- United States

- /

- Specialty Stores

- /

- NasdaqGS:EVGO

Loss-making EVgo (NASDAQ:EVGO) has seen earnings and shareholder returns follow the same downward trajectory over past -45%

EVgo, Inc. (NASDAQ:EVGO) shareholders should be happy to see the share price up 27% in the last week. But that doesn't change the fact that the returns over the last year have been less than pleasing. In fact, the price has declined 45% in a year, falling short of the returns you could get by investing in an index fund.

The recent uptick of 27% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for EVgo

EVgo isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

EVgo grew its revenue by 278% over the last year. That's a strong result which is better than most other loss making companies. Given the revenue growth, the share price drop of 45% seems quite harsh. Our sympathies to shareholders who are now underwater. On the bright side, if this company is moving profits in the right direction, top-line growth like that could be an opportunity.

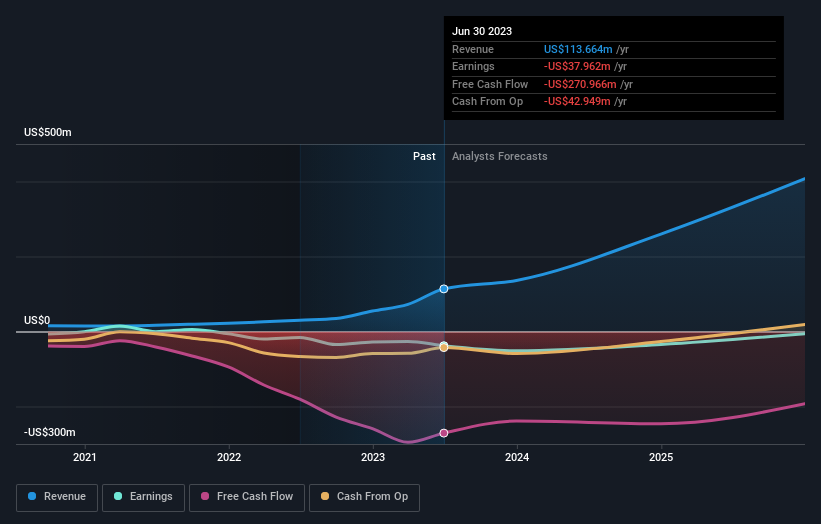

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

EVgo is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for EVgo in this interactive graph of future profit estimates.

A Different Perspective

Given that the market gained 8.6% in the last year, EVgo shareholders might be miffed that they lost 45%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 17% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand EVgo better, we need to consider many other factors. Even so, be aware that EVgo is showing 4 warning signs in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if EVgo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EVGO

EVgo

Owns and operates a direct current fast charging network for electric vehicles in the United States.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives