- United States

- /

- Residential REITs

- /

- NYSE:UMH

What Do UMH Properties’ Recent Price Swings Mean for Investors in 2025?

Reviewed by Bailey Pemberton

If you are tracking UMH Properties and wondering whether now is the right time to act, you are not alone. The stock has had a bumpy ride lately, dipping by 1.0% over the past week and dropping 4.4% in the last month. Zoom out a bit further, and the year-to-date decline sits at 22.9%, with a 19.4% loss over the past year. Still, long-term investors will notice that the three-year return is up 11.6%, and the five-year gain stands at 26.9%, so this is a company that has seen both turbulence and growth.

Much of the recent weakness in share price can be tied to broader market shifts affecting real estate investment trusts. Changing interest rate expectations and evolving investor sentiment have played a role in repricing assets across the sector. For some, these developments have introduced fresh concerns, but for others, a lower price means potential opportunity.

If you are weighing whether UMH Properties is undervalued at these levels, you will want to know about the company’s current valuation score: a 3 out of 6. That means UMH checks the “undervalued” box on half of the major measures analysts use to gauge a stock’s price versus its worth, a fairly balanced, but definitely not overwhelming, signal.

So, how do those valuation checks actually work, and which ones tip the scale in UMH’s favor? Next, we will break down each of the main approaches to valuing a company like UMH Properties, and at the end, discuss a smarter way to make sense of what all the numbers tell you.

Why UMH Properties is lagging behind its peers

Approach 1: UMH Properties Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. For UMH Properties, this model uses adjusted funds from operations to give a clearer picture of ongoing business performance, filtering out one-off expenses and capital structure effects.

Currently, UMH Properties generates $66.26 million in free cash flow. Analysts predict steady growth, with free cash flow expected to reach $89.56 million by 2027. Looking further ahead, Simply Wall St extrapolates the company’s free cash flow projections over the next decade and points to a gradual increase year over year.

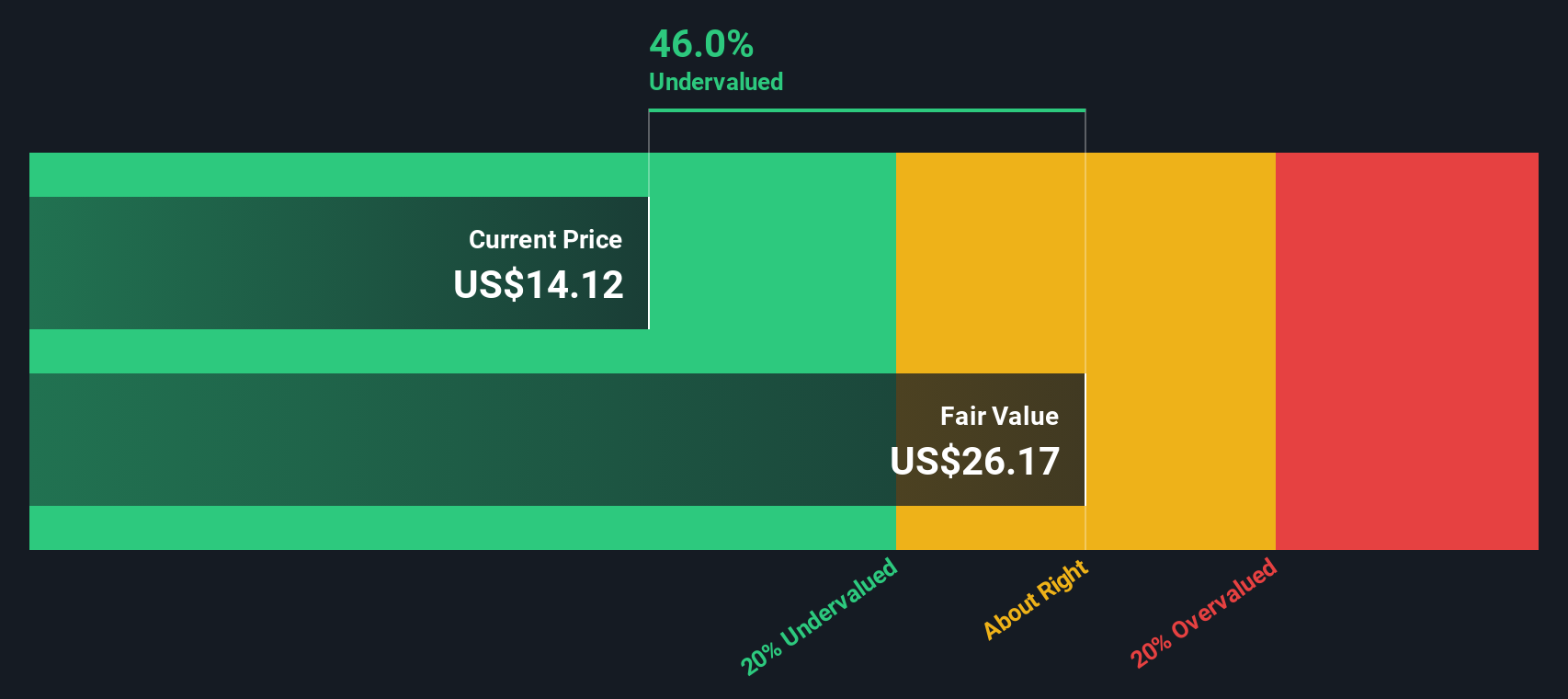

Based on these projections and the two-stage free cash flow to equity approach, the DCF model calculates UMH Properties’ intrinsic value at $26.22 per share. Compared to its current share price, this suggests the stock is trading at a 44.4% discount. In summary, the DCF model indicates that UMH Properties is significantly undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests UMH Properties is undervalued by 44.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: UMH Properties Price vs Earnings (P/E Ratio)

The Price-to-Earnings (P/E) ratio is a common valuation tool for profitable companies because it ties the company's stock price directly to its actual earnings. Investors often use the P/E ratio to assess how much they are paying for each dollar of earnings, making it especially helpful when gauging companies that generate consistent profits.

Growth expectations and perceived risks play a big role in what makes a P/E ratio "fair." Companies with higher growth rates or more stable earnings can often justify a higher P/E, while businesses facing uncertainty or slowdowns tend to trade at lower ratios.

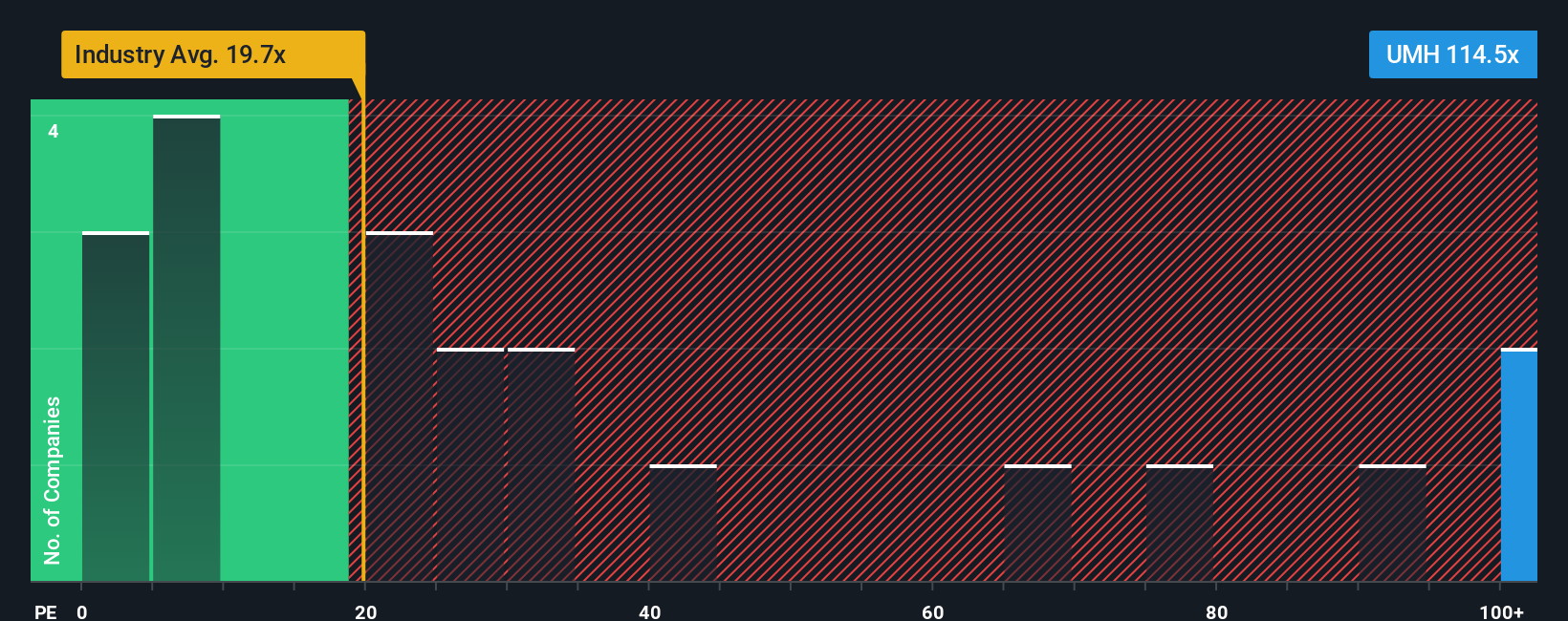

Currently, UMH Properties trades at a P/E ratio of 118.19x, which is substantially higher than the Residential REITs industry average of 20.50x and the average for its peers at 31.90x. At first glance, this might suggest UMH is overvalued compared to others in its space. However, Simply Wall St provides a more nuanced perspective with its proprietary Fair Ratio metric. This metric calculates a fair P/E for UMH at 50.81x based on factors such as its earnings growth potential, profit margins, market cap, industry conditions, and company-specific risks.

The Fair Ratio offers a more tailored benchmark than broad industry or peer comparisons because it incorporates the full picture of what makes UMH unique. In this case, UMH's actual P/E is still well above its Fair Ratio, suggesting that the stock may be priced optimistically relative to the company's fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your UMH Properties Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are an approach that lets investors tell the story behind the numbers by connecting their view on UMH Properties' business outlook to specific financial forecasts such as future revenue, profit margins, or fair value. By crafting a Narrative, you link what you believe is driving the company (like regulatory changes, demand trends, or market risks) directly to a forecast and then see how that translates into a fair value estimate.

This method goes beyond static ratios and numbers by showing your thought process, and it is easy to use right within the Community page on Simply Wall St, where millions of investors contribute their own Narratives daily. Narratives help you act more confidently, as you can instantly compare your view of fair value against the live share price, making it clearer when it might be time to buy, hold, or sell.

Best of all, Narratives update dynamically as new news or quarterly results arrive, so your investment rationale stays fresh and relevant. For example, one investor might argue that favorable laws and robust housing demand will propel UMH Properties to a $23.50 price target, while another might focus on acquisition risks and project just $18.00 as fair value, both backing up their story with concrete numbers and timely data.

Do you think there's more to the story for UMH Properties? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UMH

UMH Properties

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that currently owns and operates 145 manufactured home communities, containing approximately 27,000 developed homesites, of which 10,800 contain rental homes, and over 1,000 self-storage units.

Established dividend payer with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)