- United States

- /

- Retail REITs

- /

- NYSE:SPG

Simon Property Group (SPG): Assessing Valuation After Cramer’s Praise and the IEM "Micro Spaces" Partnership

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 0.6% Undervalued

The most widely followed narrative views Simon Property Group as nearly fairly valued, with only a slight undervaluation. Analysts' consensus takes into account all major business drivers, recent performance, and sector re-rating to reach this conclusion.

Strategic redevelopment and transformation of existing assets into mixed-use, experience-focused environments, such as the ongoing projects and the Brickell City Centre acquisition, aim to address evolving consumer preferences for experience-driven destinations. This approach supports not only stable rent growth but also incremental revenue from diversified income streams, which enhances margins and long-term earnings power.

Eager to find out why Simon's fair value is ticking upward? There is a bold assumption in this narrative, involving profitable evolution and a market-beating profit multiple. Interested in the insight into which levers such as earnings, revenue shifts, and margin boosts really shape the math behind this price target? All will be revealed in the details of this analyst consensus.

Result: Fair Value of $186.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent retail bankruptcies or sudden tenant turnover remain real risks. These factors could test Simon’s pricing power and long-term revenue stability.

Find out about the key risks to this Simon Property Group narrative.Another View: Value Signals from the SWS DCF Model

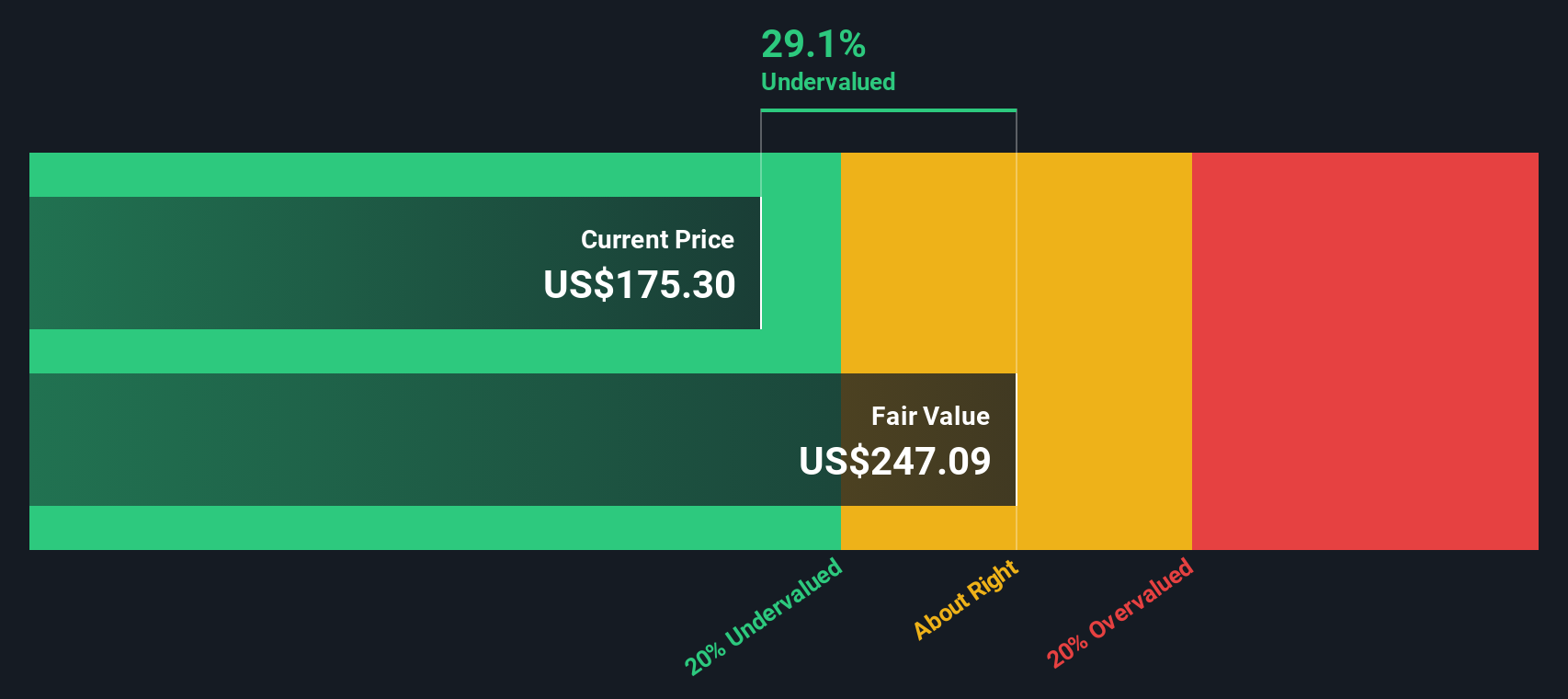

Taking a different approach, our DCF model also weighs in with a result that points to undervaluation. This method analyzes future cash flows in greater detail, which may provide a more realistic view of Simon’s long-term potential.

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Simon Property Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Simon Property Group Narrative

If you see things differently or want a personalized perspective, you can dig into the numbers and craft your own story in under three minutes. Do it your way

A great starting point for your Simon Property Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Jump on emerging trends and strengthen your portfolio with fresh opportunities beyond Simon Property Group. Don’t let the next big winner pass you by.

- Accelerate your returns by tapping into stocks offering reliable payouts. Start with dividend stocks with yields > 3% for impressive yields and resilient performance through market cycles.

- Capture tomorrow’s breakthroughs by seeking out companies at the forefront of artificial intelligence. Make your move with AI penny stocks and find businesses shaping technology’s future.

- Spot hidden gems trading below their true worth. Seize the advantage with undervalued stocks based on cash flows to target stocks with strong fundamentals and exciting upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPG

Simon Property Group

Simon Property Group, Inc. (NYSE:SPG) is a self-administered and self-managed real estate investment trust (“REIT”).

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives