- United States

- /

- Specialized REITs

- /

- NYSE:PSA

Is There Now an Opportunity in Public Storage After the Self Storage REIT Downturn?

Reviewed by Bailey Pemberton

If you're considering your next move with Public Storage stock, you're not alone. Many investors are watching closely, wondering if now is the right time to buy, sell, or hold. Over the past year, the stock has dipped by 12.2%, yet it remains up 14.0% over three years and an impressive 54.3% over five years. This kind of long-term story can be both exciting and a little nerve-racking, especially with short-term bumps like the recent 1.6% uptick over the last week. These swings have lined up with broader market shifts in real estate investment trusts and evolving investor sentiment about the self-storage sector in general. This is less about company-specific news and more about the market digesting economic outlook for property-related names.

Of course, understanding what the market is “pricing in” can be a challenge. Are investors overlooking hidden value, or is risk already built in? That is where a valuation analysis becomes essential. Public Storage currently scores a 4 out of 6 on our value checklist, meaning the company looks undervalued in several respects but not across the board. In the next section, we will dig into exactly which valuation methods suggest there is more upside or caution. Even better, we will close out with a more intuitive way to see if the stock is truly a bargain or not, so you can make a decision with real confidence.

Why Public Storage is lagging behind its peers

Approach 1: Public Storage Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what Public Storage is truly worth by projecting its future adjusted funds from operations and then discounting those expected cash flows back to today's dollars. In essence, this approach asks what someone should pay today for a business given all its estimated future cash generation.

Currently, Public Storage generates $3.03 Billion in free cash flow (FCF) over the last twelve months. Analyst estimates predict annual FCF growth, forecasting $3.47 Billion by the end of 2029. While analysts provide detailed projections for about five years, longer-term numbers beyond that are extrapolated using a steady growth approach to round out the next decade of expected performance.

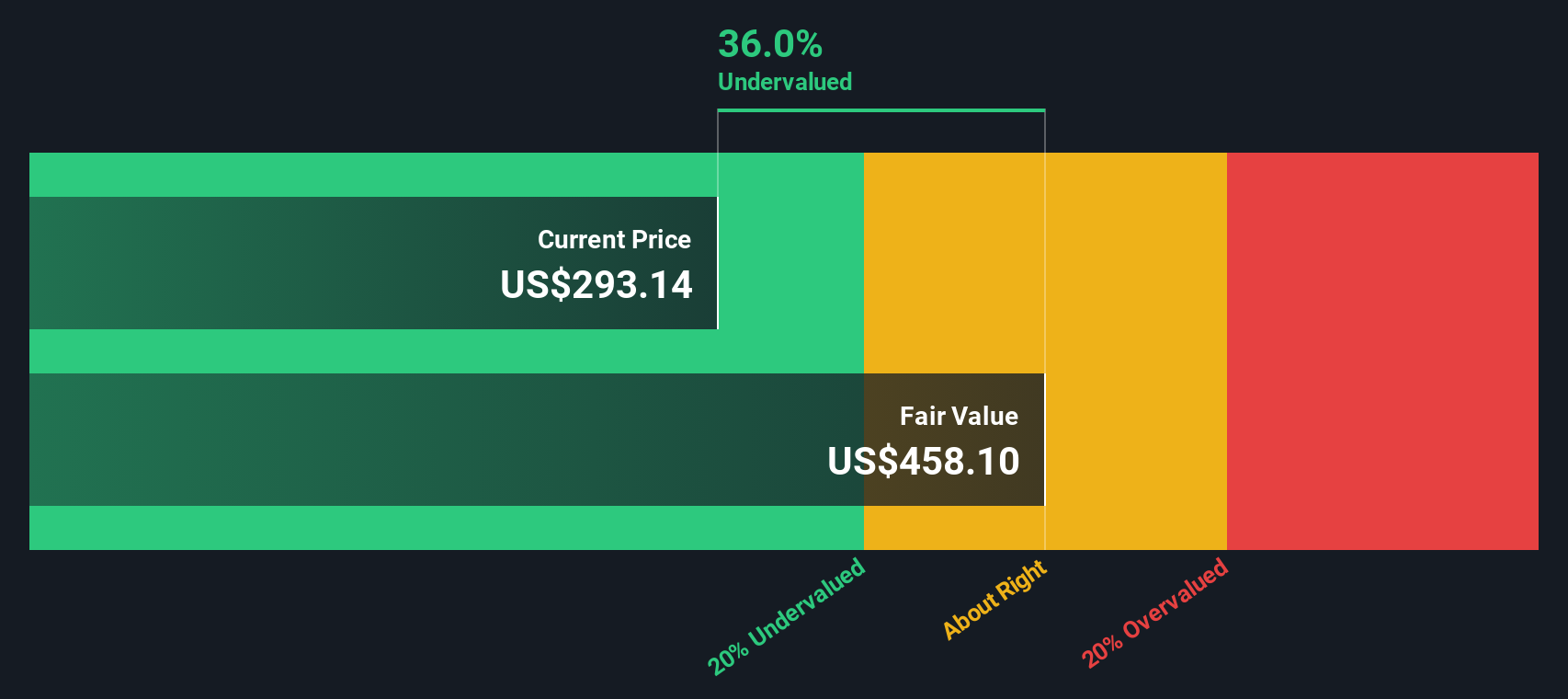

Based on these forward cash flows and discounting them appropriately, the DCF model returns an intrinsic fair value of $457.56 per share. This implies the stock is trading at a 35.8% discount to its estimated fair value, suggesting Public Storage could be significantly undervalued at its current price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Public Storage is undervalued by 35.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Public Storage Price vs Earnings

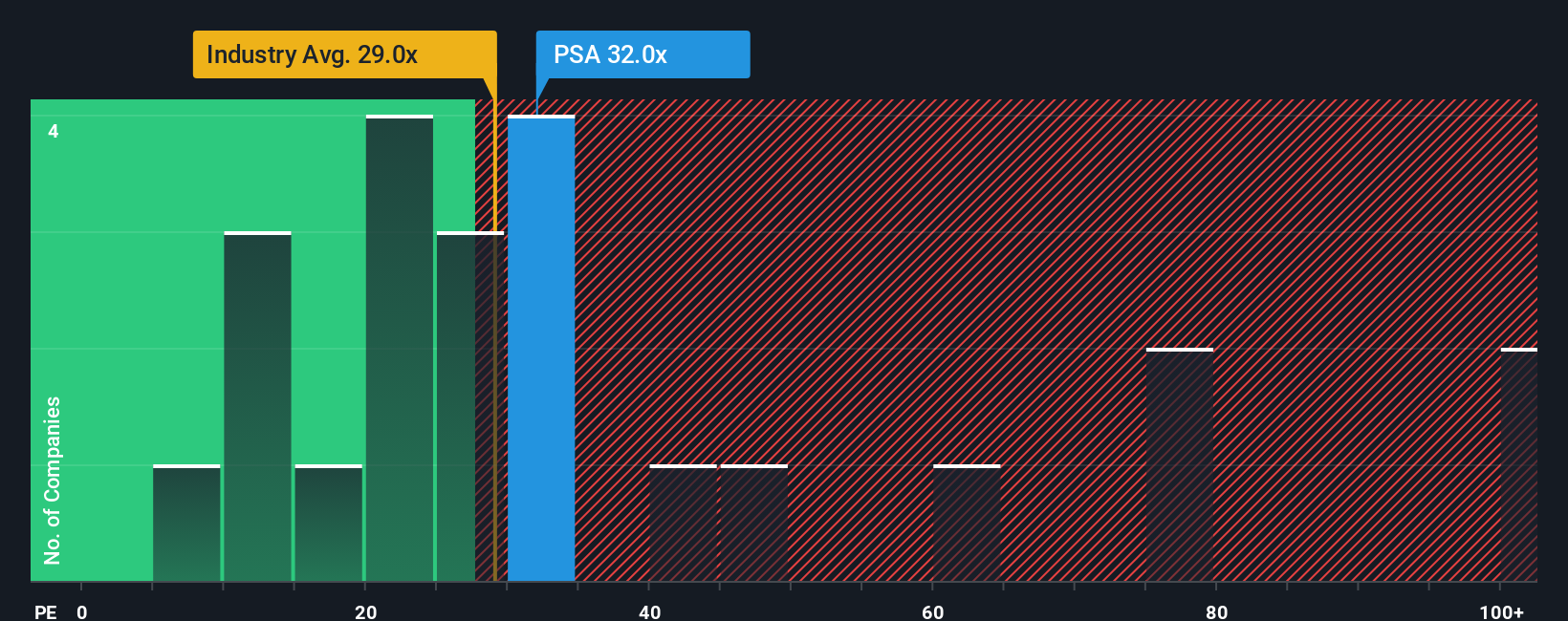

The Price-to-Earnings (PE) ratio is often the go-to valuation metric for profitable companies like Public Storage because it relates the company’s current share price to its per-share earnings. This provides a simple snapshot of how much investors are willing to pay for a dollar of profit. Since Public Storage has a solid earnings profile, this approach helps put the company’s valuation into a context that is easy to compare across both its peers and the broader industry.

Growth expectations and perceived risk play a big role in what qualifies as a “normal” or “fair” PE ratio. Higher anticipated growth or lower risk usually justifies a higher multiple, reflecting investor willingness to pay more for quality or strong prospects. Conversely, slower growth or greater risks can lower that fair level.

Right now, Public Storage is trading at a PE ratio of 31.94x. This is noticeably above the industry average of 17.41x for specialized REITs but slightly below its direct peer average of 37.32x. However, instead of simply focusing on these benchmarks, we use the Simply Wall St “Fair Ratio.” In this case, it is calculated at 35.79x. This proprietary metric is more nuanced as it factors in specific company elements such as growth potential, profit margins, scale, and unique risks, beyond the surface-level comparisons of peers or industry averages.

Comparing Public Storage’s current 31.94x PE to its Fair Ratio of 35.79x suggests the stock is trading below where you might expect based on the company’s fundamentals and outlook. That indicates the shares may be undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Public Storage Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company, combining your view of its future revenue, earnings, and margins, then linking that perspective to a financial forecast and a fair value. Narratives empower you to see how different business stories translate into actual numbers and valuations, so you can cut through the noise and make more confident decisions. On Simply Wall St's Community page, Narratives are shared and updated dynamically as new information, such as earnings or news, emerges, a feature used by millions of investors. This means you can always compare your fair value estimate to the current market price and quickly decide if the stock is a buy or a sell for you. For example, with Public Storage, some investors outline a highly optimistic scenario: strong digital initiatives, urbanization, and resilience could justify a fair value as high as $350 per share. Others, more skeptical about regulatory and cost risks, see a fair value closer to $287. Narratives make it easy to weigh these stories side by side, helping you turn complex forecasts into practical investment actions.

Do you think there's more to the story for Public Storage? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSA

Public Storage

A member of the S&P 500, is a REIT that primarily acquires, develops, owns, and operates self-storage facilities.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives