- United States

- /

- Retail REITs

- /

- NYSE:O

Realty Income (O): Taking a Fresh Look at Valuation as Sentiment Shifts Without Major Headlines

Reviewed by Simply Wall St

Most Popular Narrative: 3.2% Undervalued

According to andre_santos, the most widely discussed narrative suggests Realty Income's shares are trading slightly below their estimated fair value, implying a modest undervaluation in today’s market.

Given the expectation that Realty Income’s dividend growth will decelerate in the coming years, greater weight will be assigned to the Dividend Discount Model. This model reflects more appropriately the anticipated slowdown in dividend growth. In contrast, the Historical Yield method assumes mean reversion, which introduces a higher degree of uncertainty and so it will have a lower weight on the valuation.

Want to see the financial rationale powering this valuation? One model gets a bigger say thanks to expected changes in Realty Income's growth. How does predictable income and slowing dividend growth combine to reach this value? Find out what factors tip the scale behind the headline fair value.

Result: Fair Value of $61.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slowing dividend growth or unexpected interest rate hikes could challenge the current undervaluation outlook and shift investor sentiment.

Find out about the key risks to this Realty Income narrative.Another View: Price Comparison Raises Questions

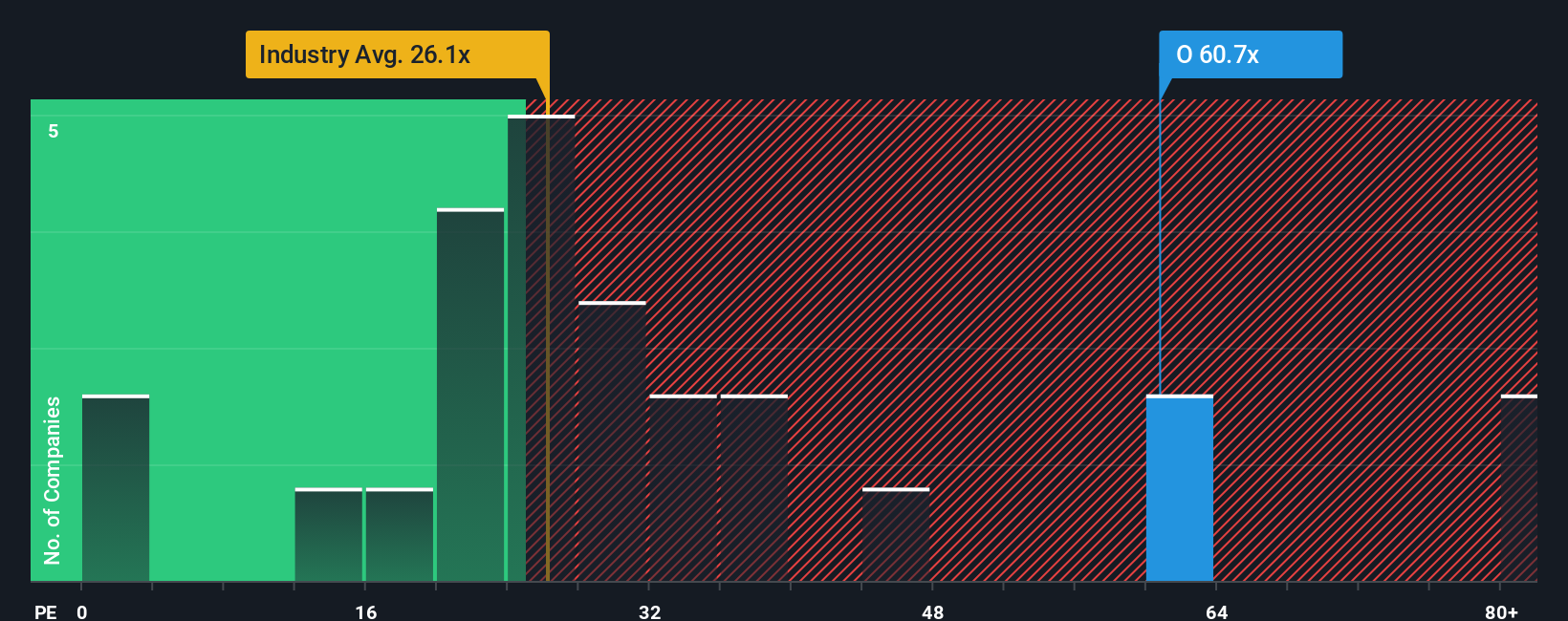

Looking from another angle, comparing Realty Income’s valuation to the wider industry shows its shares are priced high relative to similar stocks. Could this market premium signal resilience, or does it suggest caution is warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Realty Income Narrative

If you think there’s another story to be uncovered, or you want to dive into the details yourself, building your own view takes just a few minutes with our tools. Do it your way.

A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Angles?

Don’t limit your search to just one stock. Explore new possibilities by scanning markets for tomorrow’s winners with our custom screeners. If you aren’t using these powerful tools, you could be missing potential breakthroughs that others might catch first.

- Capitalize on emerging AI breakthroughs by checking out the latest innovative opportunities in AI penny stocks.

- Boost your income potential and discover companies delivering steady yields via our selection of dividend stocks with yields > 3%.

- Find undervalued gems that could offer more upside with our focused search for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives