- United States

- /

- Specialty Stores

- /

- NasdaqGS:FIVE

Five Below (FIVE) Q3: Revenue Beat Keeps 7% Net Margin Narrative Under Scrutiny

Reviewed by Simply Wall St

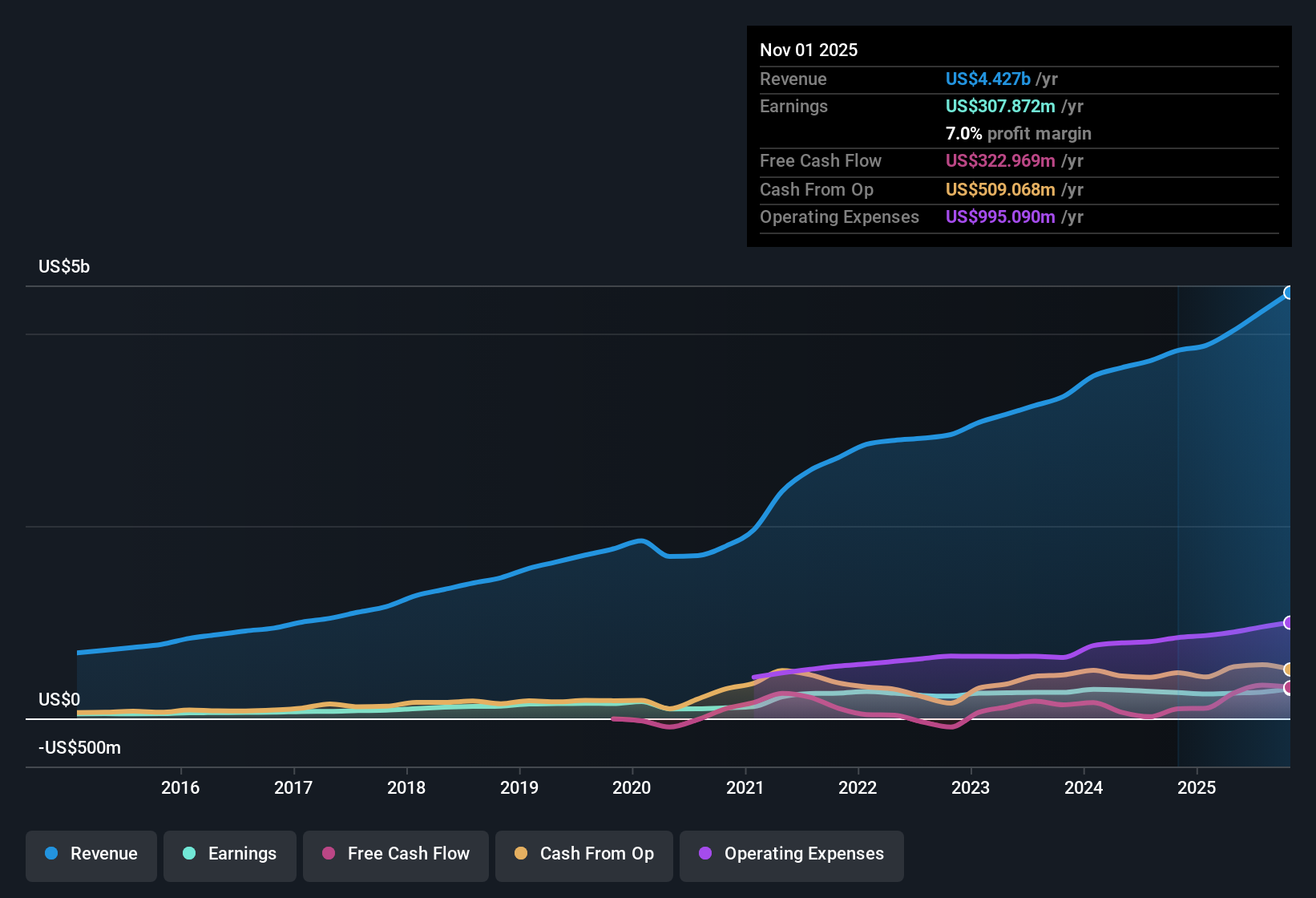

Five Below (FIVE) just posted its Q3 2026 report with revenue of about $1.0 billion and EPS of $0.66, alongside net income of roughly $36.5 million as the discount retailer heads into the crucial holiday stretch. The company has seen quarterly revenue move from about $843.7 million in Q3 2025 to $1.0 billion in Q3 2026, while quarterly EPS shifted from near flat at $0.03 in Q3 2025 to $0.66 this quarter. This sets up a story where investors will be weighing solid topline scale against how much profit actually flows through. Overall, the latest print keeps margins in focus as traders watch how efficiently those higher sales are translating into bottom line performance.

See our full analysis for Five Below.With the numbers on the table, the next step is to compare this quarter’s performance with the dominant Five Below narratives and see which storylines the latest margins and growth really support.

See what the community is saying about Five Below

Trailing EPS Growth Outpaces Store Level Volatility

- On a trailing 12 month basis, EPS has climbed from $4.61 to $5.59 while quarterly EPS bounced between $0.03 and $3.41 over the last five reported quarters.

- Consensus narrative leans on operational simplification and value focused merchandising to support durable growth, and the last year of earnings adds weight to that view but also shows how choppy the path can be:

- EPS over the past year grew 14.7% and has compounded about 8.3% annually over five years, yet individual quarters still swing sharply, such as Q3 2025 at $0.03 versus Q4 2025 at $3.41.

- Same store sales growth moved from 0.6% in Q3 2025 to 12.4% in Q2 2026, which fits the growth story but also highlights that execution on traffic and ticket needs to stay consistently strong for that narrative to hold.

7 percent Net Margin Puts Focus On Scale Not Pricing Power

- Trailing net profit margin sits at 7% and is unchanged from last year, even as trailing revenue increased from about $3.9 billion to $4.4 billion and TTM net income rose from roughly $253.6 million to $307.9 million.

- Bulls argue that efficiency and inventory discipline will expand margins over time, but the flat 7% margin and tariff and labor headwinds in the consensus narrative keep that claim on probation for now:

- Recent periods show net income growing from about $253.6 million to $307.9 million largely alongside higher sales, which lines up with a scale driven story rather than obvious margin expansion.

- Analysts still model profit margins slipping from around 6.5% to 6.2% over the next few years, and the unchanged 7% trailing margin supports that more cautious profitability trajectory rather than a rapid margin lift.

30 point 2 times P E And DCF Fair Value Diverge

- Five Below trades at 30.2 times trailing earnings versus an industry average of 18.5 times and a peer average of 38.3 times, while DCF fair value of about $78.79 sits well below the current $168.42 share price and below the 179.76 analyst target.

- Bears point to rich valuation and slower than market growth forecasts, and the current metrics give them concrete numbers to work with:

- Revenue and earnings are forecast to grow about 9.4% and 8.6% per year, both below broader US market expectations, yet the stock still commands a premium multiple to the specialty retail group.

- The wide gap between the $168.42 share price and $78.79 DCF fair value, even with an analyst target of 179.76, underlines how sensitive the story could be if growth or margin delivery drifts below those projections.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Five Below on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers through a different lens? Use that angle to shape your own narrative in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Five Below.

See What Else Is Out There

Five Below’s flat margins, premium valuation, and choppy quarterly earnings leave little room for execution missteps or disappointment against already rich expectations.

If that combination feels too fragile, use our these 909 undervalued stocks based on cash flows to quickly redirect your attention toward companies where price, growth, and risk look more sensibly aligned today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIVE

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026