- United States

- /

- Residential REITs

- /

- NYSE:UMH

UMH Properties (UMH): Margin Decline Challenges Bullish Undervaluation Narrative Despite Strong Earnings Forecast

Reviewed by Simply Wall St

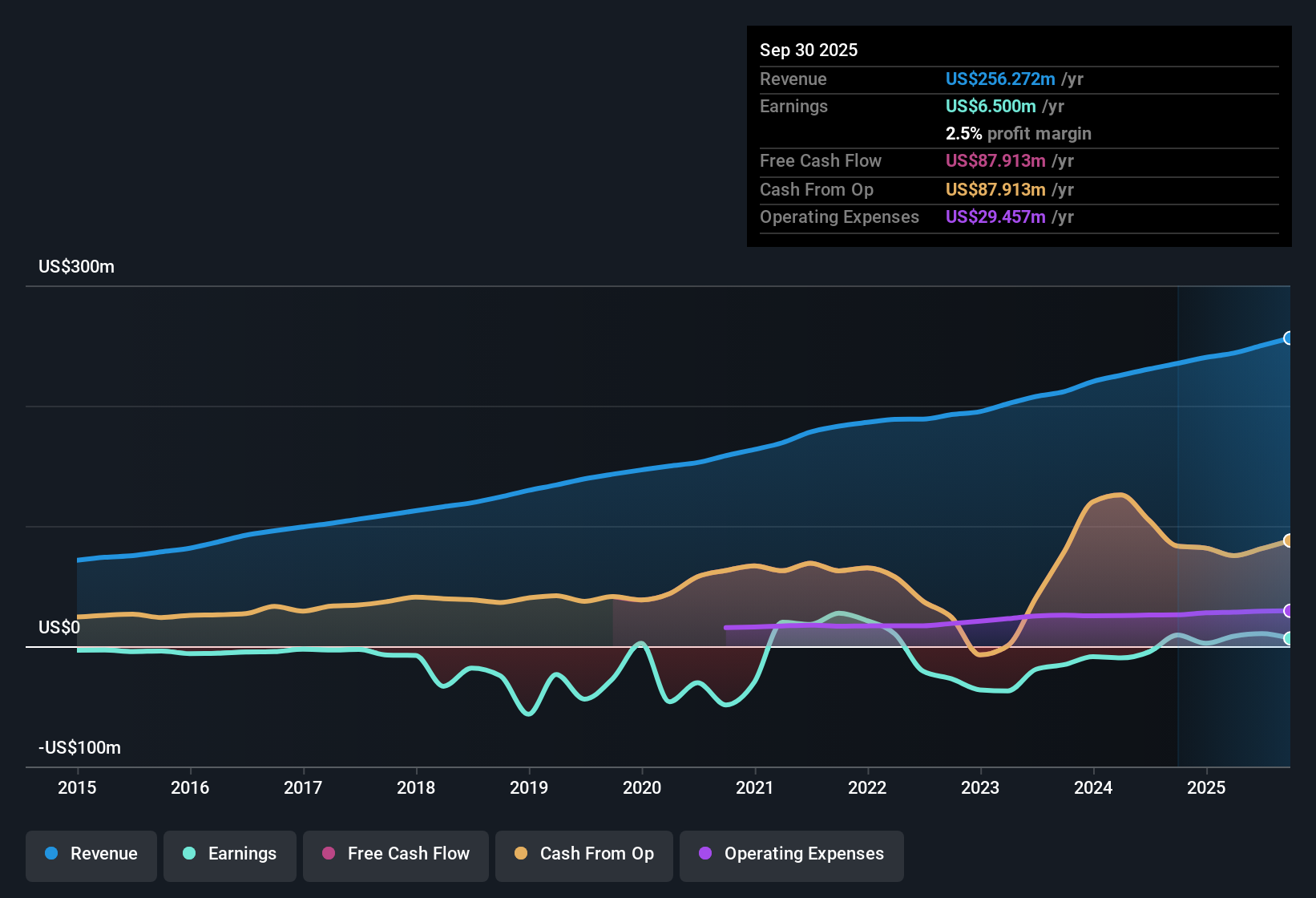

UMH Properties (UMH) has seen its earnings forecast surge, with analysts projecting 58.2% annual earnings growth in the years ahead, outpacing the broader US market’s 16% pace. While revenue is expected to grow at 8.9% per year, which trails the sector average, the company has become profitable over the last five years, averaging 13.2% earnings growth annually. Despite a slip in net profit margins from 3.9% to 2.5% year-over-year, investors are likely to focus on UMH’s high-quality earnings and perceived undervaluation as the foundation for its constructive outlook.

See our full analysis for UMH Properties.Next up, we’ll see how these headline results line up against the narratives that dominate community and analyst discussions around UMH Properties.

See what the community is saying about UMH Properties

Profit Margins Compressed Despite Forecast Upswing

- Net profit margins have fallen to 2.5%, down from 3.9% last year. This reflects increased cost pressure even as revenue growth forecasts remain solid.

- Analysts' consensus view highlights heavy reliance on acquisitions and higher debt exposure as potential risks for future margin recovery.

- Gross margin declined from 38% to 32% in the company’s home sales business, raising concerns that expansion phases may put further stress on overall profitability.

- Despite guidance for profit margins to reach 9.9% three years out, the current margin trend challenges the case for rapid turnaround and supports analysts' concerns about long-term compression.

Undervaluation Signals Versus Price Target Gap

- With shares trading at $14.55, UMH is approximately 24.1% below the analyst price target of $19.25. The stock is highlighted as undervalued versus peers on a price-to-sales basis.

- Analysts' consensus view notes that the gap between the current price and target is reinforced by strong earnings growth forecasts, but this depends on achieving a projected $327.1 million in revenue and a price-to-earnings ratio of 81.1x by 2028.

- Potential for multiple expansion relies on ongoing regulatory and financing support, which means the upside case is closely tied to successful execution of growth initiatives.

- The undervalued reading by price-to-sales could be at risk if profit margins remain compressed or acquisition activity slows, underscoring the importance of operational follow-through for future gains.

Consensus sees a tug-of-war between rapid earnings growth and margin pressure. See how this shapes the full narrative in the community's detailed analysis. 📊 Read the full UMH Properties Consensus Narrative.

Acquisition Pipeline and Debt Fuel Risk

- UMH’s ongoing growth depends on securing $120 to $150 million per year for acquisitions. Management has stated there are currently no properties under contract, increasing both funding and expansion risk.

- Analysts' consensus view flags that increased borrowing and higher refinancing rates could impact earnings, as the company’s move from equity to debt may expose it to greater refinancing risk if interest rates remain high.

- Reliance on debt in a rising rate environment introduces volatility to future net profits, especially in light of recent declines in gross and net margins.

- Operational headwinds, such as elevated payroll and utility costs and significant tenant credit exposure, further increase the importance of successful deal execution and capital management.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for UMH Properties on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have another take on these results? Shape your perspective in just a few minutes. There’s never been a better time to make your narrative. Do it your way

A great starting point for your UMH Properties research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

UMH Properties faces ongoing profit margin compression and increasing reliance on debt, which casts doubt on its ability to sustain growth if costs rise further.

If you'd rather focus on companies with stronger financial footing and less debt risk, check out solid balance sheet and fundamentals stocks screener (1981 results) to discover high-quality alternatives built for resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UMH

UMH Properties

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that currently owns and operates 145 manufactured home communities, containing approximately 27,000 developed homesites, of which 10,800 contain rental homes, and over 1,000 self-storage units.

Established dividend payer with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion