Unfortunately for shareholders, when Nam Tai Property Inc. (NYSE:NTP) reported results for the period to December 2020, its auditors, Moore Stephens, expressed uncertainty about whether it can continue as a going concern. Thus we can say that, based on the results to that date, the company should raise capital or otherwise raise cash, without much delay.

Given its situation, it may not be in a good position to raise capital on favorable terms. So current risks on the balance sheet could have a big impact on how shareholders fare from here. The biggest concern we would have is the company's debt, since its lenders might force the company into administration if it cannot repay them.

See our latest analysis for Nam Tai Property

What Is Nam Tai Property's Debt?

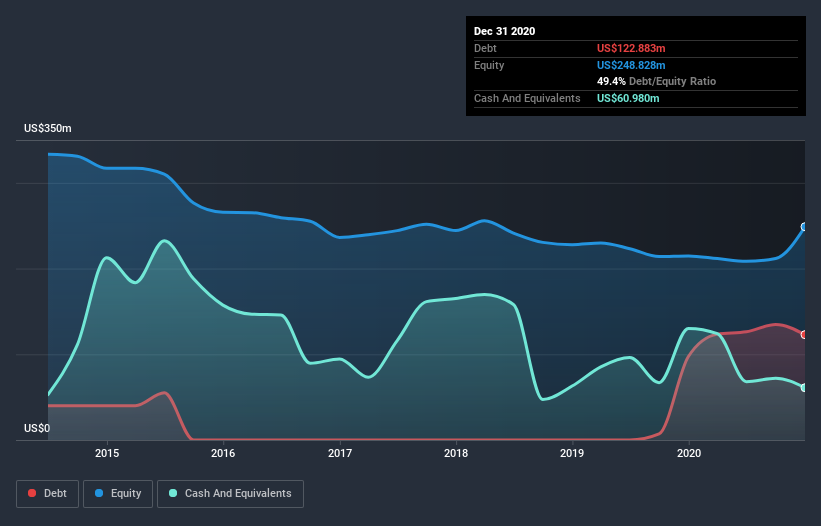

As you can see below, at the end of December 2020, Nam Tai Property had US$122.9m of debt, up from US$97.4m a year ago. Click the image for more detail. However, it does have US$61.0m in cash offsetting this, leading to net debt of about US$61.9m.

A Look At Nam Tai Property's Liabilities

According to the last reported balance sheet, Nam Tai Property had liabilities of US$433.9m due within 12 months, and liabilities of US$18.5m due beyond 12 months. On the other hand, it had cash of US$61.0m and US$3.97m worth of receivables due within a year. So its liabilities total US$387.4m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Nam Tai Property is worth US$702.9m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Nam Tai Property's net debt is 2.6 times its EBITDA, which is a significant but still reasonable amount of leverage. But its EBIT was about 1k times its interest expense, implying the company isn't really paying a high cost to maintain that level of debt. Even were the low cost to prove unsustainable, that is a good sign. Notably, Nam Tai Property made a loss at the EBIT level, last year, but improved that to positive EBIT of US$21m in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Nam Tai Property's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the last year, Nam Tai Property saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Nam Tai Property's conversion of EBIT to free cash flow and level of total liabilities definitely weigh on it, in our esteem. But its interest cover tells a very different story, and suggests some resilience. Taking the abovementioned factors together we do think Nam Tai Property's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. Some investors may be interested in buying high risk stocks at the right price, but we prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. Our preference is to invest in companies that always make sure the auditor has confidence that the company will continue as a going concern. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 5 warning signs for Nam Tai Property you should be aware of, and 3 of them are a bit concerning.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Nam Tai Property or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nam Tai Property might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:NTPI.F

Nam Tai Property

Through its subsidiaries, owns, develops, and operates technology parks in the People’s Republic of China.

Very low risk with weak fundamentals.

Market Insights

Community Narratives