- United States

- /

- Retail REITs

- /

- NYSE:SPG

Is Simon Property Group a Bargain After Mixed Mall Sales and Recent Price Drop?

Reviewed by Bailey Pemberton

Thinking about buying, selling, or just holding your Simon Property Group shares? You are not alone. Investors have had plenty to consider in recent months, especially as the stock has made some big moves. Over the last year, Simon Property Group has delivered a solid 7.8% gain, handily outpacing many rivals. If you zoom out to a five-year view, the stock boasts a remarkable 254.0% return. Of course, recent weeks have been less rosy, with short-term jitters pulling the price down 5.4% this past week and 2.2% over the past month. These swings reflect shifting market sentiment around real estate and retail exposure, along with broader economic headwinds.

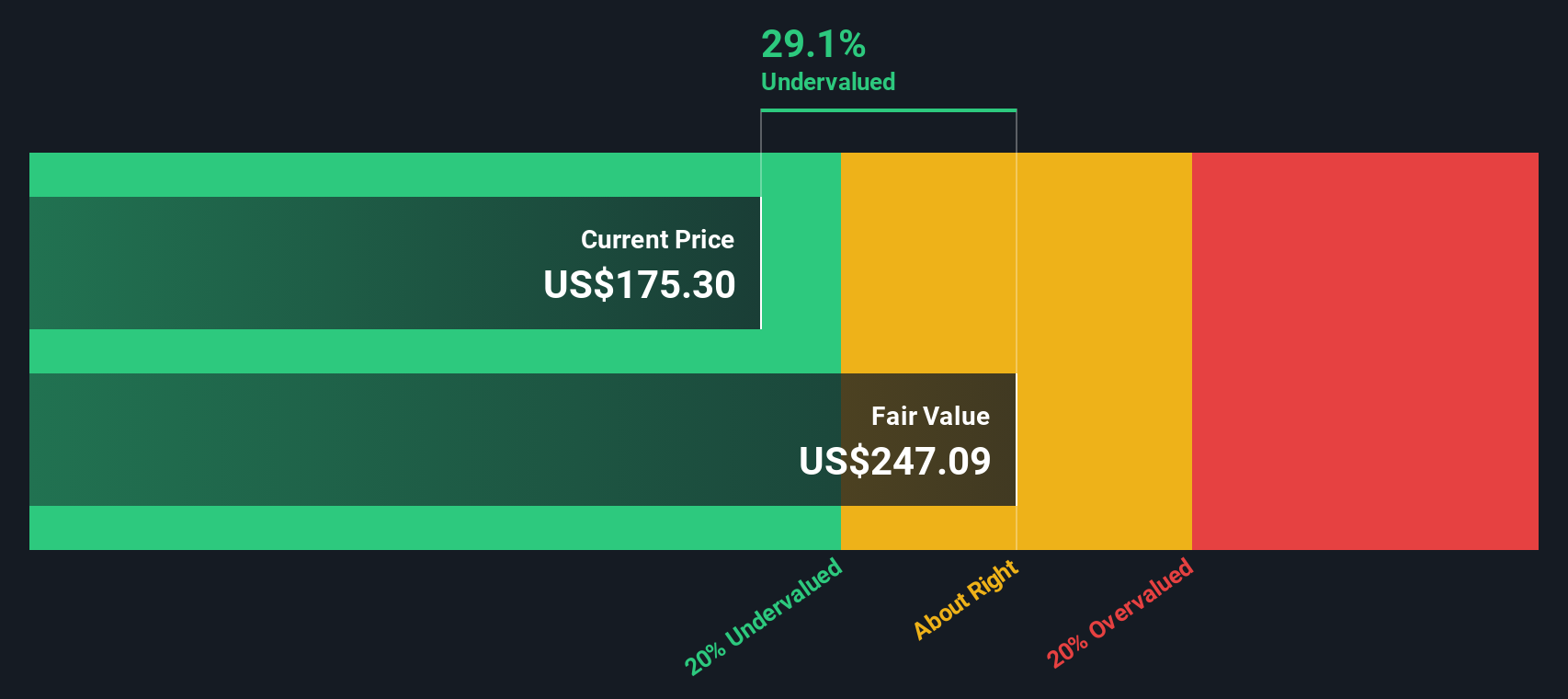

With the last close at $175.30, you may be wondering if Simon Property Group still represents good value or if this is the time to take some chips off the table. The company currently scores an impressive 4 out of 6 on our value checklist, suggesting it is undervalued in several key areas. This can be a promising sign for value-focused investors. But what exactly does that value score mean, and does it tell the full story?

Next, we will break down the different ways analysts assess a stock’s valuation, revealing where Simon Property Group shines and where you might want to dig a little deeper. Stay tuned, because at the end of this article, I will introduce a smarter approach to thinking about valuation. This could give you a crucial edge as you decide your next move.

Approach 1: Simon Property Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting future adjusted funds from operations and then discounting those anticipated cash flows back to today’s value. For Simon Property Group, this means using its current free cash flow (FCF), which stands at $4.36 billion, and assessing how these cash flows are expected to grow over time.

Analysts provide estimates out through 2029, with the FCF forecasted to increase gradually, reaching a projected $4.85 billion in that year. Beyond this period, projections are extrapolated using Simply Wall St’s methodology up to 2035, where the free cash flow could exceed $5.89 billion. This multi-stage approach provides a comprehensive view of both near-term analyst expectations and long-term growth assumptions.

Based on these projections, Simon Property Group’s estimated intrinsic share value comes in at $246.67. With the current share price at $175.30, the DCF calculation signals a 28.9% discount. According to this model, the stock appears significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Simon Property Group is undervalued by 28.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Simon Property Group Price vs Earnings (PE)

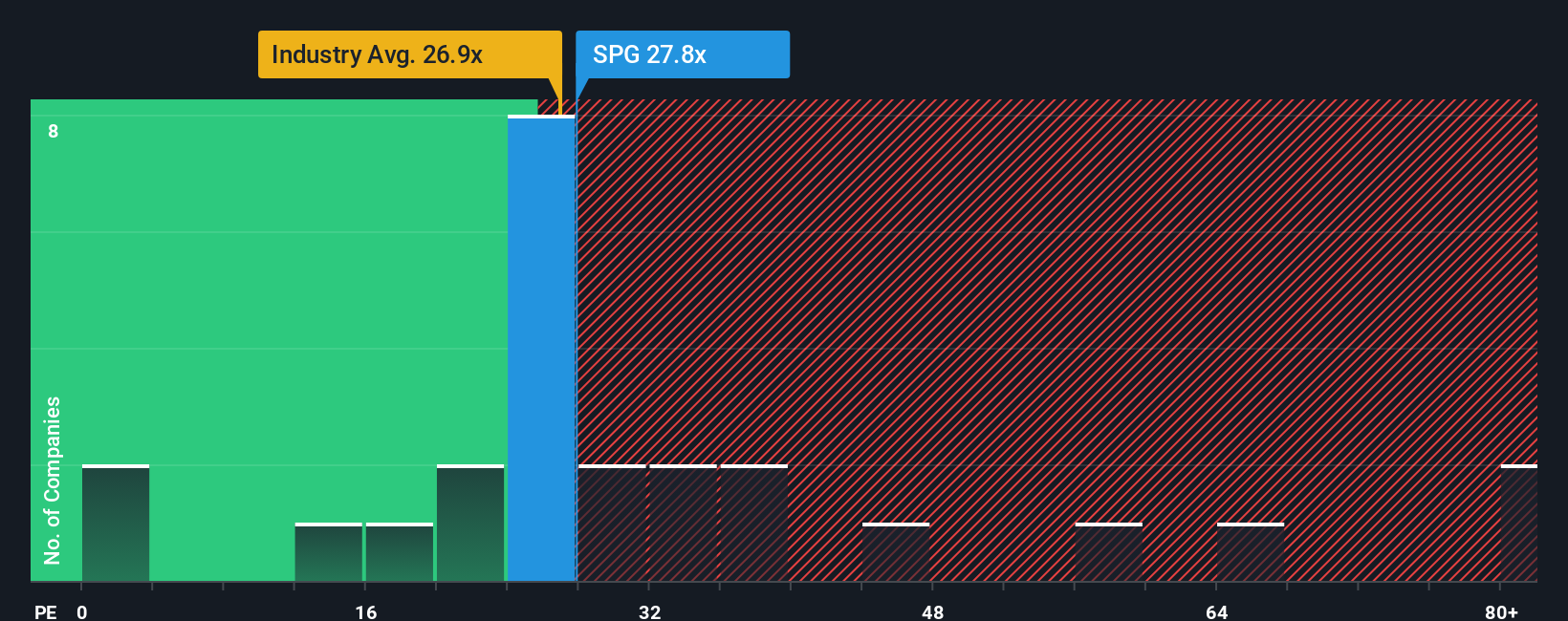

The Price-to-Earnings (PE) ratio is a classic tool for valuing profitable companies like Simon Property Group. It measures how much investors are willing to pay today for each dollar of earnings, making it especially useful for evaluating established businesses with consistent profits. A lower PE can signal a bargain if the company’s prospects and risks are in line with the market.

Growth expectations and perceived risk play a big part in what counts as a normal or fair PE ratio. Fast-growing or safer companies usually command higher PEs, while slower growers or riskier businesses tend to trade at lower multiples. Simon Property Group currently trades at a PE of 27.1x. This compares favorably with both the industry average for Retail REITs of 25.2x and the average of its closest peers at 35.2x.

Simply Wall St’s “Fair Ratio” offers a more informed benchmark by factoring in not just industry norms, but also Simon’s growth outlook, profitability, size, and company-specific risks. For Simon, the Fair Ratio stands at 35.0x. This approach provides a fuller sense of value than a straight comparison with peers because it reflects a nuanced analysis of what a business like Simon deserves in the market.

With the current PE of 27.1x well below the Fair Ratio of 35.0x, Simon Property Group appears undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Simon Property Group Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company’s future; it is where you make your own forecasts for revenue, earnings, and profit margins, and use them to calculate your fair value for the stock. Narratives bridge the gap between the numbers and the bigger picture, connecting your view of Simon Property Group’s strategy, risks, and industry trends to the company’s future financials and, ultimately, its true worth.

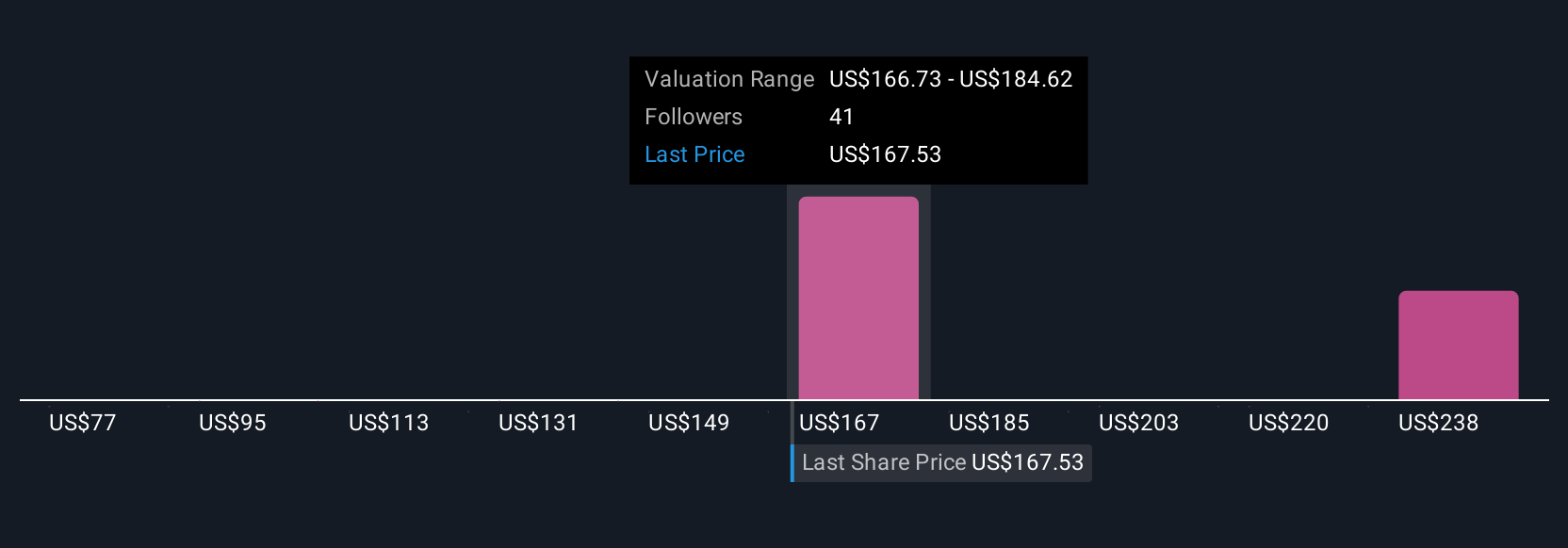

Available to millions of investors on Simply Wall St’s Community page, Narratives are a user-friendly, powerful tool that helps you act confidently: you can quickly compare your fair value to today’s share price, see if your thesis still makes sense, and know when to buy or sell. Narratives update automatically with the latest news or results, so your view stays relevant as new information arrives. For example, some investors might think Simon Property Group’s mixed-use redevelopment projects will drive earnings and assign a high fair value (as high as $225), while others worry about retail headwinds and set theirs lower (as low as $169). The Narrative you build reflects your own unique outlook.

Do you think there's more to the story for Simon Property Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPG

Simon Property Group

Simon Property Group, Inc. (NYSE:SPG) is a self-administered and self-managed real estate investment trust (“REIT”).

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives