- United States

- /

- Industrial REITs

- /

- NYSE:REXR

Is Now the Right Moment for Rexford After Latest Stock Rebound?

Reviewed by Bailey Pemberton

If you have been watching Rexford Industrial Realty stock in your portfolio or on your watchlist, you are certainly not alone. With the share price closing recently at $42.17, the real question is whether this is a smart entry point, or if caution still makes sense. Over the past week, Rexford’s stock moved up by 1.6%, offering a glimmer of momentum, even as the 30-day return ticked slightly into negative territory at -1.6%. The year-to-date performance, up a healthy 9.8%, shows signs of renewed investor interest after a tougher past year, where the stock is still down 10.8%.

Some market watchers are pointing to broader shifts in industrial real estate demand as a tailwind for the sector, while others remain cautious, still weighing risk in a changing rate environment. Rexford’s longer-term performance is a mixed bag, gaining just 1.0% over five years and slipping 8.7% over three years. This all highlights the push and pull between optimism and risk perception that shapes any decision here.

But what about valuation? Using a six-point checklist for measuring undervaluation, Rexford scores a 2, meaning it is undervalued in two out of six metrics. That is not a slam dunk, but also not something to dismiss. So, let’s dig deeper. We will break down Rexford’s valuation through several popular approaches and, even better, touch on a smarter way to think about value later on.

Rexford Industrial Realty scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Rexford Industrial Realty Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model aims to estimate Rexford Industrial Realty's underlying worth by projecting its adjusted funds from operations years into the future and then discounting those cash flows back to today’s dollars. This approach evaluates what the business is really worth, rather than simply relying on current share price trends.

For Rexford, the latest figures highlight a last twelve months’ free cash flow of $543.16 million. Analyst estimates extend for five years, projecting steady growth, after which expert models extrapolate future increases. By 2029, free cash flow is expected to reach $662.29 million, with even higher figures forecast into the next decade as growth gradually slows. These projections drive the DCF model’s fair value calculation.

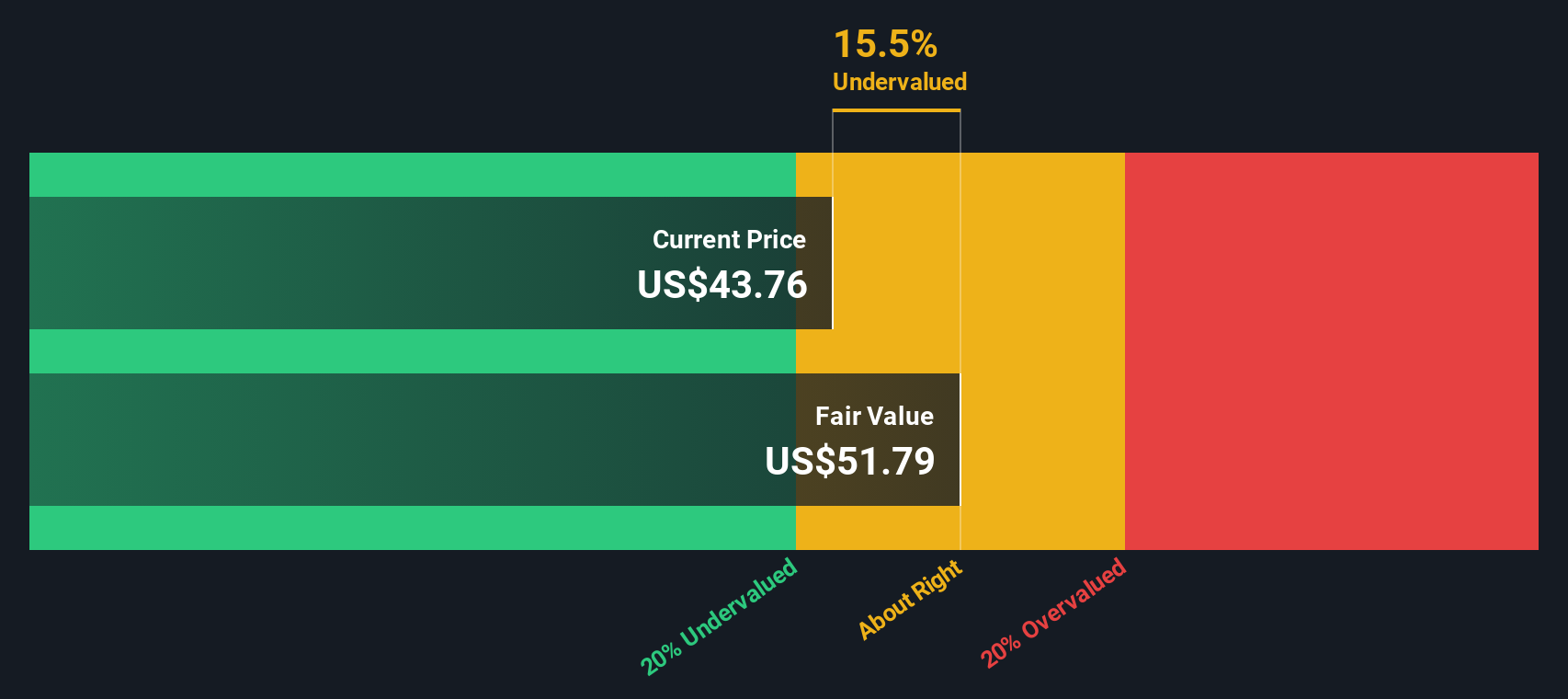

Applying this methodology, Rexford’s estimated intrinsic value arrives at $50.42 per share. With the stock currently trading at $42.17, the model suggests Rexford is trading at a 16.4% discount to its true worth. This may be a sign of undervaluation according to this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rexford Industrial Realty is undervalued by 16.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Rexford Industrial Realty Price vs Earnings

The Price-to-Earnings (PE) ratio is often considered the gold standard for valuing profitable companies because it connects a company’s current share price to its earnings. It is a useful way to gauge how much investors are willing to pay today for a dollar of future earnings, and whether that price makes sense given the company’s outlook. Growth prospects and perceived risks play a huge role here. A company expected to grow faster or deliver stable results will usually command a higher “normal” PE, while those facing bigger risks or uncertainties might see a lower one.

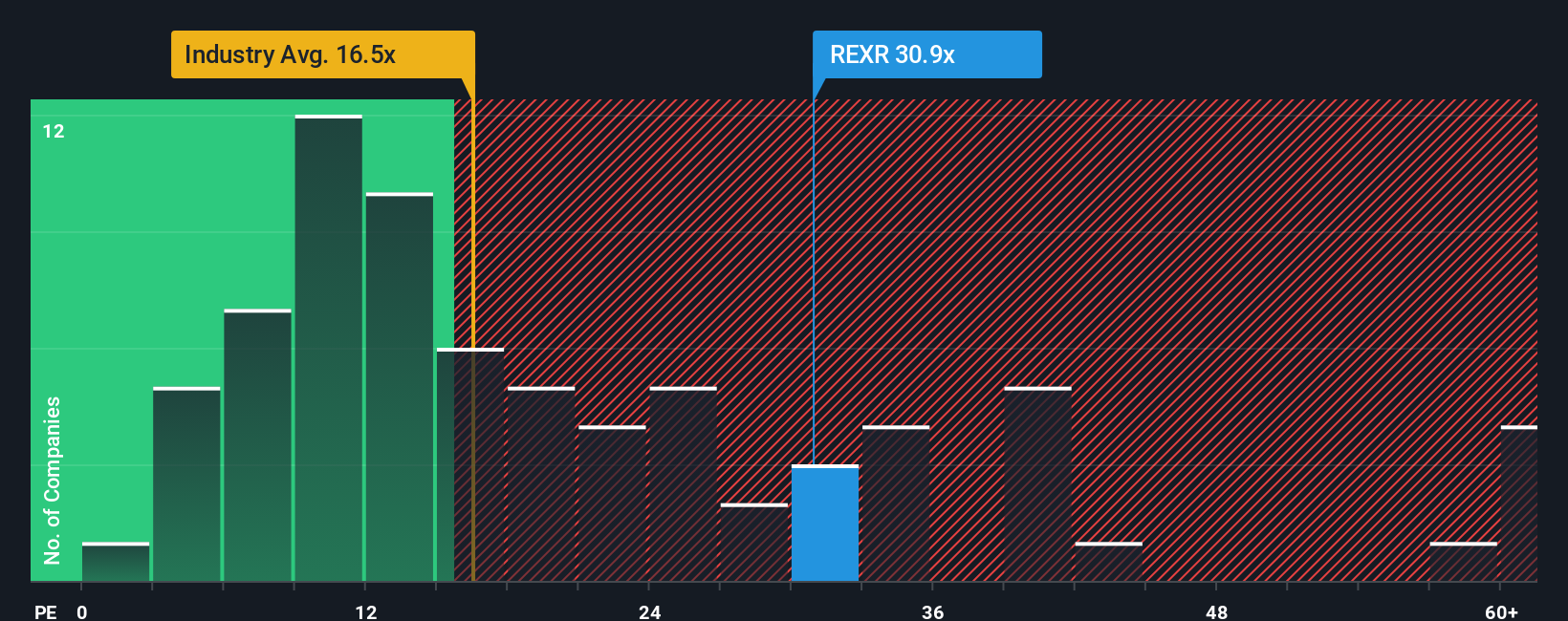

Rexford currently trades at a PE ratio of 32.5x, which is notably higher than the industrial REITs industry average of 16.5x, and above the peer average of 29.9x. On the surface, this might suggest Rexford is a bit pricey, but standard multiples do not consider unique factors like the company’s individual growth runway, margin profile, and specific risks.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio for Rexford is 34.1x, a metric that integrates expected earnings growth, profitability, sector nuances, company size, and risk profile. Unlike raw peer comparisons, this tailored multiple reflects what would be fair for Rexford’s actual situation, not just the group it is bucketed with. Because simply copying peer or industry averages might miss what sets the company apart, the Fair Ratio acts as a more holistic benchmark.

Comparing the current PE (32.5x) with the Fair Ratio (34.1x), Rexford’s stock is trading slightly below its fair value estimate. By this measure, the stock appears modestly undervalued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rexford Industrial Realty Narrative

Earlier, we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company, describing how you see its strengths, challenges, and future prospects, translated into your own forecasts (like expected revenue, profit margins, and fair value). Narratives directly link this story with the financial outlook and a living fair value, making your investment thesis tangible and actionable.

Available to millions of investors on Simply Wall St’s Community page, Narratives give you a structured yet simple way to compare your view of a company's future to others, and to the current market price. They help you decide when to buy or sell, as you can instantly see how your assumptions stack up. Narratives stay up to date as new news or earnings arrive, so your thesis evolves with the facts.

For Rexford Industrial Realty, some analysts expect the stock can reach $44 if redevelopment and market scarcity drive sustained rent growth. Others set a lower target of $35 amid risks like softer rents or redevelopment delays. This shows that even the same data can yield different stories. With Narratives, you can build your own, see others’ perspectives, and make decisions based on the story you believe in.

Do you think there's more to the story for Rexford Industrial Realty? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:REXR

Rexford Industrial Realty

Rexford Industrial creates value by investing in, operating and redeveloping industrial properties throughout infill Southern California, the world's fourth largest industrial market and consistently the highest-demand with lowest-supply major market in the nation.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives