- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Is Amazon Stock Undervalued in July 2025?

Thinking about what to do with your Amazon shares, or maybe deciding whether now is the right time to jump in? You are definitely not alone. After years as a go-to growth stock, Amazon has been serving up more curveballs lately and investors are watching closely. The stock is up about 26% over the last 90 days and boasts a 22% gain for the past year, suggesting that optimism has returned. However, if you look a little closer, returns have been more volatile in the short term. Over the past week, shares have barely moved, perhaps reflecting new concerns about risk, competition, and changing consumer trends.

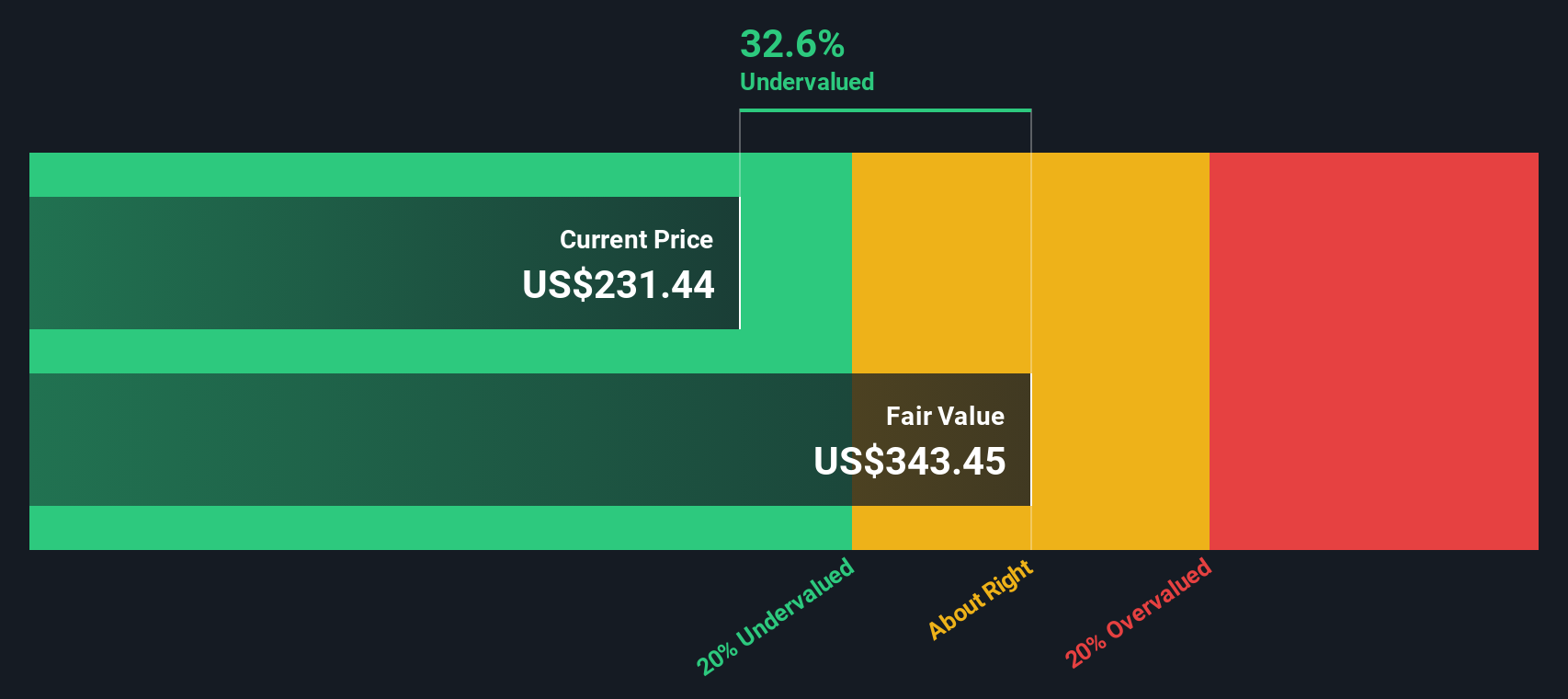

What is affecting the stock? Headlines have included major cost increases for household essentials after new trade tariffs and significant job cuts in Amazon’s cloud computing division, AWS. Meanwhile, news of leadership meetings in Washington and changing dynamics among major AI players only add more uncertainty about where Amazon is headed. In the midst of all this, some investors view the company as somewhat undervalued right now. Amazon scores a 3 out of 6 on our valuation checklist, which means it appears undervalued on half of the key metrics we monitor.

So, is Amazon truly a bargain for long-term investors, or have recent price gains simply moved it back to fair value? Let us break down each of the main valuation approaches, point by point, to find out what the numbers really reveal.

Is Amazon.com financially strong enough to weather the next crisis?

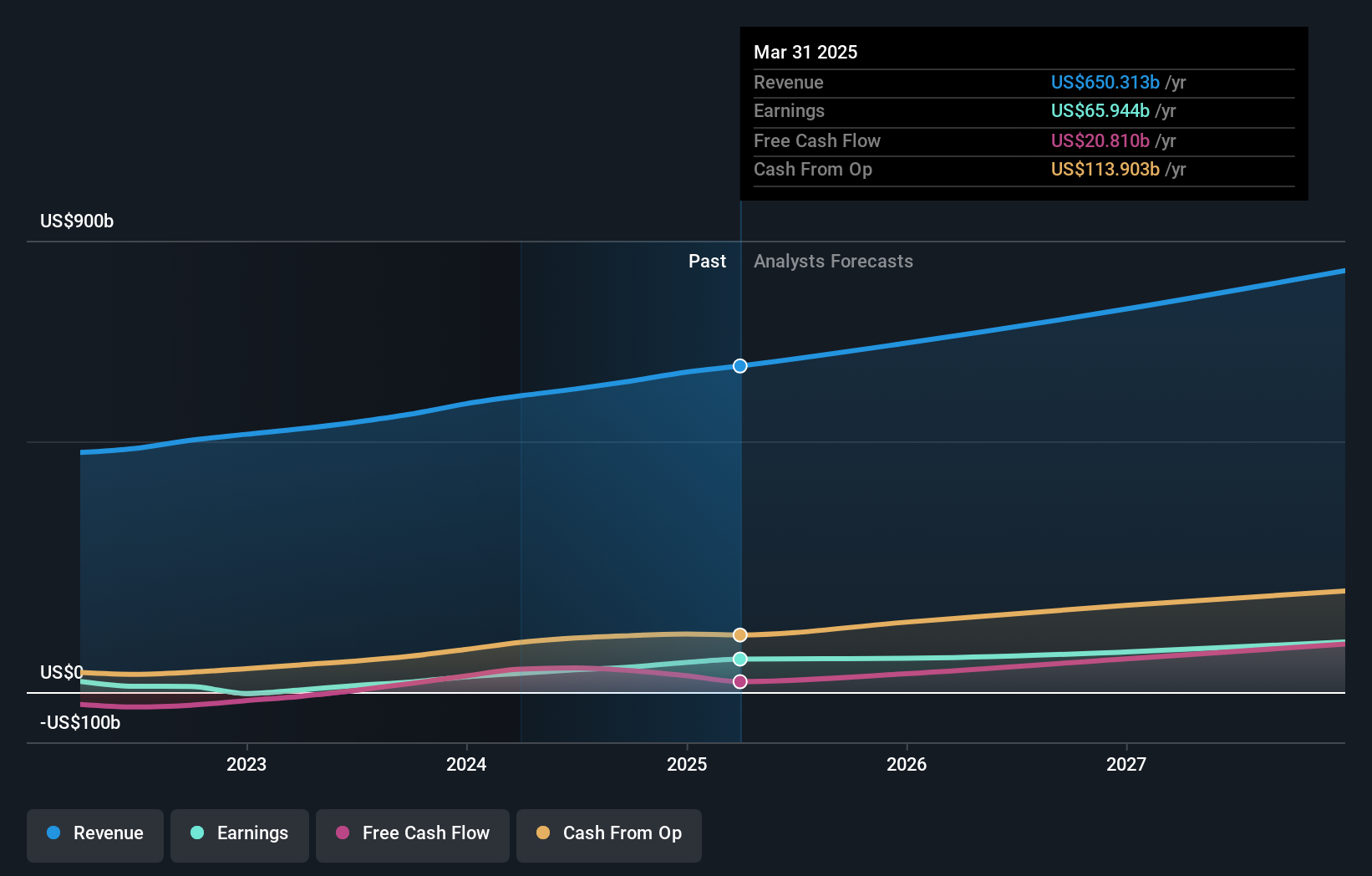

Approach 1: Amazon's Cash Flows

The Discounted Cash Flow (DCF) model estimates a company’s worth by projecting its future free cash flows and discounting them back to today’s dollars. This approach helps investors understand the intrinsic value of a stock based on expected cash generation, beyond just headline profits or recent market movements.

For Amazon, the latest data shows free cash flow (FCF) over the last twelve months at $36.8 billion. Analysts project this figure could rise to nearly $268.3 billion by 2035, reflecting expectations for robust long-term growth. By discounting each year’s forecasted cash flow, the model calculates an intrinsic value of approximately $343 per share. This value is about 33.7% higher than the current trading price, suggesting Amazon stock is significantly undervalued according to this fundamental analysis.

Result: UNDERVALUED

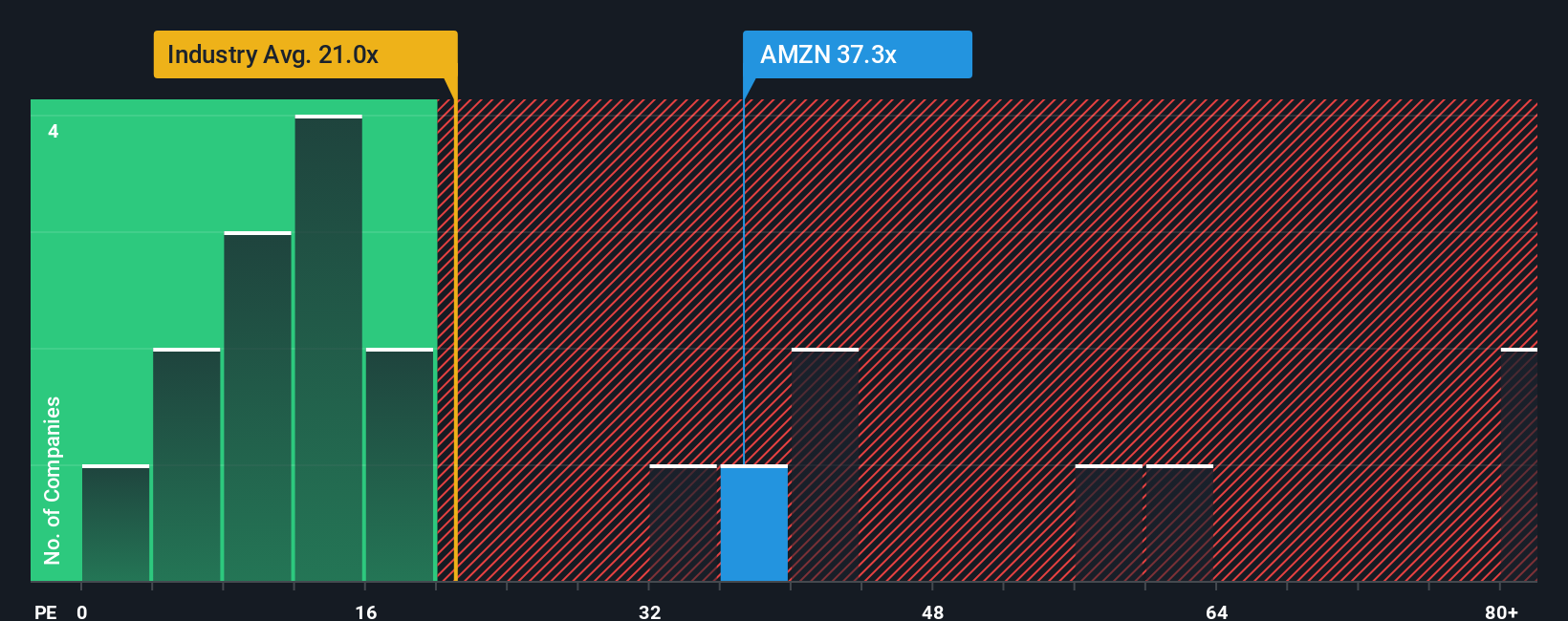

Approach 2: Amazon Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular way to value established, profitable companies because it ties a company’s share price directly to the earnings it generates. For a company like Amazon, which has moved well beyond its early growth phase and delivers steady profits, the PE ratio provides a clear snapshot of how much investors are willing to pay for each dollar of earnings today.

Of course, what counts as a “fair” PE ratio depends on several factors, especially growth expectations and risk. Higher growth prospects generally justify a higher PE, while companies with steadier, less risky earnings may trade at a premium. Amazon currently trades at a PE of 36.6x, which is well above the retail industry average of 15.8x and its peer group’s average of 23.4x. However, when factoring in Amazon’s faster expected earnings growth, we calculate a Fair Ratio of 42.0x. This multiple reflects a reasonable price given Amazon’s outlook.

With Amazon’s actual PE ratio sitting about 13% below its Fair Ratio, the numbers suggest the stock is undervalued relative to its growth potential. If you believe Amazon can keep up its momentum, this could represent a compelling opportunity.

Result: UNDERVALUED

Is Amazon.com's CEO getting paid too much for the company's performance?

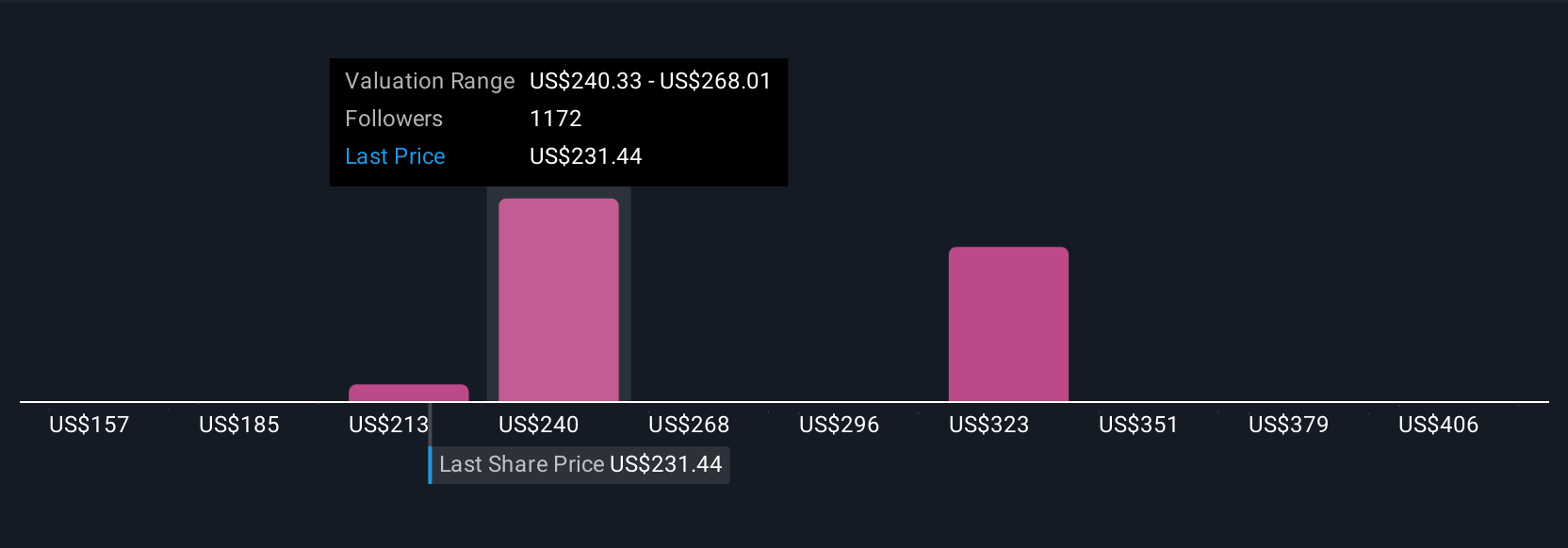

Upgrade Your Decision Making: Choose your Amazon Narrative

A Narrative is more than just a collection of numbers or a single estimate. It is your story or perspective about a company, combining what you believe about its future with the financial data that supports those beliefs. Think of a Narrative as the bridge connecting Amazon’s past achievements, present position, and your expectations for its future results.

On Simply Wall St, Narratives make investing more accessible and interactive for everyone. With a community of over 8 million investors, you can easily create or follow Narratives that lay out why a stock like Amazon should be valued a certain way, tying together projected revenue, profit margins, and a fair value estimate. When you create or select a Narrative, you are essentially matching Amazon’s story to concrete numbers: your forecasted revenue growth, earnings outlook, and long-term strategy. This ultimately produces a fair value that you can compare to today’s price.

What makes Narratives especially valuable is their dynamic nature. Whenever new events such as earnings reports, leadership changes, or market swings occur, Narratives can be updated so your outlook stays relevant and timely. This means you are always comparing the latest fair value to the current share price, helping you decide when it makes sense to buy, hold, or sell.

For example, when looking at Amazon Narratives right now, they span a wide range. The most optimistic Narrative sees Amazon’s fair value at $288 per share, based on rapid cloud growth and strong margin expansion. A more conservative Narrative estimates a fair value closer to $195, factoring in steadier growth and risks like increased competition and higher costs. Your own Narrative might land anywhere in between, reflecting your understanding of the business and your expectations for its future. This Narrative approach helps turn complex financial decisions into clear, actionable choices tailored to you.

See our AI narrative and valuation for Amazon.com See our AI narrative and valuation for Amazon.com

For Amazon, we will make it really easy for you with previews of two leading Amazon Narratives:

Amazon Bull Case | Amazon Bear Case |

| Fair Value: $239.33

| Fair Value: $227.14

|

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AMZN .

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Bailey Pemberton

Bailey is an Equity Analyst at Simply Wall St with 4 years of experience as an Associate Adviser at Baywealth Financial Group, where he helped with client portfolio management, investment strategy and research. He completed a Bachelor of Commerce majoring in Finance from the University of Western Australia. As an equity analyst, Bailey provides the team with valuable insights, helping guide the creation of article content and new features like Narratives.

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives