- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:EBAY

eBay Stock Gains 47% in 2025 as Valuation Debate Heats Up

Reviewed by Bailey Pemberton

So, you are wondering whether now might be the right time to make a move on eBay stock? You are not alone. Investors have been keeping a close eye on eBay, especially as its share price continues to surprise even the seasoned analysts. This year alone, eBay has charged ahead with a remarkable 47.4% gain so far, and over the past three years, it is up an eye-popping 159.2%. While there have been some recent pullbacks, like a mild -1.0% over the past month, the longer-term trend is undeniably strong. Much of this optimism comes as the broader online retail market navigates new consumer behaviors and eBay itself finds ways to keep its marketplace relevant, connecting buyers and sellers in every imaginable category of goods.

As momentum gathers, though, the question turns to value. Is eBay’s current price justified, or are we seeing more excitement than substance? That is where the numbers start to tell an interesting story. When we put eBay through six different valuation checks, it scored a solid 4 out of 6, signaling that the company is undervalued based on four separate metrics. For anyone wondering if eBay's continued climb is sustainable, these checks provide fascinating clues.

Next, we are going to break down exactly how these valuation models work, what they reveal about eBay, and why there might be an even better way to assess whether to buy, sell, or hold. Let’s dig into the details.

Approach 1: eBay Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting those amounts back to today, reflecting the time value of money. For eBay, this approach reveals intriguing insights about the company's intrinsic worth.

Currently, eBay generates Free Cash Flow of $1.42 billion. Analysts forecast steady growth, with Free Cash Flow expected to reach $3.66 billion by the end of 2029. While analyst estimates are available for the next five years, projections beyond that are extended using financial modeling techniques, which paints a picture of ongoing expansion.

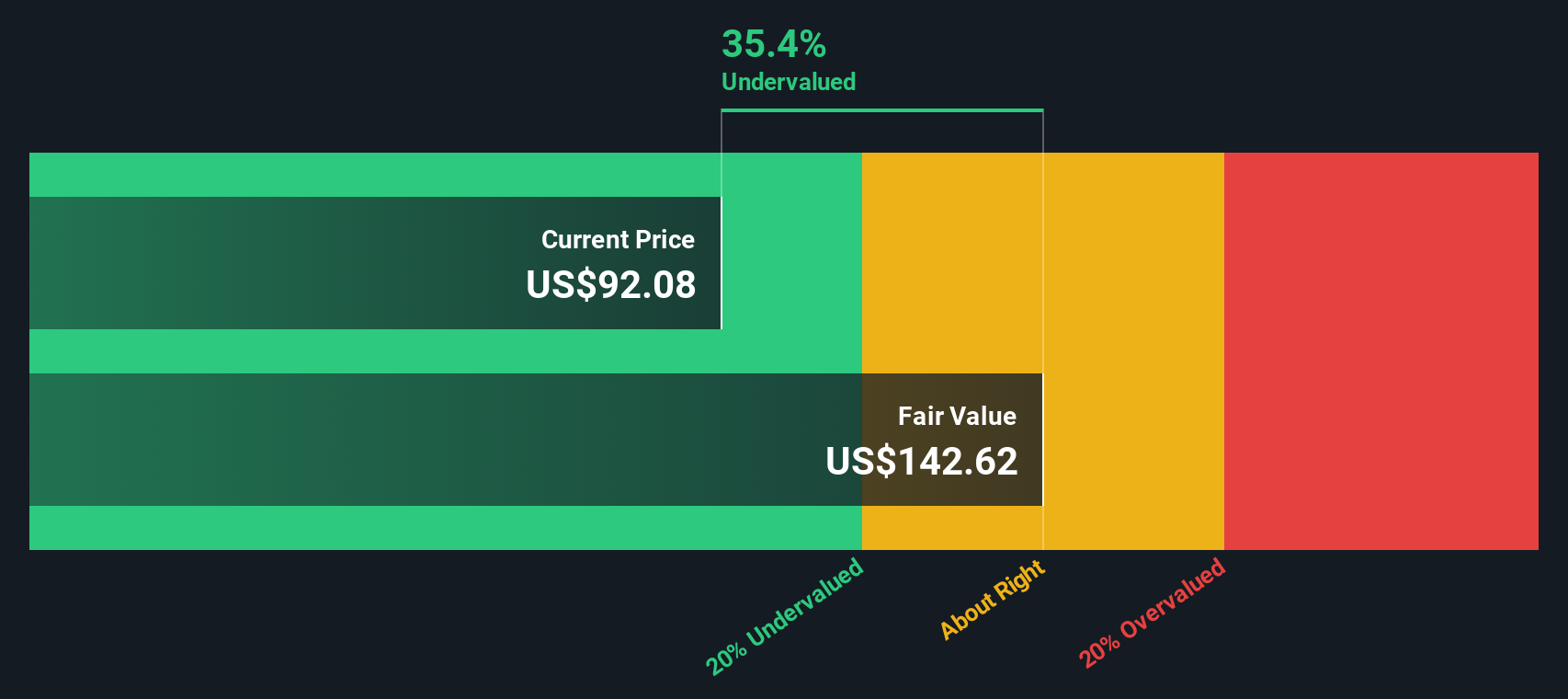

All cash flows for this analysis are in US dollars. When plugging these figures into a two-stage DCF formula, the resulting intrinsic value for eBay is calculated at $142.74 per share. This value sits noticeably above the current share price and represents a 35.7% discount. This suggests that the market is undervaluing eBay based on the company's cash flow potential.

This DCF perspective presents a confident case for eBay being attractively priced at this time, with a significant margin of safety for prospective investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests eBay is undervalued by 35.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: eBay Price vs Earnings

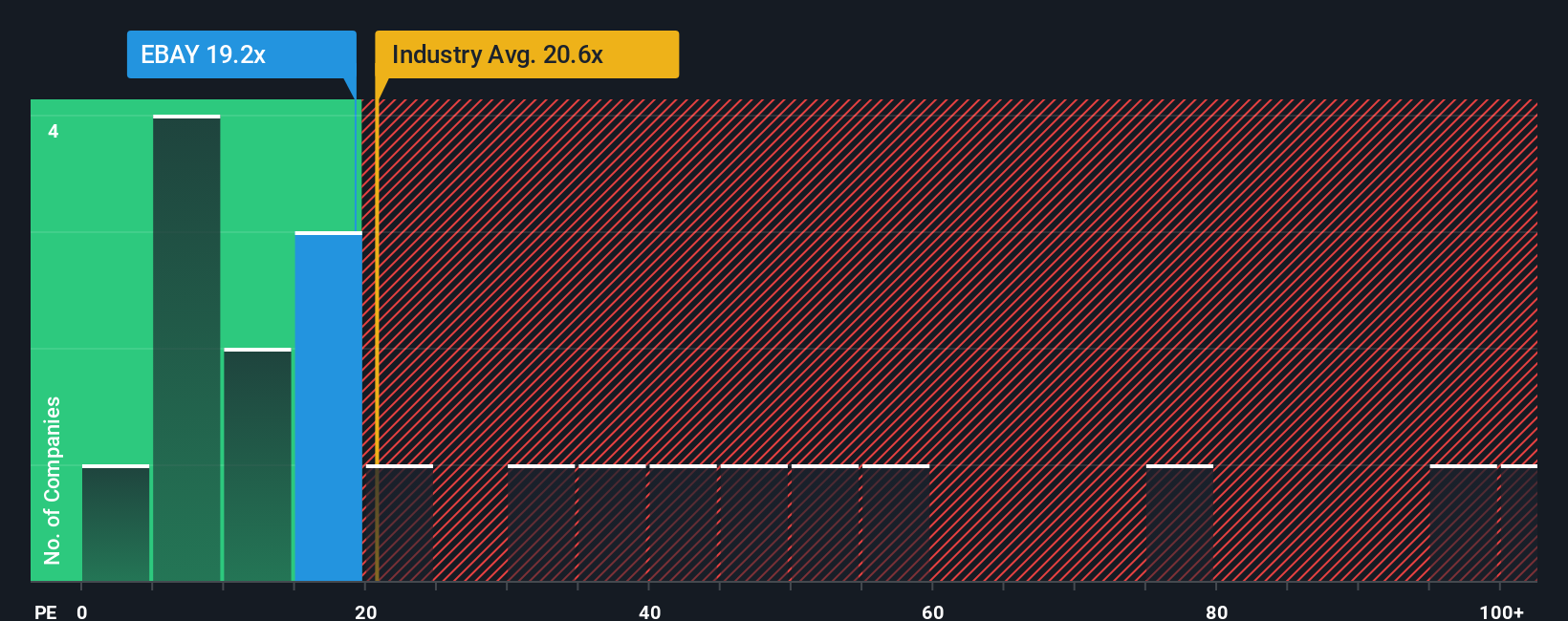

For companies that are consistently profitable, the Price-to-Earnings (PE) ratio is one of the most widely used metrics to gauge valuation. The PE ratio essentially tells you how much investors are willing to pay today for a dollar of a company’s earnings. This makes it a key tool to compare companies both within and across industries.

The “normal” or “fair” PE ratio for any company is not set in stone, as it depends on a few important factors. When expected earnings growth is high and risks are low, investors typically assign a higher PE. On the flip side, if growth prospects are limited or risks seem elevated, a lower PE is considered justified. Industry dynamics and overall market sentiment also play a role in what is considered reasonable.

Right now, eBay trades at a PE ratio of 19.2x. This is close to the Multiline Retail industry average PE of 21.8x and significantly below the average of its selected peers, which stands at 68.9x. However, simply matching up to the industry or peer group is not enough. The Simply Wall St “Fair Ratio” is a proprietary number that takes into account not just eBay’s growth outlook and profit margins, but also factors in the company’s size, industry landscape, and risk profile. In this case, eBay’s Fair Ratio is calculated at 18.7x, just below its current PE. This tailored benchmark is a more holistic way of assessing whether eBay is trading at a sensible valuation, compared to just looking at broad industry statistics.

Given that eBay’s PE of 19.2x is only slightly above its Fair Ratio of 18.7x, the evidence suggests the stock is valued about right at this time.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your eBay Narrative

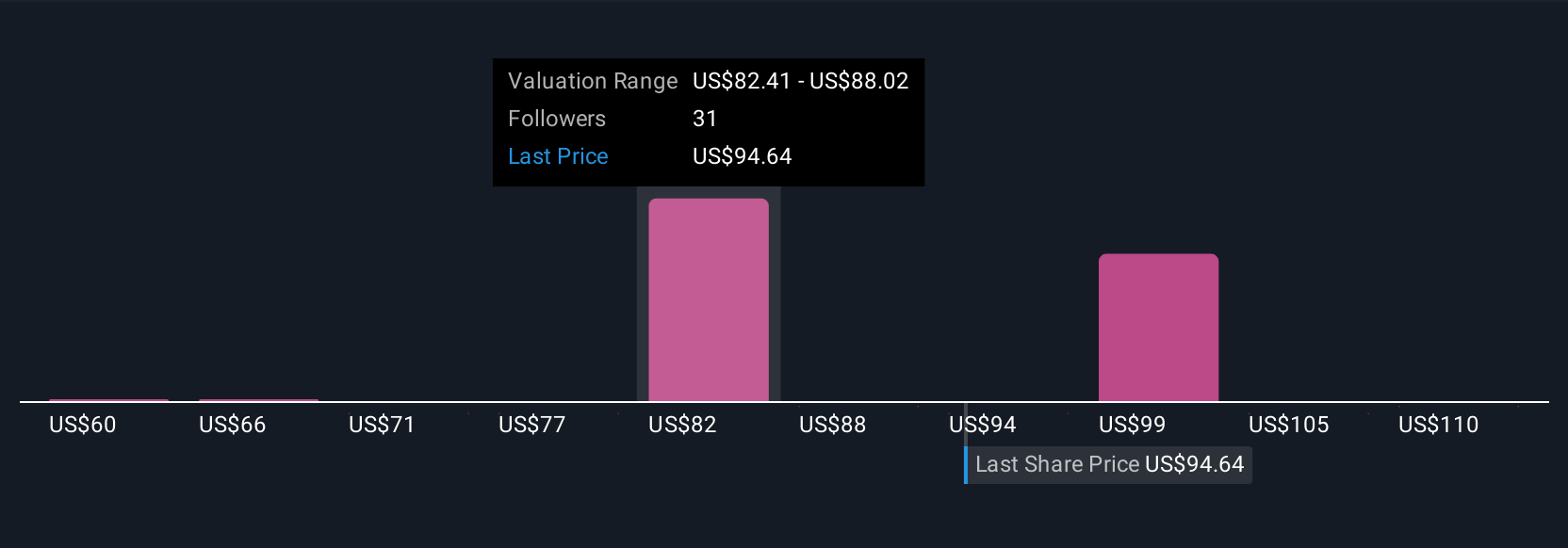

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a clear, easy-to-use framework that helps investors tell the story behind the numbers by connecting their own perspective on eBay’s business outlook to a specific set of future assumptions about revenue, earnings, and margins. This process leads to a personalized fair value.

Instead of just relying on headline financial ratios, Narratives give you a way to link what you believe about eBay’s strategy, market trends, and competitive strengths directly to the financial forecast and estimated value of the company. Narratives are available to everyone on Simply Wall St’s Community page, where millions of investors can create and share their views with others.

Here is the powerful part: as news or earnings are released, Narratives on the platform update dynamically, showing how your valuation (and that of others) shifts with each new detail. Comparing your Narrative fair value to the current price can help you decide when to buy, sell, or hold. This approach makes investment decisions more agile and more personal.

For eBay, some investors argue that AI-driven growth and category expansion could justify a fair value as high as $102 per share, while others focus on margin risks and competitive threats, leading to much more cautious estimates around $60. Narratives let you map out your own scenario and see how it compares to the market’s collective wisdom.

Do you think there's more to the story for eBay? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBAY

eBay

Operates marketplace platforms that connect buyers and sellers in the United States, the United Kingdom, China, Germany, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives