- United States

- /

- Specialty Stores

- /

- NasdaqGS:CTRN

Citi Trends (CTRN) Q3: Renewed EPS Losses Challenge Bullish Margin-Recovery Narrative

Reviewed by Simply Wall St

Citi Trends (CTRN) opened Q3 2026 with revenue of about $197.1 million and a basic EPS of roughly -$0.86, as net income excluding extra items came in around -$6.9 million. This keeps the focus squarely on how quickly the business can tighten its margins. The company has seen quarterly revenue move from $179.1 million in Q3 2025 to $190.8 million in Q2 2026 and then $197.1 million in Q3 2026. Over the same stretch, EPS has swung from -$0.86 to $0.48 and back to -$0.86, underscoring how choppy profitability has been. For investors, that volatility puts execution under the microscope, with the latest quarter highlighting how sensitive margins remain to shifts in performance.

See our full analysis for Citi Trends.With the headline numbers on the table, the next step is to see how this mixed margin story lines up against the widely followed narratives about Citi Trends and where those narratives might need updating.

Curious how numbers become stories that shape markets? Explore Community Narratives

Same Store Sales Growth Near 10%

- Store performance looked stronger earlier in 2026, with same store sales growth of 9.9 percent in Q1 and 9.2 percent in Q2, compared with 5.7 percent back in Q3 2025.

- Bulls highlight Citi Trends as a niche value retailer serving multicultural families, and these mid single digit to high single digit same store gains

- Support the idea that its targeted customer base is still spending, with Q1 and Q2 2026 comps close to double the 5.7 percent level seen in Q3 2025.

- Also line up with the broader view that off price and value retailers can hold traffic even while the overall market is only expected to grow revenue around 5.4 percent per year.

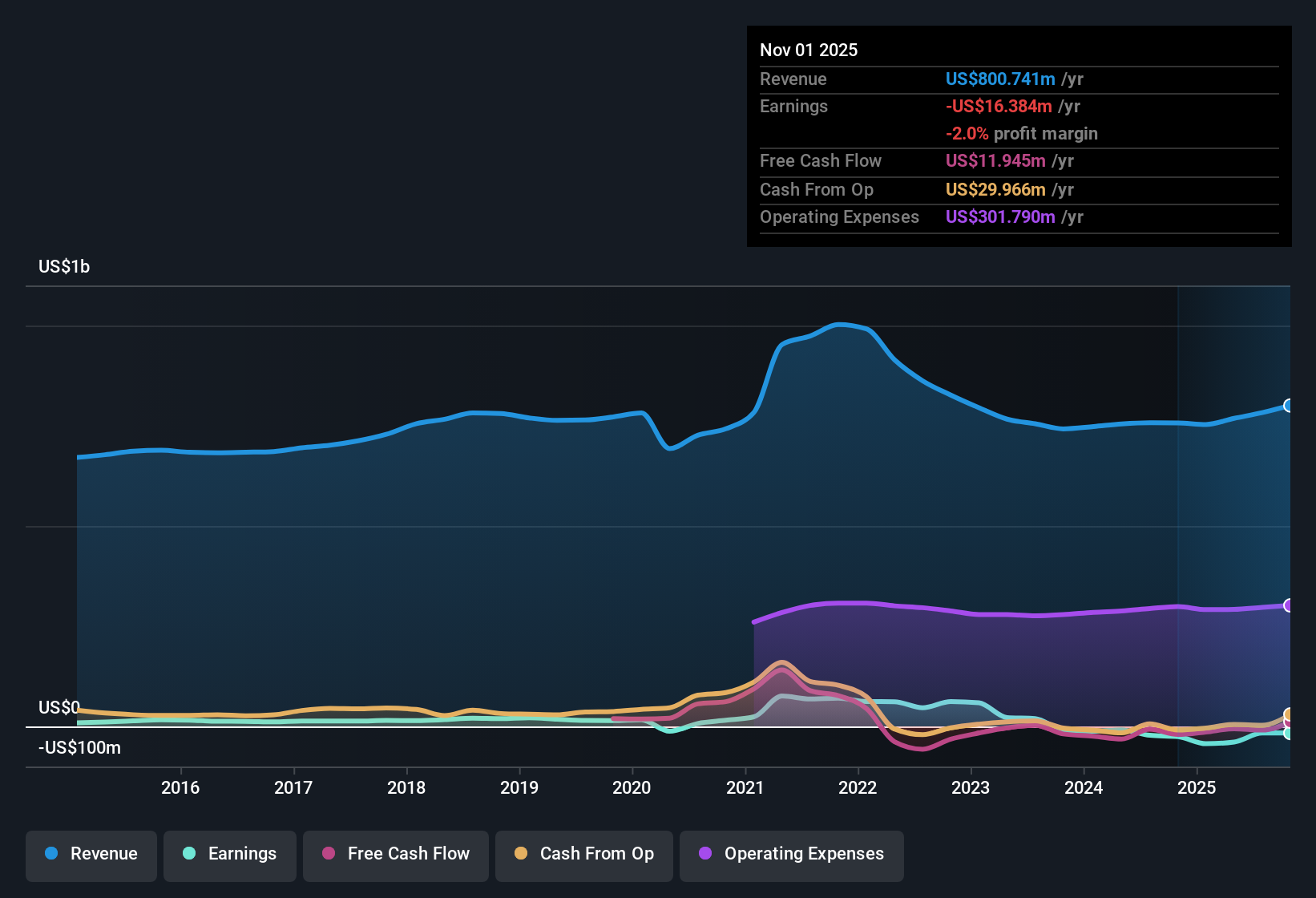

Trailing Losses Still Over $16 Million

- Over the last twelve months, Citi Trends generated about 800.7 million dollars of revenue but still posted roughly 16.4 million dollars of net losses excluding extra items, reflecting a multi year pattern where losses have grown at about 56.2 percent per year.

- Bears argue that this persistent unprofitability overshadows any near term sales momentum

- The data shows that even as trailing revenue rose from about 753.1 million dollars in 2025 Q4 to 800.7 million dollars by 2026 Q3, the company remained in the red with negative net income in every trailing period listed.

- This history backs the concern that Citi Trends has not yet shown it can convert its revenue base into consistent profits, despite forecasts that earnings will eventually turn positive and then grow rapidly.

DCF Fair Value Far Above Price

- The stock trades around 43.47 dollars while the DCF fair value in the dataset is 115.89 dollars and the company carries a price to sales ratio of 0.4 times, below the US specialty retail industry average of 0.5 times but slightly above the 0.3 times peer average.

- What is striking for a more optimistic angle is how these valuation markers sit next to the profitability forecasts

- Analysts in the dataset expect revenue to grow at roughly 5.4 percent per year and earnings to flip from negative to positive within three years, with modeled earnings growth around 72.02 percent annually after that.

- If that earnings turnaround happens, today’s discount of about 62.5 percent to the DCF fair value would heavily support a bullish case that the market is not fully pricing in that shift yet.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Citi Trends's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Citi Trends’ uneven earnings, persistent losses, and dependence on a still fragile margin recovery highlight how exposed investors remain to execution missteps and cyclical pressure.

If that volatility makes you uneasy, use our stable growth stocks screener (2073 results) to quickly refocus on companies delivering steadier revenue and earnings trends that can compound more predictably over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTRN

Citi Trends

Operates as a value retailer of fashion apparel, accessories, and home goods.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in