- United States

- /

- Retail REITs

- /

- NYSE:O

Did Realty Income's (O) CityCenter Preferred Deal and Bigger 2025 Pipeline Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Realty Income recently completed an US$800 million perpetual preferred equity investment in the CityCenter Las Vegas real estate, including the ARIA Resort & Casino and Vdara Hotel & Spa, while also lifting its 2025 investment volume outlook to over US$6.00 billion.

- This move deepens its relationship with Blackstone Real Estate, expands its gaming exposure, and secures a priority position in the capital stack with a 7.4% initial unlevered return and future escalators, plus a right of first offer on Blackstone’s common equity stake.

- We’ll now examine how this large preferred equity commitment to CityCenter and raised 2025 investment plans affect Realty Income’s investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Realty Income Investment Narrative Recap

To own Realty Income, you need to believe in its ability to keep turning long-term net leases into dependable, growing monthly dividends, even as it diversifies beyond core retail. The US$800 million CityCenter preferred stake and higher 2025 investment outlook appear consistent with that story, but they do not materially change the key near term swing factors: maintaining an attractive cost of capital and managing execution risk as the company expands into newer verticals like gaming and Europe.

Against this backdrop, Realty Income’s repeated monthly dividend increases in 2025, including its 665th consecutive payout at US$0.2695 per share, underline how central stable cash distributions remain to the investment case, even as the REIT takes on larger, more complex deals like CityCenter. That consistency may reassure investors watching the impact of rising competition for net lease assets on acquisition yields and future growth.

Yet while the income story looks steady, investors should still be aware that intensifying competition for net lease deals could...

Read the full narrative on Realty Income (it's free!)

Realty Income's narrative projects $6.2 billion revenue and $1.6 billion earnings by 2028. This requires 4.1% yearly revenue growth and an earnings increase of about $700 million from $908.1 million today.

Uncover how Realty Income's forecasts yield a $63.29 fair value, a 10% upside to its current price.

Exploring Other Perspectives

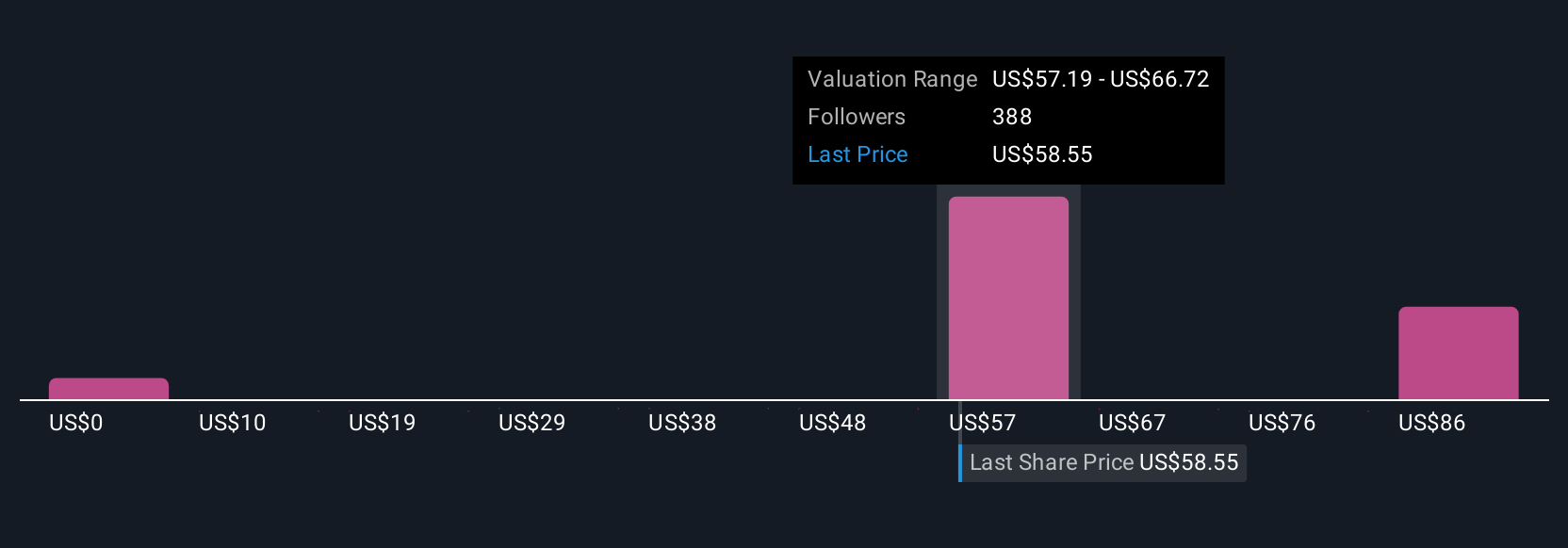

Sixteen members of the Simply Wall St Community currently place Realty Income’s fair value between US$56.50 and US$97.54, reflecting a very wide spread of expectations. When you compare those views with the growing competition for net lease assets highlighted earlier, it is clear that you are weighing very different assumptions about how efficiently Realty Income can keep deploying capital and protecting its returns over time.

Explore 16 other fair value estimates on Realty Income - why the stock might be worth as much as 70% more than the current price!

Build Your Own Realty Income Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Realty Income research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Realty Income's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026