- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

ArcticCollagen Joins Amazon.com (NasdaqGS:AMZN) Offering Flavored Natural Collagen Peptides

Reviewed by Simply Wall St

ArcticCollagen recently announced the launch of its collagen peptide packets on Amazon.com (NasdaqGS:AMZN), a notable step that coincides with a 20% rise in Amazon's share price over the past month. This development occurred alongside strong quarterly financials from Amazon, with Q1 2025 revenue and income showing substantial year-over-year growth. Additionally, Amazon's recent business expansions, including a new AWS region planned in Chile, and strategic collaborations with companies like AWS, highlight the company's robust operational strategies. Despite a 1% market decline last week, Amazon's stock price gains significantly outperformed, underscoring its strong position in the tech sector.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

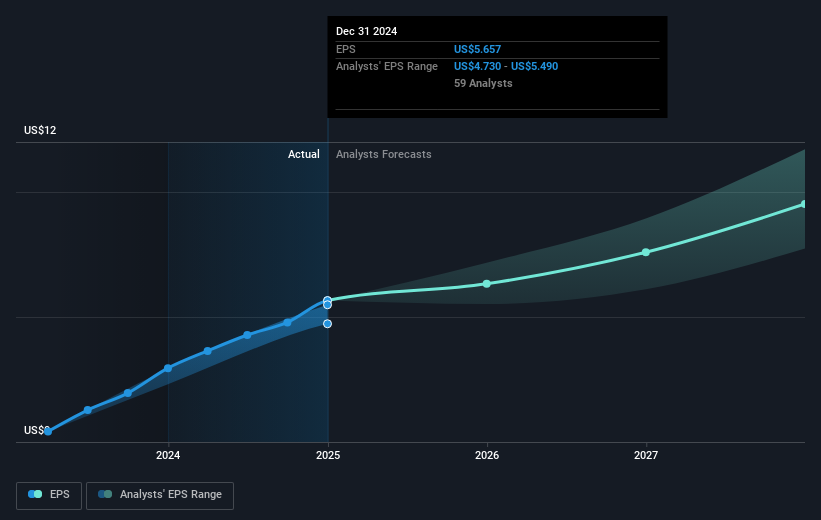

The recent launch of ArcticCollagen's collagen peptide packets on Amazon.com could enhance Amazon's expansive portfolio, potentially driving revenue growth by catering to the increasing demand for health and wellness products. This product extension aligns with Amazon's strategy to leverage its vast distribution network and could positively impact future earnings forecasts, reinforcing its competitive edge in retail and consumer goods. With the share price currently positioned at US$185.01, the consensus analyst price target of US$239.33 points to potential upside, although actual gains depend on Amazon meeting growth expectations and mitigating risks.

Over the past three years, Amazon's total shareholder return reached 88.36%, indicating robust long-term performance despite short-term fluctuations. Compared to the broader market and industry over the past year, Amazon's shares matched the US market's return of 9.1%, while underperforming the US Multiline Retail industry, which returned 11.5%. This suggests that while Amazon has maintained significant growth historically, it faces competition pressures within its sector.

Unlock comprehensive insights into our analysis of Amazon.com stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives