- United States

- /

- Real Estate

- /

- NYSE:HOUS

Broker Revenue Forecasts For Realogy Holdings Corp. (NYSE:RLGY) Are Surging Higher

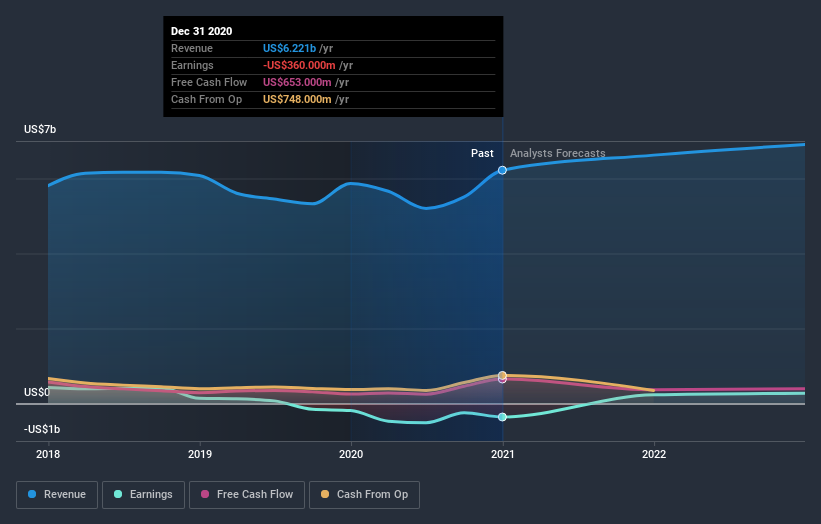

Shareholders in Realogy Holdings Corp. (NYSE:RLGY) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The revenue forecast for this year has experienced a facelift, with the analysts now much more optimistic on its sales pipeline.

After this upgrade, Realogy Holdings' four analysts are now forecasting revenues of US$7.3b in 2021. This would be a notable 18% improvement in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of US$6.6b in 2021. The consensus has definitely become more optimistic, showing a decent improvement in revenue forecasts.

See our latest analysis for Realogy Holdings

There was no particular change to the consensus price target of US$18.86, with Realogy Holdings' latest outlook seemingly not enough to result in a change of valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on Realogy Holdings, with the most bullish analyst valuing it at US$24.00 and the most bearish at US$15.00 per share. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

Of course, another way to look at these forecasts is to place them into context against the industry itself. One thing stands out from these estimates, which is that Realogy Holdings is forecast to grow faster in the future than it has in the past, with revenues expected to display 18% annualised growth until the end of 2021. If achieved, this would be a much better result than the 0.7% annual decline over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 15% annually. So while Realogy Holdings' revenues are expected to improve, it seems that it is expected to grow at about the same rate as the overall industry.

The Bottom Line

The highlight for us was that analysts increased their revenue forecasts for Realogy Holdings this year. Analysts also expect revenues to grow approximately in line with the wider market. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Realogy Holdings.

Analysts are definitely bullish on Realogy Holdings, but no company is perfect. Indeed, you should know that there are several potential concerns to be aware of, including recent substantial insider selling. For more information, you can click through to our platform to learn more about this and the 2 other warning signs we've identified .

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading Realogy Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Anywhere Real Estate, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:HOUS

Anywhere Real Estate

Through its subsidiaries, provides residential real estate services in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives