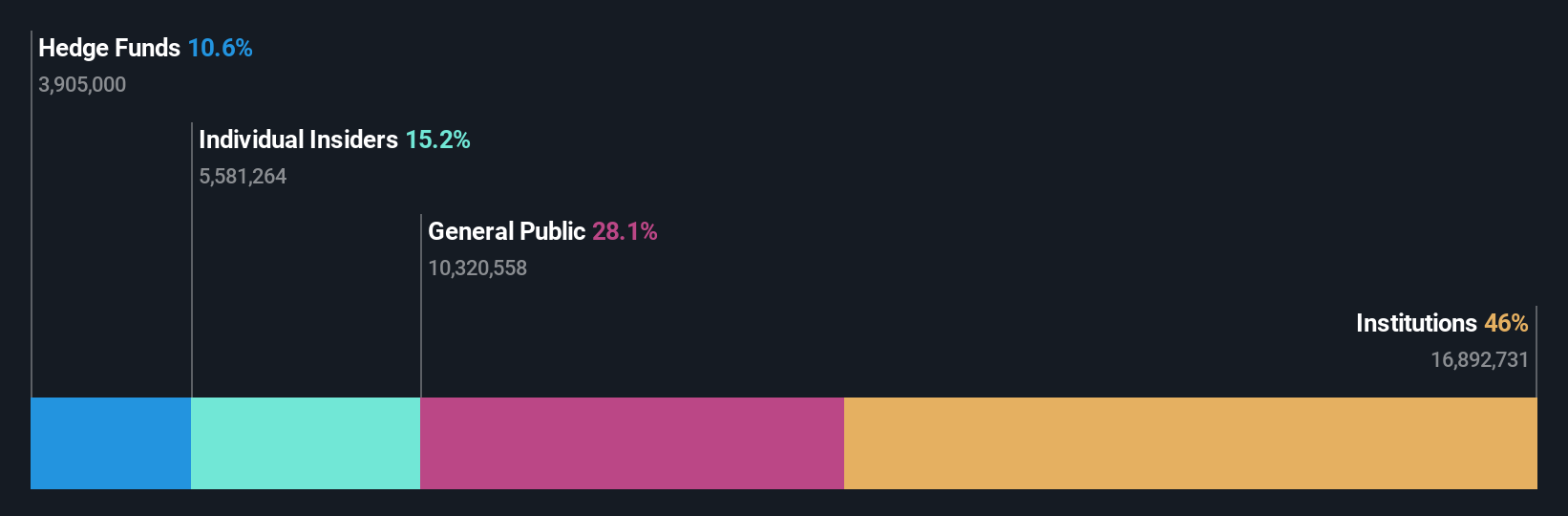

Harrow (NasdaqGM:HROW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Harrow, Inc. is an eyecare pharmaceutical company focused on the discovery, development, and commercialization of ophthalmic products with a market cap of approximately $1.21 billion.

Operations: The company generates revenue from its segment focused on the discovery, development, and commercialization of innovative ophthalmic therapies amounting to $133.22 million.

Insider Ownership: 13.7%

Revenue Growth Forecast: 39.2% p.a.

Harrow is experiencing substantial revenue growth, projected at 39.2% annually, surpassing the US market average. Analysts anticipate a significant stock price increase of 65.8%. Despite recent losses, Harrow's strategic moves include appointing Dr. Amir Shojaei as CSO to enhance its ophthalmic product development and expanding access through partnerships with Asembia and GoodRx. Trading well below estimated fair value, Harrow's initiatives aim to improve accessibility and affordability in the eyecare sector.

- Click here and access our complete growth analysis report to understand the dynamics of Harrow.

- The analysis detailed in our Harrow valuation report hints at an deflated share price compared to its estimated value.

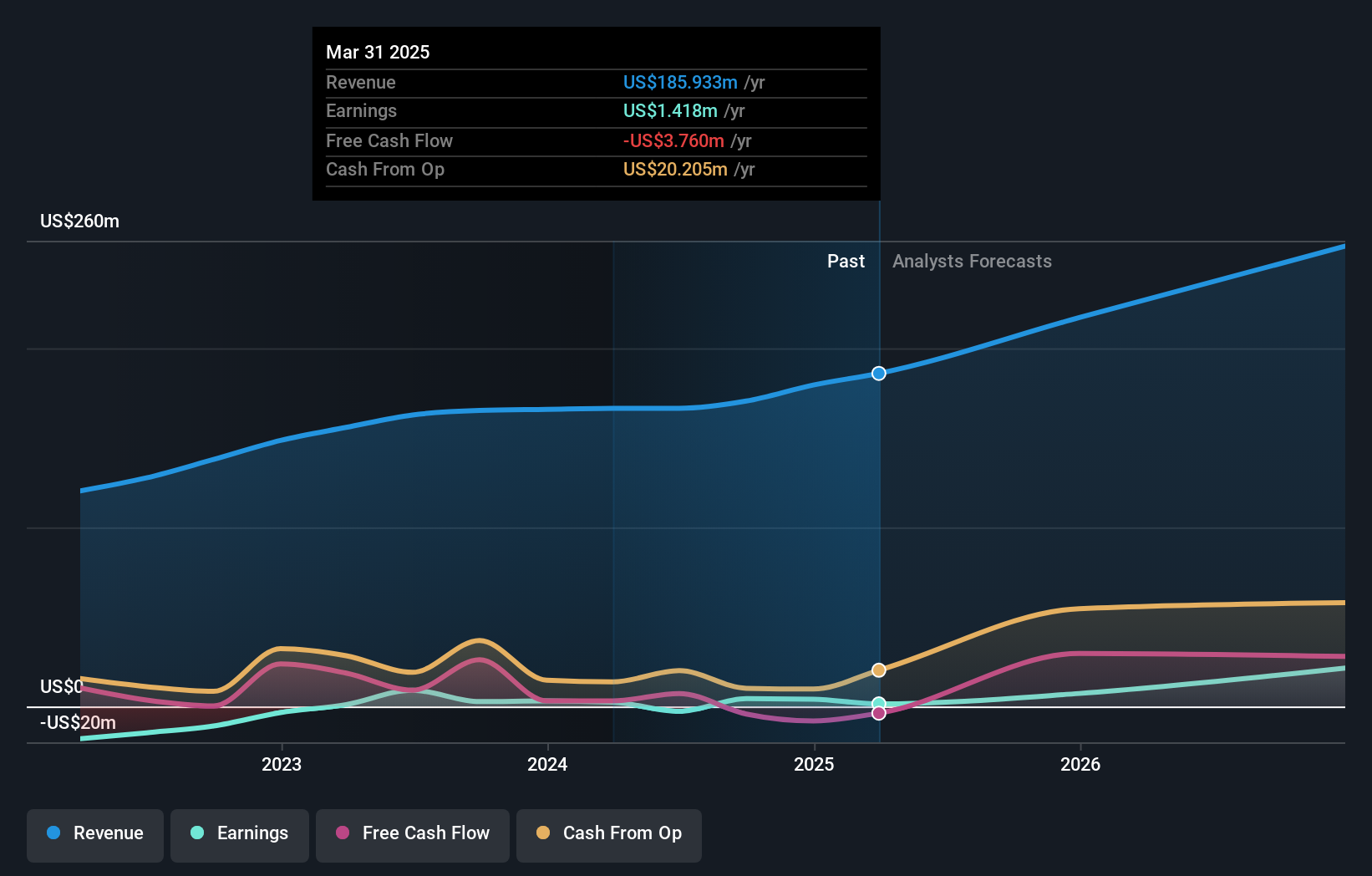

PDF Solutions (NasdaqGS:PDFS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PDF Solutions, Inc. offers proprietary software, intellectual property products for integrated circuit designs, measurement hardware tools, methodologies, and professional services globally with a market cap of approximately $1.08 billion.

Operations: The company generates revenue of $170.51 million from its software and programming segment.

Insider Ownership: 17.4%

Revenue Growth Forecast: 18.6% p.a.

PDF Solutions has demonstrated robust earnings growth of 63.1% over the past year, with expectations for continued significant earnings expansion at 73.81% annually, outpacing the US market average. Despite insider selling in recent months, no substantial insider buying occurred. Revenue is forecasted to grow at 18.6% per year, faster than the US market but below its long-term target of 20%. Analysts agree on a potential stock price increase of 44.8%.

- Navigate through the intricacies of PDF Solutions with our comprehensive analyst estimates report here.

- Our valuation report here indicates PDF Solutions may be overvalued.

Turning Ideas Into Actions

- Unlock our comprehensive list of 206 Fast Growing US Companies With High Insider Ownership by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade PDF Solutions, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDFS

PDF Solutions

Provides proprietary software, physical intellectual property for integrated circuit designs, electrical measurement hardware tools, proven methodologies, and professional services in the United States, Japan, China, Taiwan, and internationally.

Flawless balance sheet with proven track record.