- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGM:DIBS

1stdibs.Com, Inc.'s (NASDAQ:DIBS) 25% Share Price Surge Not Quite Adding Up

Despite an already strong run, 1stdibs.Com, Inc. (NASDAQ:DIBS) shares have been powering on, with a gain of 25% in the last thirty days. The last 30 days bring the annual gain to a very sharp 53%.

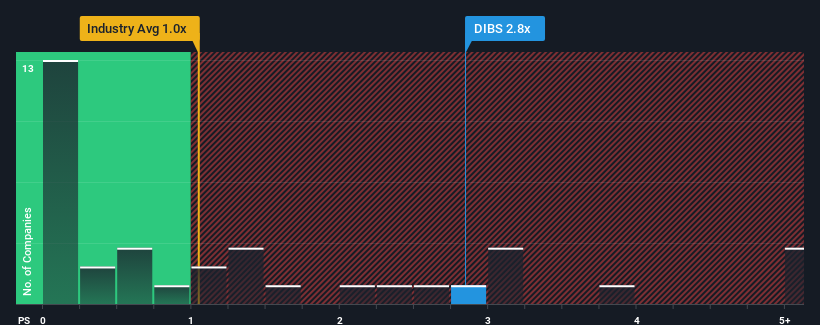

After such a large jump in price, when almost half of the companies in the United States' Multiline Retail industry have price-to-sales ratios (or "P/S") below 1x, you may consider 1stdibs.Com as a stock probably not worth researching with its 2.8x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for 1stdibs.Com

What Does 1stdibs.Com's Recent Performance Look Like?

1stdibs.Com hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think 1stdibs.Com's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as 1stdibs.Com's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 9.2% per annum as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 13% per annum, which is noticeably more attractive.

With this information, we find it concerning that 1stdibs.Com is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does 1stdibs.Com's P/S Mean For Investors?

1stdibs.Com's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that 1stdibs.Com currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with 1stdibs.Com, and understanding should be part of your investment process.

If you're unsure about the strength of 1stdibs.Com's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:DIBS

1stdibs.Com

Operates an online marketplace for luxury design products worldwide.

Flawless balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives