- United States

- /

- Retail REITs

- /

- NYSE:NTST

Assessing NETSTREIT (NTST) Valuation Following Major Debt Financing and Expanded Growth Capacity

Reviewed by Kshitija Bhandaru

NETSTREIT (NTST) just closed $450 million in additional debt financing and made several updates to its credit facilities. This move boosts its financial flexibility and supports upcoming growth initiatives. Investors may find these expanded resources encouraging for the company’s outlook.

See our latest analysis for NETSTREIT.

Over the past year, NETSTREIT’s share price has climbed more than 30% year-to-date and delivered a 22% total shareholder return. This reflects growing confidence following recent capital moves and a steady upward trend since early 2024.

If you’re looking for more companies showing strong momentum and insider conviction, it’s worth discovering fast growing stocks with high insider ownership.

With shares up more than 30% this year and a recent boost from new debt financing, investors may wonder whether NETSTREIT is still trading at a discount to its intrinsic value or if the market has already priced in these positive developments.

Most Popular Narrative: 7.7% Undervalued

With NETSTREIT’s fair value estimated at $19.72 and a last close price of $18.21, the stock is currently seen as trading below its fair value target. This positioning draws attention to the underlying assumptions guiding the outlook from analysts and industry watchers.

Population and household growth in key U.S. Sun Belt and suburban regions continues to fuel strong demand for necessity-based retail locations. This allows NETSTREIT to maintain low vacancy rates, attract high-quality tenants, and achieve stable rental revenue growth over the long term. Demand from institutional and 1031 buyers for essential retail and net-leased properties remains robust. This supports strong asset valuations and enables NETSTREIT to recycle capital efficiently through accretive dispositions and reinvestment, which could support earnings growth.

Earnings growth? Profit margins? Not what you might expect. The narrative relies on bold financial assumptions and debated valuation multiples. Find out which projections could define this calculated undervaluation.

Result: Fair Value of $19.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts towards e-commerce and market saturation among key tenants could present challenges for NETSTREIT’s long-term earnings growth and revenue stability.

Find out about the key risks to this NETSTREIT narrative.

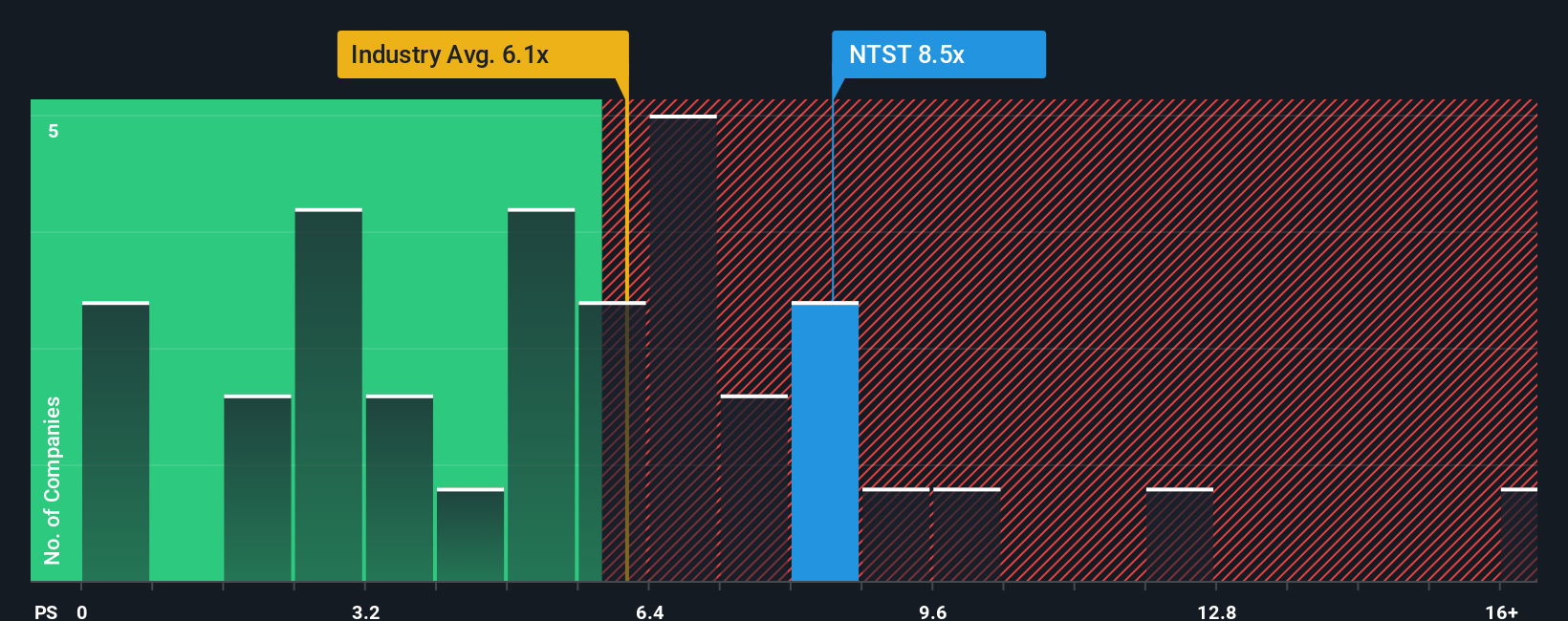

Another View: Looking at Price-to-Sales

While some see NETSTREIT as undervalued, its current price-to-sales ratio of 8.6x stands noticeably above the US Retail REITs average of 6.2x, its peer average of 5.7x, and a fair ratio closer to 7.4x. This suggests the market may be pricing in either stronger future growth or potential risk. Could a shift in market sentiment narrow this gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NETSTREIT Narrative

If you see the story differently or want to dig deeper into the numbers yourself, crafting a personalized take is quick and easy. Just Do it your way.

A great starting point for your NETSTREIT research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself a winning edge and seize new opportunities by tapping into some of the most compelling stock themes on Simply Wall Street right now.

- Boost your income stream and pinpoint attractive payouts with these 19 dividend stocks with yields > 3%, which offers yields above 3%.

- Tap into tomorrow's breakthroughs by targeting these 24 AI penny stocks in artificial intelligence that are shaping innovation worldwide.

- Spot undervalued gems with steady cash flow by screening through these 903 undervalued stocks based on cash flows before they catch the market’s attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NETSTREIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NTST

NETSTREIT

An internally managed real estate investment trust (REIT) based in Dallas, Texas that specializes in acquiring single-tenant net lease retail properties nationwide.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives