- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:ETSY

Etsy (ETSY): Evaluating Valuation After OpenAI ChatGPT Integration Sparks Investor Optimism

Reviewed by Kshitija Bhandaru

Etsy (ETSY) shares surged nearly 16% after news broke that the company will integrate with OpenAI’s ChatGPT using the Instant Checkout feature. This move allows ChatGPT users to purchase Etsy products directly within their conversations.

See our latest analysis for Etsy.

Etsy’s sharp climb following the ChatGPT integration comes after several attention-grabbing headlines, including a move to the New York Stock Exchange and ongoing debate around new state tax rules for marketplaces. While the one-day share price jump was impressive, Etsy’s total shareholder return over the past year sits at just 0.36%, underscoring the longer-term challenges the company has faced. Still, this latest burst of momentum has investors watching whether Etsy can convert fresh interest into sustained growth.

If you’re curious about what’s next in retail tech or want to widen your investing focus, check out the companies featured in our fast growing stocks with high insider ownership.

But with Etsy’s stock now trading well above recent analyst targets and expectations for AI-driven growth running high, investors are left wondering if there is real upside left, or if future success has already been priced in.

Most Popular Narrative: 11% Overvalued

The narrative's fair value estimate suggests Etsy's recent rally has left shares trading above consensus expectations, even amid a surge of AI-fueled optimism.

Expansion of direct marketing and app-based engagement, with the Etsy app now accounting for nearly 45% of total GMS and providing a higher customer LTV, is an operational pivot that is expected to increase buyer retention, loyalty, and overall platform stickiness. These factors contribute to longer-term revenue and margin expansion.

Want to know what profit margins and growth rates are factored into this fair value? There is a twist behind the high valuation. The most closely watched assumptions might surprise you. Why are analysts betting on a dramatic shift in platform economics? Dive in to uncover which datapoints are driving this controversial narrative.

Result: Fair Value of $65.12 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in gross merchandise sales and falling active buyer numbers could quickly undermine the optimistic outlook for Etsy’s future growth.

Find out about the key risks to this Etsy narrative.

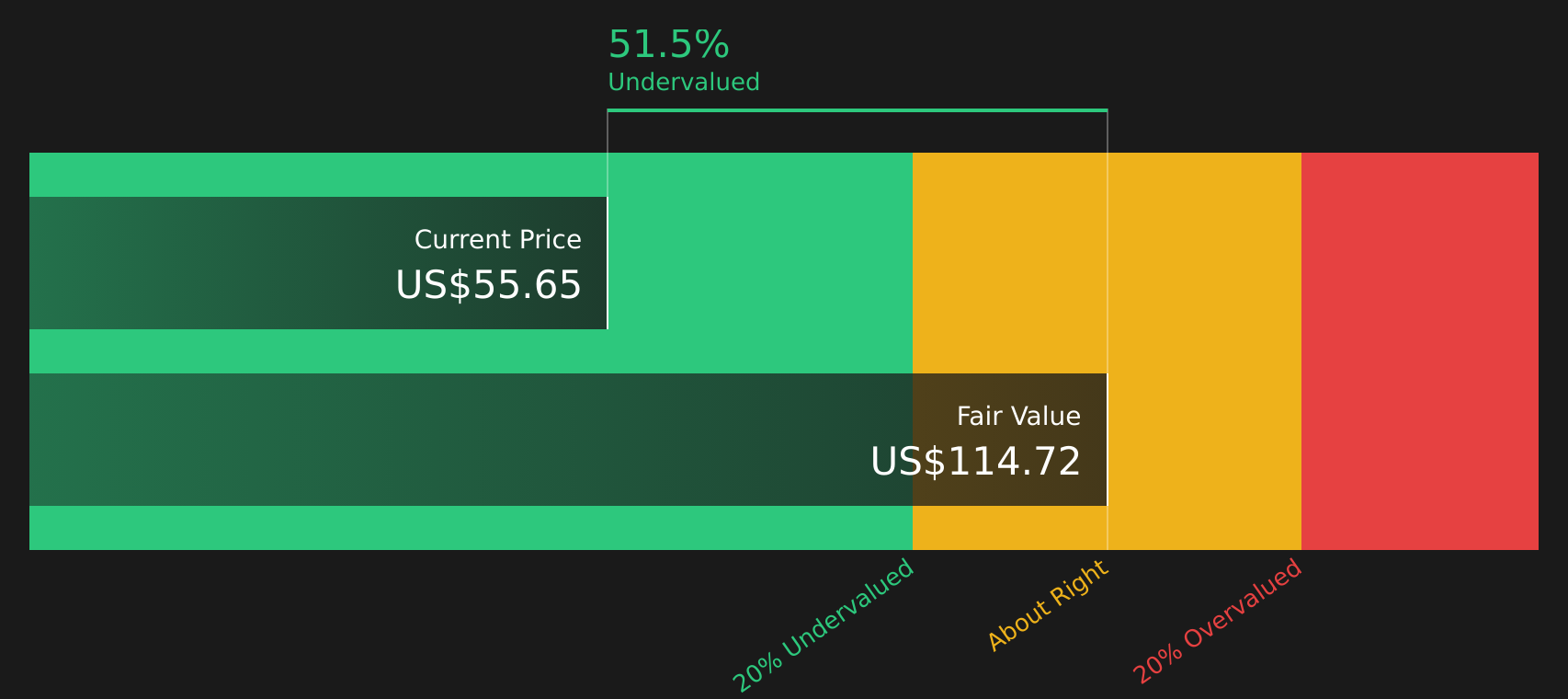

Another View: Discounted Cash Flow Points to Undervaluation

While analyst targets indicate that Etsy’s stock is overvalued based on earnings growth and peer multiples, our DCF model presents a very different perspective. Using future cash flows, the SWS DCF model estimates fair value at $122.12, which is significantly above the current price. That creates a large gap, so which method might be more accurate?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Etsy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Etsy Narrative

You can dig into the numbers and trends yourself to develop your own perspective in just a few minutes. It has never been easier to put your research and ideas together, your way with Do it your way.

A great starting point for your Etsy research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the next big opportunity slip by. Take action today and unlock new insights beyond Etsy by screening for standout stocks across emerging trends.

- Accelerate your search for the next market disruptor and explore potential with these 24 AI penny stocks on the cutting edge of artificial intelligence.

- Unlock strong passive income by checking out these 19 dividend stocks with yields > 3% offering yields above 3% for growth and stability.

- Focus on how innovators are changing medicine by reviewing these 32 healthcare AI stocks advancing healthcare through breakthroughs in AI-driven diagnostics and therapies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Etsy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ETSY

Etsy

Operates two-sided online marketplaces that connect buyers and sellers worldwide.

Moderate risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives