- United States

- /

- Specialty Stores

- /

- NasdaqGS:DLTH

January 2025's Top US Penny Stocks To Consider

Reviewed by Simply Wall St

As the U.S. stock market experiences a positive shift following recent executive orders, investors are keenly observing potential opportunities across various sectors. Penny stocks, often associated with smaller or newer companies, continue to capture interest due to their affordability and growth potential. Despite being considered a somewhat outdated term, these stocks offer unique opportunities when backed by strong financials, making them appealing for those seeking under-the-radar investments with promising prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $108.36M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.89 | $6.46M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.91 | $11.73M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.73 | $2.08B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.275 | $10.12M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.58 | $52.14M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.57 | $61.94M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.13 | $20.04M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8937 | $80.38M | ★★★★★☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

X4 Pharmaceuticals (NasdaqCM:XFOR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: X4 Pharmaceuticals, Inc. is a late-stage clinical biopharmaceutical company dedicated to the research, development, and commercialization of novel therapeutics for rare diseases, with a market cap of $86.57 million.

Operations: Currently, there are no reported revenue segments for this late-stage clinical biopharmaceutical company focused on novel therapeutics for rare diseases.

Market Cap: $86.57M

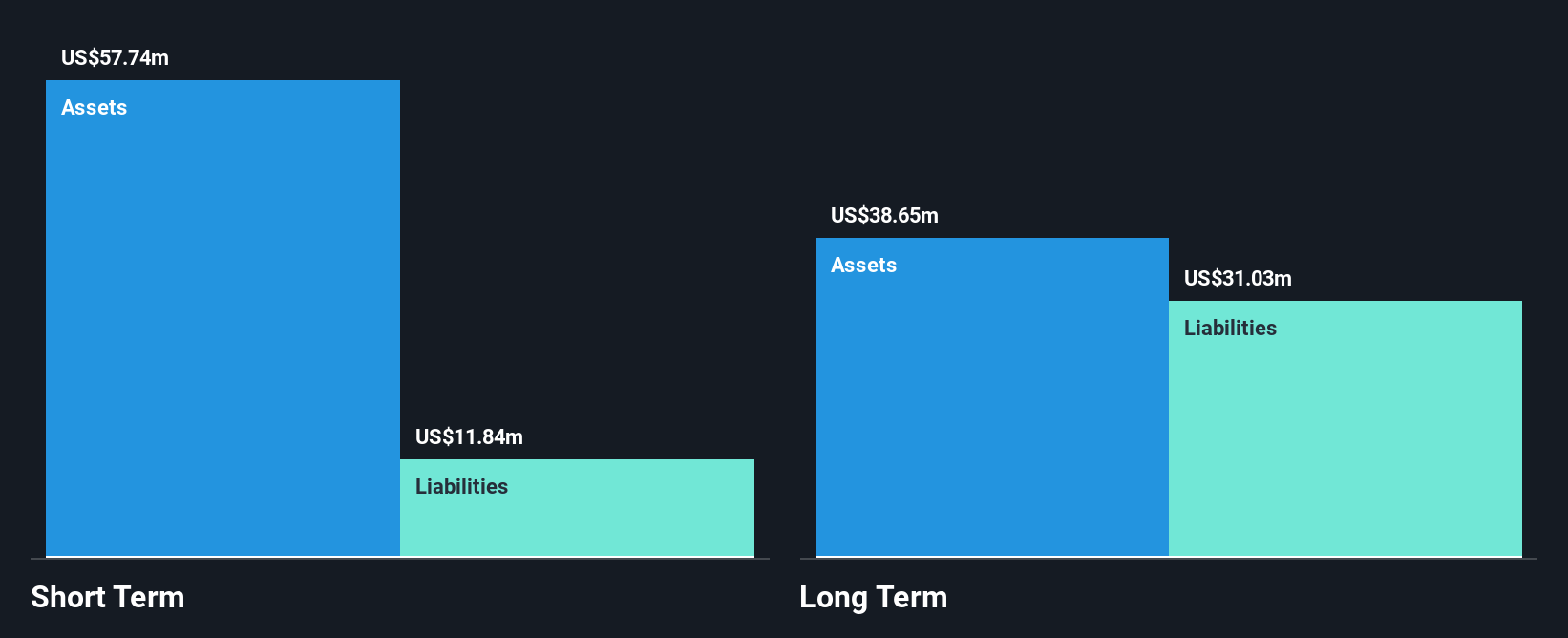

X4 Pharmaceuticals, Inc. is a pre-revenue biopharmaceutical company with a market cap of US$86.57 million, focusing on rare diseases. Despite its unprofitability and increasing losses over the past five years, X4's short-term assets exceed both its long-term and short-term liabilities, indicating solid financial management. The company has more cash than total debt and a sufficient cash runway for more than a year based on current free cash flow. Recent developments include an exclusive licensing agreement with Norgine Pharma for mavorixafor in Europe, Australia, and New Zealand, potentially providing significant future revenue streams contingent upon regulatory approvals.

- Get an in-depth perspective on X4 Pharmaceuticals' performance by reading our balance sheet health report here.

- Assess X4 Pharmaceuticals' future earnings estimates with our detailed growth reports.

Duluth Holdings (NasdaqGS:DLTH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Duluth Holdings Inc. operates under the Duluth Trading brand, offering casual wear, workwear, outdoor apparel, and accessories for men and women in the United States, with a market cap of approximately $106.94 million.

Operations: The company generates revenue from its online retail segment, amounting to $630.97 million.

Market Cap: $106.94M

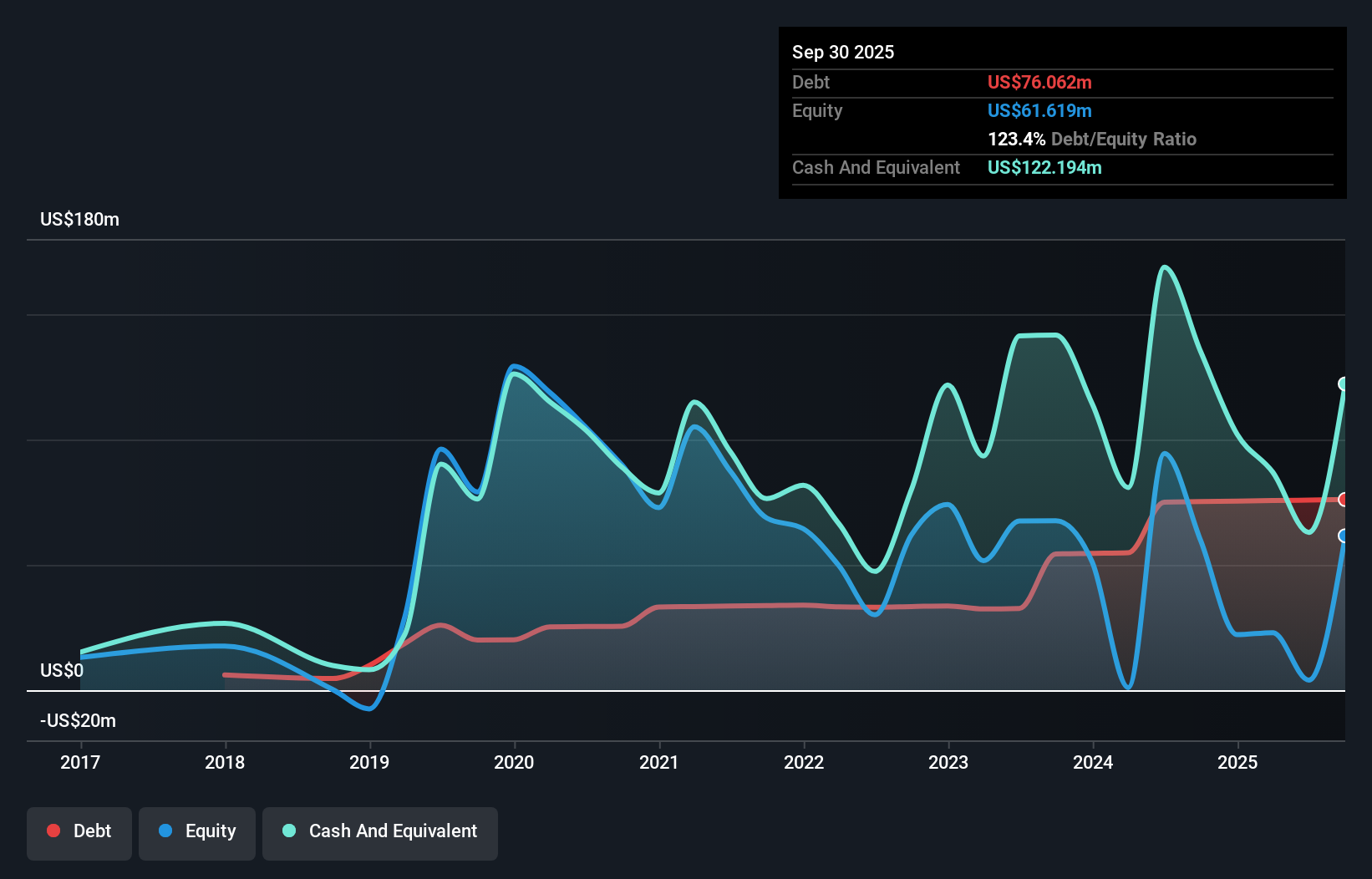

Duluth Holdings Inc., with a market cap of US$106.94 million, faces challenges as it reports increased losses, with a net loss of US$28.54 million in the third quarter compared to US$10.47 million last year. Despite being unprofitable and experiencing growing losses over five years, Duluth's financial structure shows resilience; its short-term assets of US$264.3 million exceed both long-term liabilities and short-term liabilities, suggesting solid asset management. The company trades at a good value relative to peers, and its debt levels are satisfactory with a net debt to equity ratio of 32.5%, although cash flow coverage remains weak at 16.6%.

- Jump into the full analysis health report here for a deeper understanding of Duluth Holdings.

- Evaluate Duluth Holdings' prospects by accessing our earnings growth report.

Elite Pharmaceuticals (OTCPK:ELTP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Elite Pharmaceuticals, Inc. is a specialty pharmaceutical company focused on developing, manufacturing, and selling oral controlled-release products and generic pharmaceuticals, with a market cap of approximately $526.28 million.

Operations: The company's revenue is primarily derived from Abbreviated New Drug Applications (ANDA), totaling $71.17 million.

Market Cap: $526.28M

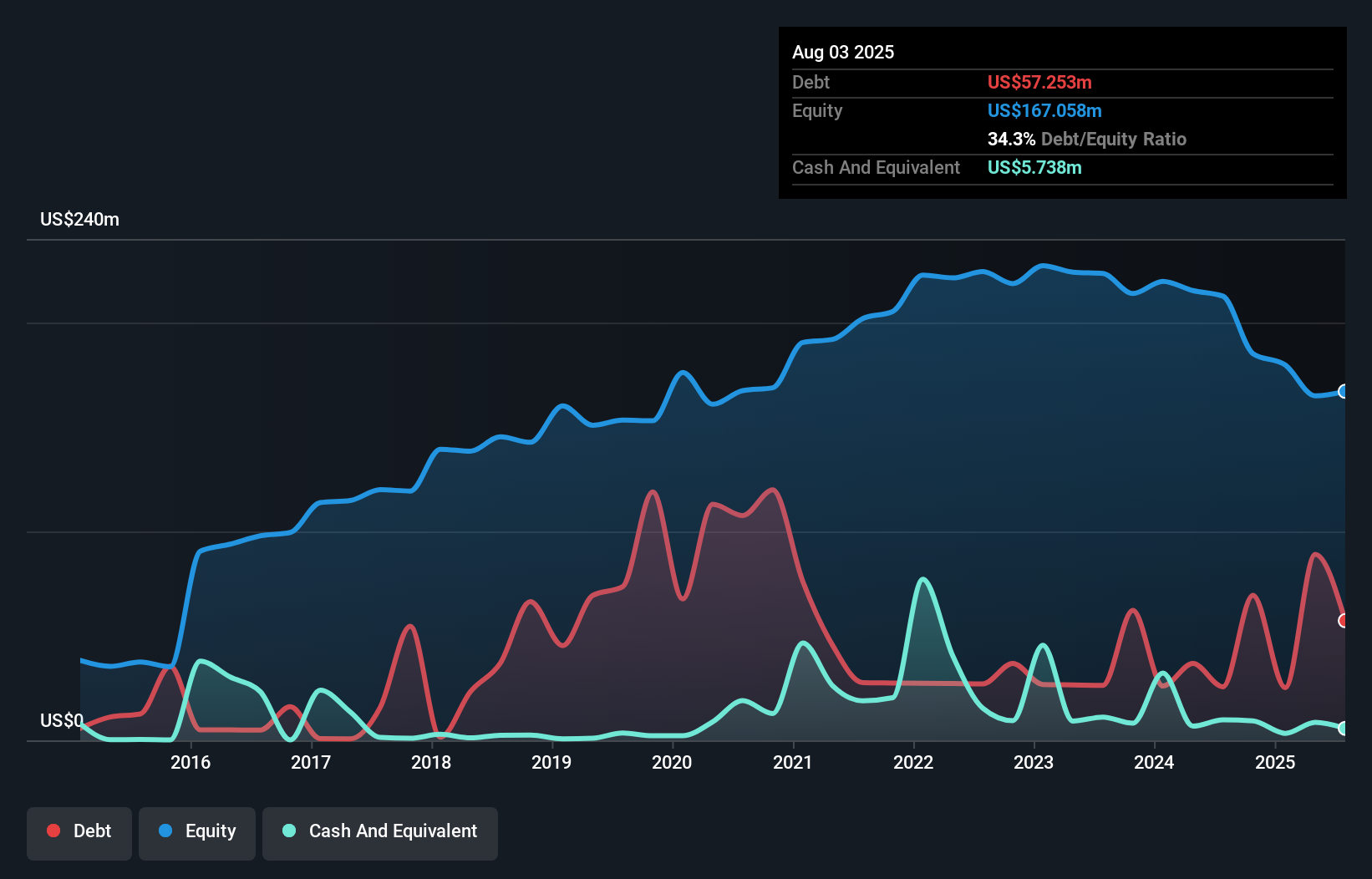

Elite Pharmaceuticals, Inc., with a market cap of US$526.28 million, has shown revenue growth, reporting US$37.68 million for the first half of 2024, up from US$23.14 million the previous year. Despite this growth, the company remains unprofitable with a net loss of US$10.42 million for the same period. Elite's financial resilience is evident as its short-term assets (US$45.3M) exceed both long-term and short-term liabilities, and it maintains a positive cash runway exceeding three years due to growing free cash flow. However, recent insider selling may warrant caution amidst high share price volatility.

- Navigate through the intricacies of Elite Pharmaceuticals with our comprehensive balance sheet health report here.

- Assess Elite Pharmaceuticals' previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Gain an insight into the universe of 709 US Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLTH

Duluth Holdings

Sells casual wear, workwear, outdoor apparel, and accessories for men and women in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives