- United States

- /

- Residential REITs

- /

- NYSE:UDR

Will UDR's (UDR) Board Refresh Shape the Company's Long-Term Strategy Amid Analyst Concerns?

Reviewed by Sasha Jovanovic

- Earlier this month, UDR, Inc. appointed Richard “Ric” B. Clark, an experienced real estate executive, to its Board of Directors while implementing leadership changes aligned with a long-term succession plan.

- Clark’s addition brings four decades of capital markets expertise as the company expands its board following the retirement of two long-tenured directors in 2025.

- We’ll explore how the appointment of a seasoned board member amid key analyst downgrades could influence UDR’s investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

UDR Investment Narrative Recap

Owning UDR requires confidence in continued strong demand for multifamily rentals amid persistent housing shortages while managing pressure from elevated new supply in Sunbelt and select urban markets. The recent addition of Ric Clark to the Board, despite arriving during analyst downgrades and ongoing leadership changes, does not materially shift the most important catalysts or risks near term, which remain centered on occupancy trends and the absorption of new units.

The upcoming earnings release on October 29, 2025, stands out as the most relevant announcement, with investors seeking clarity on how ongoing supply additions and management changes may affect short-term revenue and net operating income growth, especially given the company's recently narrowed guidance.

By contrast, what many shareholders may overlook is the risk that persistent overbuilding in key markets still poses to...

Read the full narrative on UDR (it's free!)

UDR's outlook projects $1.9 billion in revenue and $227.8 million in earnings by 2028. This is based on analysts' assumptions of 3.7% annual revenue growth and a $100.7 million increase in earnings from the current $127.1 million.

Uncover how UDR's forecasts yield a $43.02 fair value, a 19% upside to its current price.

Exploring Other Perspectives

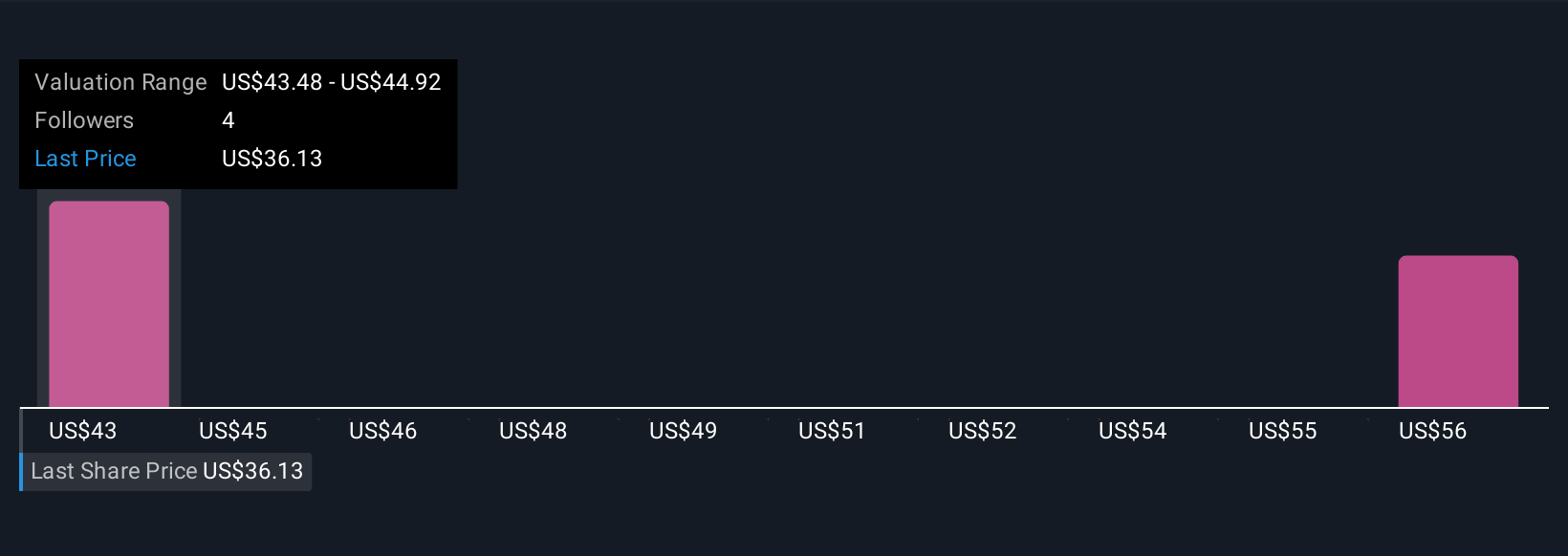

Simply Wall St Community members put UDR's fair value between US$43.02 and US$58.15 across two analyses. While supply-driven headwinds remain front of mind, investor expectations for growth and risk can widely differ, consider exploring these alternative views.

Explore 2 other fair value estimates on UDR - why the stock might be worth as much as 61% more than the current price!

Build Your Own UDR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UDR research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free UDR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UDR's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UDR

UDR

UDR, Inc. (NYSE: UDR), an S&P 500 company, is a leading multifamily real estate investment trust with a demonstrated performance history of delivering superior and dependable returns by successfully managing, buying, selling, developing and redeveloping attractive real estate properties in targeted U.S.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives