- United States

- /

- Retail REITs

- /

- NYSE:SKT

Tanger (SKT): Is There Value Left After Years of Outsized Returns?

Reviewed by Kshitija Bhandaru

Tanger (SKT) shares have edged slightly higher so far this week, even without any headline-making developments driving investor attention. The stock’s minor movement invites a closer look at how the company is currently valued in the market.

See our latest analysis for Tanger.

Tanger’s share price has pulled back slightly in recent weeks, but its three-year total shareholder return of 120% and a remarkable 529% total return over five years keep it well ahead of many peers. While short-term momentum is fading, the longer-term trend underscores investor confidence in the company’s growth and resilience.

If you’re tracking stocks with strong historical performance, now is a great time to see what else is out there and discover fast growing stocks with high insider ownership

With Tanger currently trading around 13% below its analyst price target and fundamentals showing steady growth, the key question remains: is there still a bargain here, or has the market already priced in the gains ahead?

Most Popular Narrative: 8.5% Undervalued

With Tanger closing at $32.54 and the most widely followed narrative putting fair value at $35.55, the debate is not if Tanger’s cheap, but what’s fueling that optimism. Here is what is central to the narrative behind that valuation.

Tanger’s active remerchandising and ongoing addition of differentiated brands and experiential tenants (such as food, beverage, and entertainment) is drawing new customer demographics and increasing dwell times, which has led to notable leasing spreads and supports continued rental income growth and margin improvement.

Curious why analysts believe Tanger deserves a premium price tag? What hidden levers or ambitious expansion moves could unlock incredible earnings growth? Unpack the full narrative to see which bold assumptions make this stock’s fair value stand out.

Result: Fair Value of $35.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a persistent shift toward e-commerce and reliance on a concentrated tenant mix remain potential risks that could challenge Tanger’s optimistic narrative.

Find out about the key risks to this Tanger narrative.

Another View: Market Ratios Tell a Cautionary Story

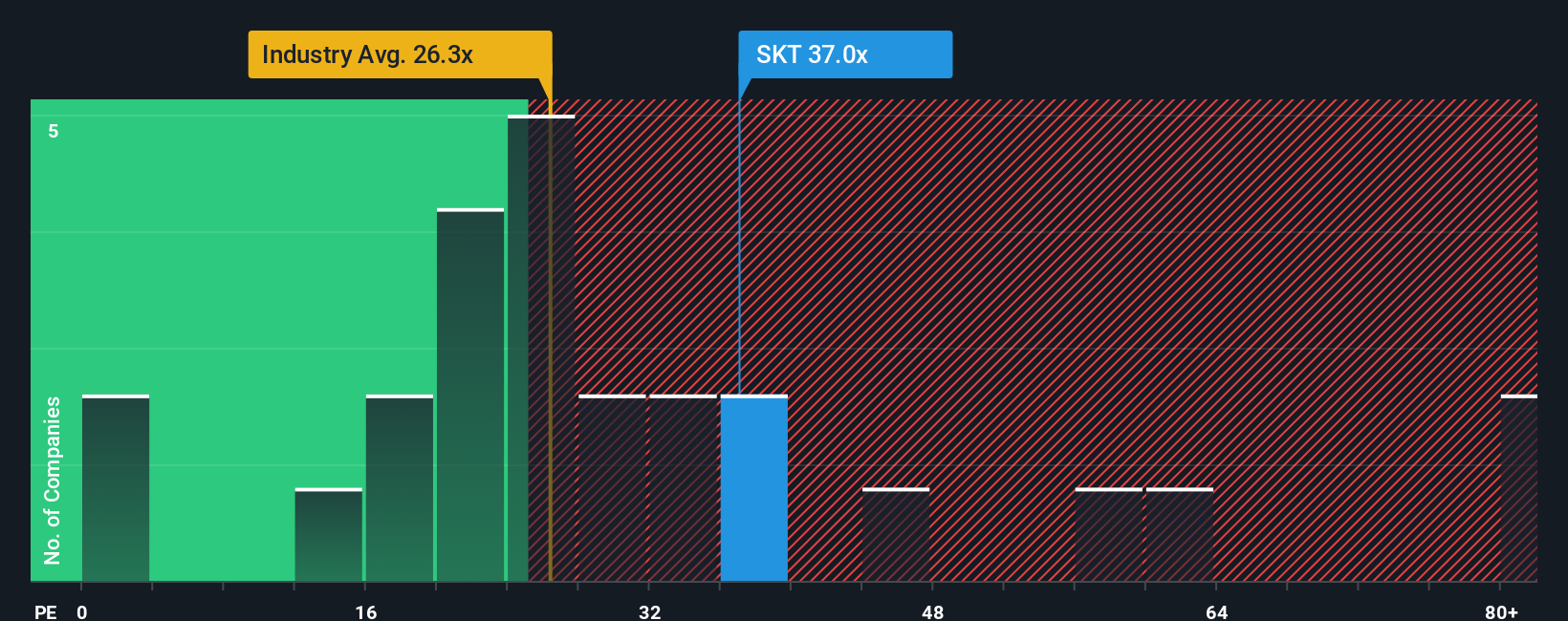

While the narrative highlights value, the company's current price-to-earnings ratio of 36.9x stands out as expensive compared to the Retail REITs industry average of 25.5x and even its own fair ratio of 35.8x. This suggests investors may be paying a premium, which adds valuation risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tanger Narrative

If you see things differently or want to dive deeper than the popular story, it only takes a few minutes to build your own view from the data. Do it your way.

A great starting point for your Tanger research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

You don’t want to miss out on stocks flying under the radar. Make your next move with these top opportunities from Simply Wall St’s powerful Screener:

- Tap into stocks offering consistent income by checking out these 18 dividend stocks with yields > 3% to uncover solid companies paying yields over 3%.

- Spot tomorrow’s tech disruptors before everyone else by reviewing these 25 AI penny stocks, a list packed with promising AI-focused companies on the rise.

- Catch undervalued gems primed for future growth by using these 881 undervalued stocks based on cash flows, which is based on robust cash flow analysis and smart valuation metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tanger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SKT

Tanger

Tanger Inc. (NYSE: SKT) is a leading owner and operator of outlet and open-air retail shopping destinations, with over 44 years of expertise in the retail and outlet shopping industries.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives