- United States

- /

- Specialized REITs

- /

- NYSE:NSA

National Storage Affiliates Trust (NYSE:NSA) Is About To Go Ex-Dividend, And It Pays A 0.9% Yield

Readers hoping to buy National Storage Affiliates Trust (NYSE:NSA) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. If you purchase the stock on or after the 12th of September, you won't be eligible to receive this dividend, when it is paid on the 30th of September.

National Storage Affiliates Trust's next dividend payment will be US$0.32 per share. Last year, in total, the company distributed US$1.28 to shareholders. Based on the last year's worth of payments, National Storage Affiliates Trust has a trailing yield of 3.8% on the current stock price of $33.85. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether National Storage Affiliates Trust can afford its dividend, and if the dividend could grow.

See our latest analysis for National Storage Affiliates Trust

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. National Storage Affiliates Trust paid out 62% of its earnings to investors last year, a normal payout level for most businesses. That said, REITs are often required by law to distribute all of their earnings, and it's not unusual to see a REIT with a payout ratio around 100%. We wouldn't read too much into this. Given that the company reported a loss last year, we now need to see if it generated enough free cash flow to fund the dividend. If National Storage Affiliates Trust didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. Thankfully its dividend payments took up just 50% of the free cash flow it generated, which is a comfortable payout ratio.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings fall far enough, the company could be forced to cut its dividend. National Storage Affiliates Trust was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

National Storage Affiliates Trust also issued more than 5% of its market cap in new stock during the past year, which we feel is likely to hurt its dividend prospects in the long run. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. National Storage Affiliates Trust has delivered an average of 21% per year annual increase in its dividend, based on the past four years of dividend payments. Growing the dividend payout ratio while earnings are declining can deliver nice returns for a while, but it's always worth checking for when the company can't increase the payout ratio any more - because then the music stops.

Remember, you can always get a snapshot of National Storage Affiliates Trust's financial health, by checking our visualisation of its financial health, here.

To Sum It Up

Should investors buy National Storage Affiliates Trust for the upcoming dividend? It's hard to get used to National Storage Affiliates Trust paying a dividend despite reporting a loss over the past year. At least the dividend was covered by free cash flow, however. In summary, while it has some positive characteristics, we're not inclined to race out and buy National Storage Affiliates Trust today.

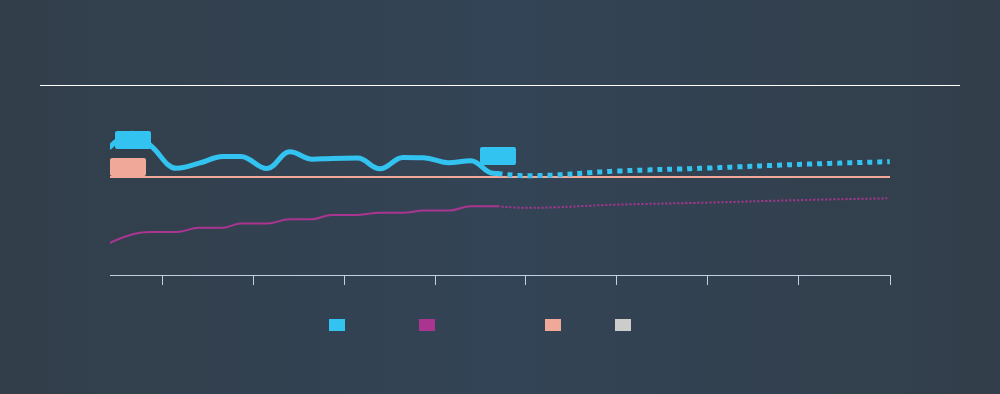

Ever wonder what the future holds for National Storage Affiliates Trust? See what the five analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:NSA

National Storage Affiliates Trust

A real estate investment trust headquartered in Greenwood Village, Colorado, focused on the ownership, operation and acquisition of self storage properties predominantly located within the top 100 metropolitan statistical areas throughout the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives