- United States

- /

- Residential REITs

- /

- NYSE:UDR

Does UDR’s Current Drop Offer Opportunity After Latest Partnership Expansion?

Reviewed by Bailey Pemberton

If you own UDR stock or have it on your watchlist, you are probably weighing your next move right now. After all, UDR's recent share performance has inspired plenty of second-guessing. The stock is down 2.2% over the past week, down 5.2% in the last month, and has drifted lower by 14.5% year-to-date. After a difficult year, UDR’s price is now about 15% below where it stood a year ago, despite a longer-term gain of 22.6% over five years. It is clear that while multifamily REITs like UDR have faced shifting market sentiment, especially as rates and economic outlooks have shifted, there is still reason for patient investors to stay interested.

Of course, sharp moves in the stock price often get us thinking, is the stock still fairly valued or does the recent dip suggest a rare opportunity? To help frame the decision, UDR’s valuation score comes in at 2, meaning it passes 2 out of 6 common undervaluation checks. That is a mixed, but not disastrous, starting point. In the next section, I will break down what these valuation checks are, and look at how UDR squares up against each one. Stick with me, because at the end, we will also talk about a smarter way to judge whether this stock is undervalued.

UDR scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: UDR Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model helps estimate a company's underlying value by projecting its future adjusted funds from operations and then discounting those expected cash flows back to today's dollars. For UDR, this approach uses recent and projected Free Cash Flow (FCF) figures in $.

Currently, UDR generates around $775.2 Million in Free Cash Flow. Analyst estimates extend for the next five years, forecasting steady growth, with projections reaching $946.3 Million by 2029. After that period, cash flows are extrapolated using reasonable long-term assumptions. These future cash flows are summed and discounted to arrive at a present value for the company.

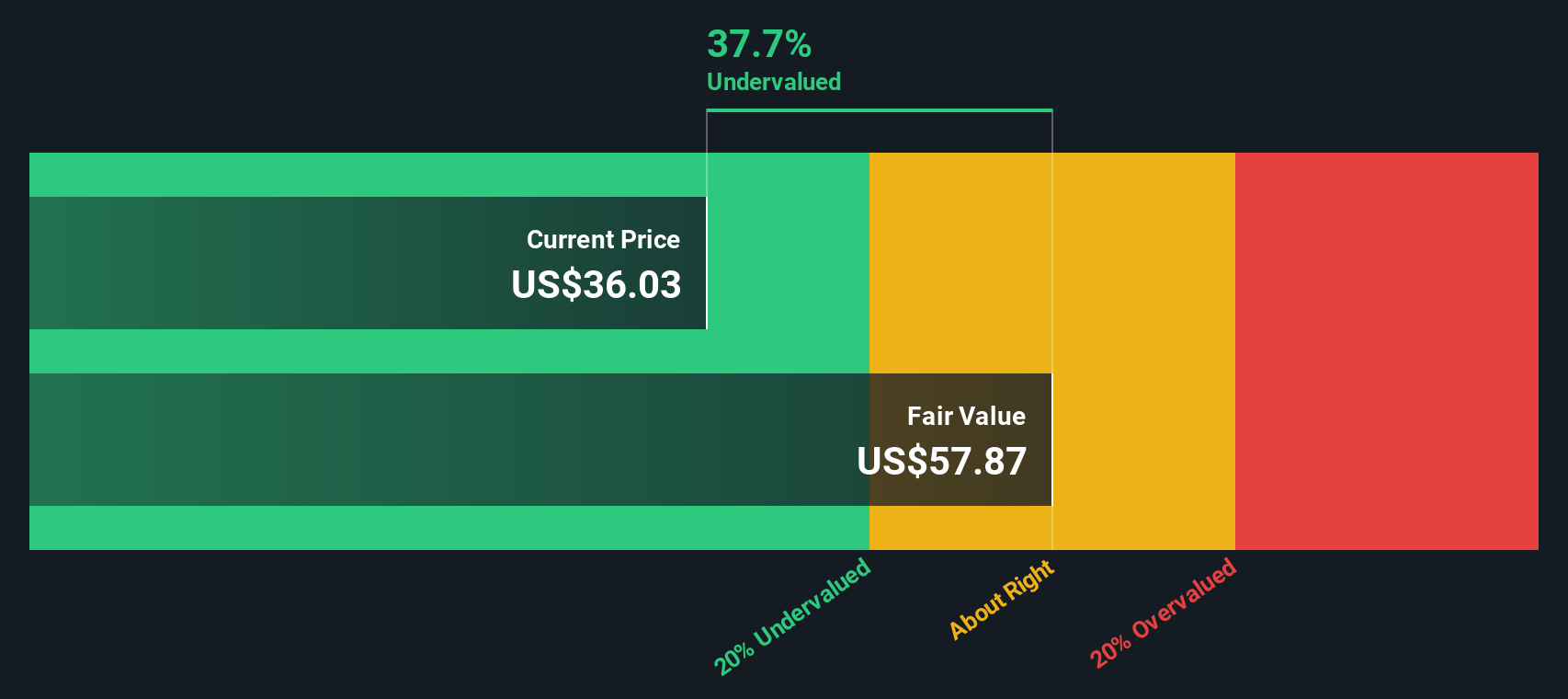

According to the DCF calculation, UDR's intrinsic value is estimated at $57.89 per share. When compared to the current share price, this implies the stock is trading at a 37.2% discount to its intrinsic value, which suggests that UDR is meaningfully undervalued based on this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests UDR is undervalued by 37.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: UDR Price vs Earnings

The Price-to-Earnings (PE) ratio is a classic tool for valuing profitable companies like UDR. It is useful because it shows how much investors are willing to pay today for a dollar of earnings, making it a solid benchmark for companies that generate steady profits.

Determining what qualifies as a “normal” or “fair” PE ratio depends not just on the company's earnings, but also on its expected future growth and the risks it faces. Generally, higher growth or lower risk supports a higher PE, while more uncertain outlooks or slow growth would typically pull the fair ratio down.

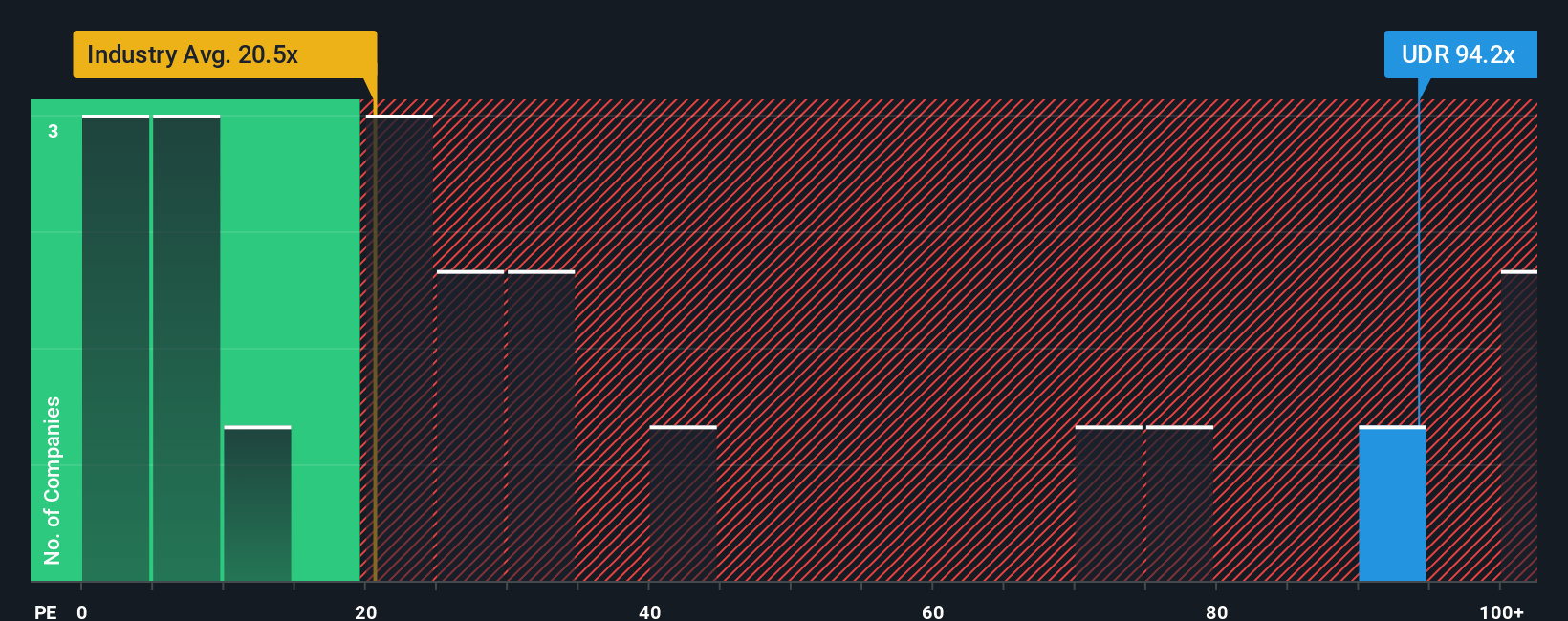

Right now, UDR trades at a PE ratio of 94.82x, which is much higher than both the Residential REITs industry average of 20.50x and the peer group’s average of 36.23x. However, rather than only comparing UDR to these sector benchmarks, we can also look at Simply Wall St’s “Fair Ratio.” This proprietary measure considers a broader set of factors such as UDR’s future earnings growth, profit margins, market cap, and risk profile, giving a more tailored view of what a justified PE should be. For UDR, the Fair Ratio is 37.78x, making it a more customized benchmark than a simple industry average.

Comparing UDR’s actual PE of 94.82x with its Fair Ratio of 37.78x, the stock appears significantly overvalued using this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your UDR Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story behind the numbers. It lets you combine your unique perspective on a company with concrete financial assumptions such as fair value, future revenue, earnings, and margins, all in one place. Narratives link UDR's business story, for example, surging demand for multifamily housing or margin pressures from new supply, to a clear financial forecast and ultimately a calculated fair value.

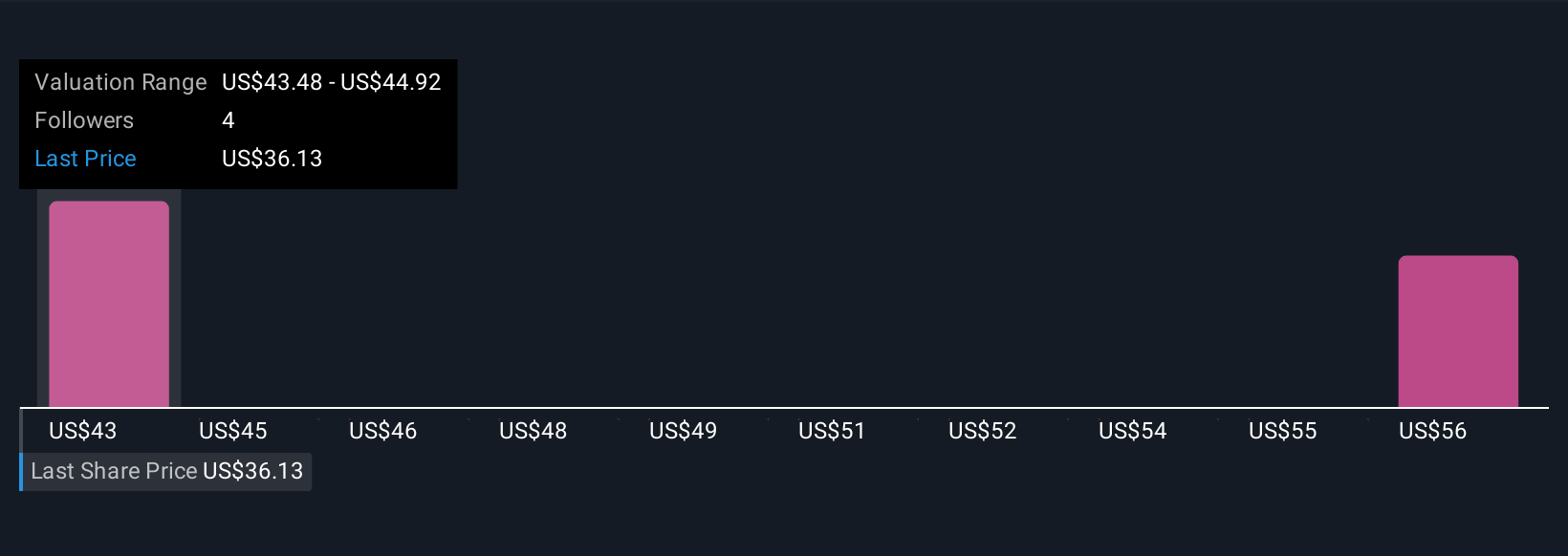

This approach is simple and accessible, available on Simply Wall St’s Community page, where millions of investors share and discuss their Narratives. Narratives help you decide when to buy or sell by visually comparing your fair value to today's share price. What makes Narratives especially powerful is that they update automatically as new data comes in, meaning your conclusions are always current, whether from quarterly results or market news.

For instance, some investors see UDR's resilient Sunbelt and coastal exposure driving upside, supporting fair values as high as $49.00. Others are more cautious about rent headwinds, setting fair values down near $37.00. In short, Narratives let you move beyond static ratios to a more dynamic, story-driven way to invest. Try creating your own for UDR and compare with the Community to gain actionable insights.

Do you think there's more to the story for UDR? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UDR

UDR

UDR, Inc. (NYSE: UDR), an S&P 500 company, is a leading multifamily real estate investment trust with a demonstrated performance history of delivering superior and dependable returns by successfully managing, buying, selling, developing and redeveloping attractive real estate properties in targeted U.S.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives