- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

The Rationale Behind the 20-1 Stock Split for Amazon (NASDAQ:AMZN)

Key takeaways:

- The value of a stock does not change in a stock split.

- Retail investors may have lower transaction costs when they buy full instead of fractional shares.

- Rarely, an influx of long-term investors may lower the cost of equity (risk) of a company.

Amazon.com, Inc. ( NASDAQ:AMZN ) is finalizing its 20-1 stock split today, and we will analyze what - if anything, this means for current and future shareholders.

Investors may have noticed strange figures for Amazon today - the stock value hasn't changed that much, but platforms will need a day to adjust the data to the new split value of the stock.

All Amazon shareholders that owned stock by May 24th, will receive 19 additional shares of the company . This will place the stock around $125 before today's open.

What Does a Split Mean for Investors

Let's get the obvious out of the way, investors that have stop-losses and coded algorithms should make sure that the split doesn't trigger an unwanted response .

Next, we need to address the benefits to regular investors.

Depending on your broker, buying and selling shares implies some transaction costs. For retail investors, who had to buy the stock before the split, it was more expensive to buy a full share, forcing many investors to buy fractional shares. While fractional shares are now widely available in almost all brokerages, they may charge slightly higher transaction costs than buying complete shares. This split makes transactions more affordable to shareholders, so retail investors may consider owning more Amazon stock in the future.

Management is keenly aware of the possible influx of retail investors, and may be hoping that this leads to changes in the ownership mix over time. One reason for this is that retail investors are not bound by the logic and regulation of institutional traders. This gives retail a longer time horizon, and many investors that are energized by a company may stick to it for longer than institutional investors.

Notably, Tesla ( NASDAQ:TSLA ) investors are known for not selling the stock despite many institutional investors considering it a viable short, and thus far, both retail and the company have come out ahead of the people that have been shorting it.

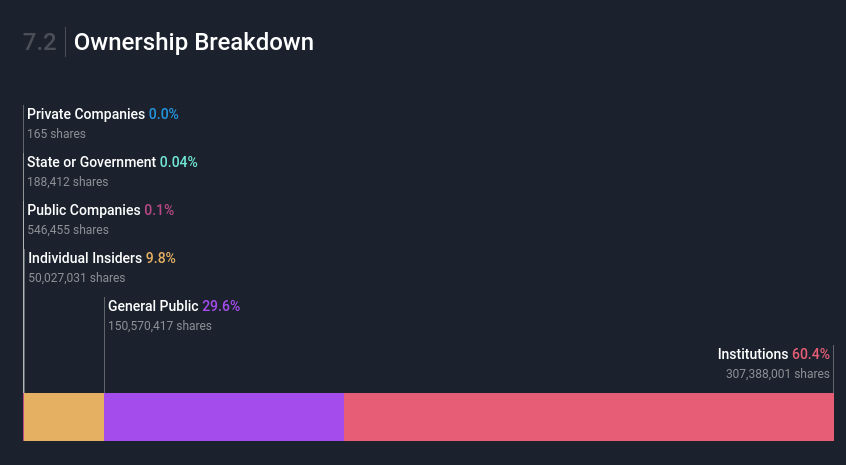

In the chart below, we can see the current ownership mix for Amazon:

We can see that the majority of shareholders are large institutions. For them, Amazon must continuously perform, otherwise they are pressured to seek higher return options, even if they believe the stock will create future value.

The stock split will allow retail investors to grow their ownership share, and management is hoping to attract long-term investors, which will also push up the price.

Finally, we come to the implication for the value of Amazon. Essentially, a stock split means nothing for value .

If the value of cash flows was $1.3t, this does not change when Amazon divides the same pie into more pieces. However, there is one possible value-creating aspect to consider - As more people buy the stock because of the affordability and decrease of transaction costs, then an inflow of new shareholders can lower the cost of equity for the stock . This may lead to a virtuous cycle and both the company and shareholders become better off in the end. Please note, that for most companies this effect is negligible , and rarely does a company manage to acquire a permanent investor "fan" base which lowers the risk of the stock.

Conclusion

Our analysis, shows that there are some positive effects from a stock split for retail investors. However, most of these may end up being insignificant and investors that are not cautious may be buying more downside risk than they otherwise would.

If the company manages to create a larger retail investor base, then they may actually lower their cost of equity, making both investors and Amazon better off.

Before you take the next step, you should know about the 3 warning signs for Amazon.com (1 is a bit concerning!) that we have uncovered.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives