- United States

- /

- Retail REITs

- /

- NYSE:NTST

NETSTREIT (NTST): Valuation Check After Reassuring Investor Update on Occupancy, Lease Terms and Balance Sheet

Reviewed by Simply Wall St

NETSTREIT (NTST) just used its latest investor presentation to underline why its portfolio looks steady right now: near perfect occupancy, long leases, and a balance sheet designed to sidestep mid term refinancing risk.

See our latest analysis for NETSTREIT.

The reassuring message from NETSTREIT’s presentation lands after a steady climb, with the share price at $17.63 and a strong year to date share price return of 26.47 percent, while the 1 year total shareholder return of 21.64 percent suggests momentum is still broadly constructive despite some recent cooling.

If NETSTREIT’s profile has you thinking about income and stability, it could be a good moment to compare it with other real estate style plays and discover fast growing stocks with high insider ownership

With defensive tenants, long leases, and the shares still trading below analyst targets, the setup looks constructive. But is NETSTREIT quietly undervalued here, or is the market already pricing in years of predictable growth?

Most Popular Narrative Narrative: 13.9% Undervalued

With NETSTREIT last closing at $17.63 against a narrative fair value near $20.47, the implied upside leans on robust long term growth math.

The analysts have a consensus price target of $19.719 for NETSTREIT based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.0, and the most bearish reporting a price target of just $17.0.

Curious how modest revenue growth, margin expansion, and a punchy future earnings multiple can still point to upside? The narrative’s assumptions are surprisingly bold. Click to unpack them.

Result: Fair Value of $20.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising rates and weaker physical retail demand could crimp acquisition economics and occupancy, forcing investors to rethink those optimistic growth and valuation assumptions.

Find out about the key risks to this NETSTREIT narrative.

Another Lens on Valuation

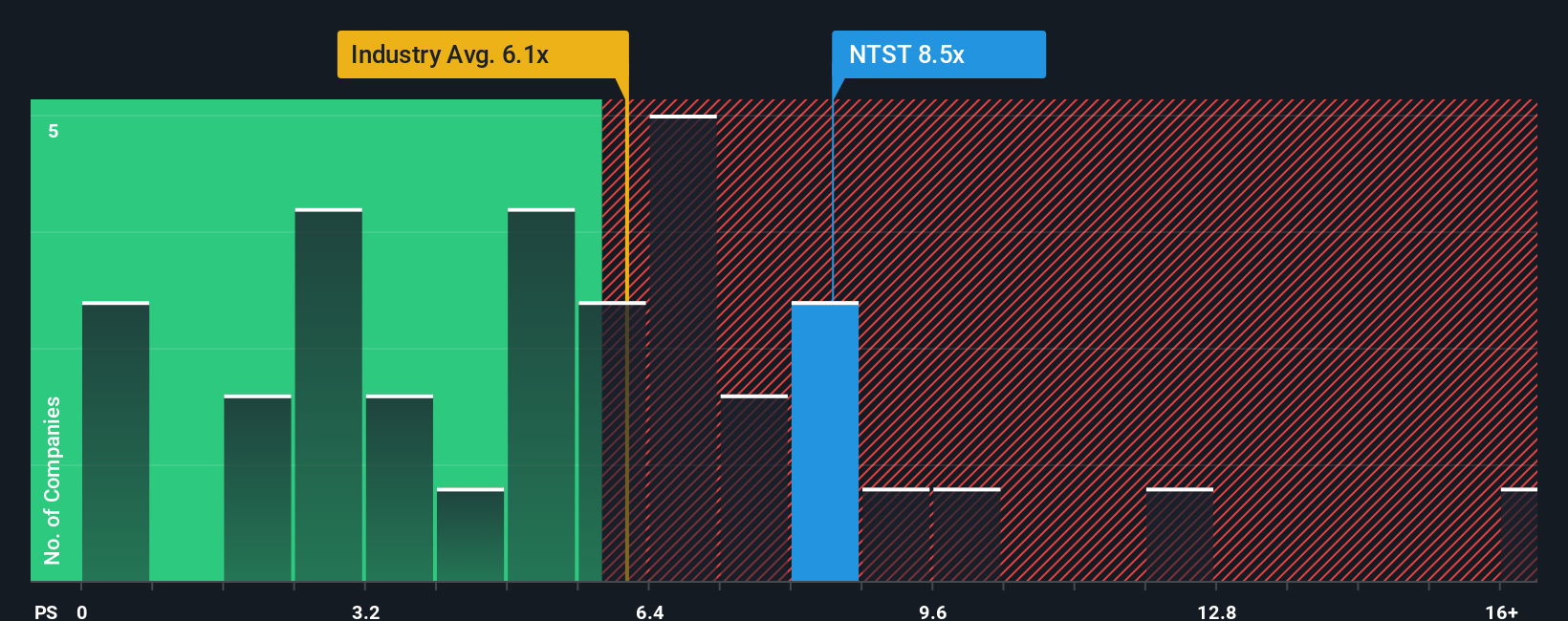

Step away from the narrative fair value and NETSTREIT suddenly looks pricey. On a price to sales basis it trades around 7.9 times, richer than the US Retail REITs at 5.9 times, its peers at 7.6 times, and its own fair ratio near 7.4 times. Is the market paying a safety premium or overreaching?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NETSTREIT Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your NETSTREIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with a single stock. Use the Simply Wall Street Screener to uncover focused opportunities that could sharpen your portfolio and keep you ahead of the crowd.

- Capture potential value before the market catches up by targeting companies trading at compelling prices with these 895 undervalued stocks based on cash flows.

- Ride powerful long term themes by zeroing in on innovation leaders through these 27 AI penny stocks.

- Strengthen your income stream by lining up reliable yield opportunities using these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NETSTREIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NTST

NETSTREIT

An internally managed real estate investment trust (REIT) based in Dallas, Texas that specializes in acquiring single-tenant net lease retail properties nationwide.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)