- United States

- /

- Retail REITs

- /

- NYSE:MAC

Why Macerich (MAC) Posted Higher Revenue but Returned to a Net Loss This Quarter

Reviewed by Simply Wall St

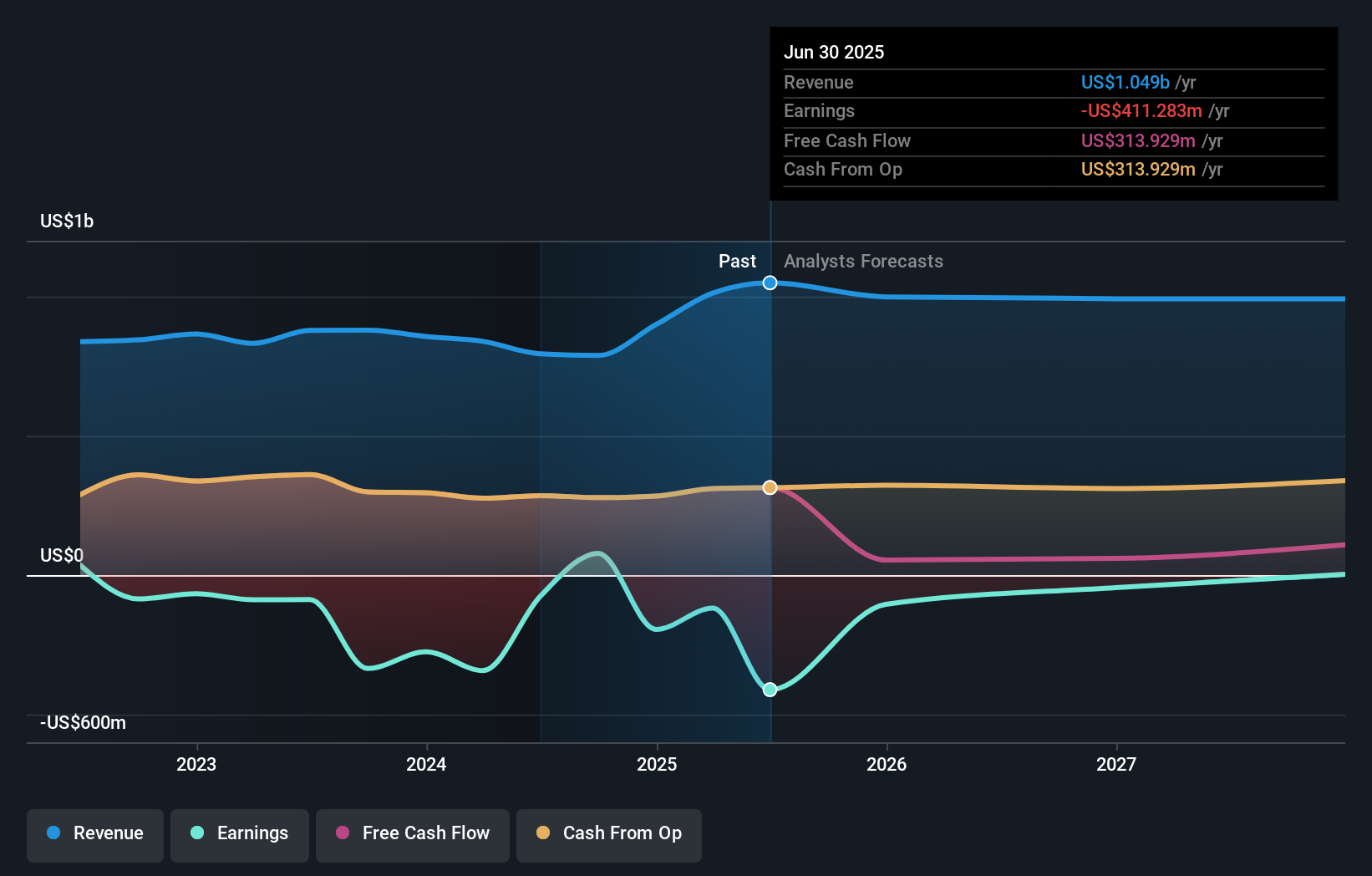

- The Macerich Company recently announced its second quarter 2025 earnings, reporting sales of US$232.73 million and a revenue increase to US$249.79 million compared to the prior year, but posting a net loss of US$40.91 million, reversing from a net income of US$252.01 million a year ago.

- Despite achieving stronger revenue in both the second quarter and first half of the year, Macerich's performance shifted from profitability to net losses, highlighting a disconnect between top-line growth and bottom-line results.

- We'll examine how Macerich's higher revenue but return to net loss impacts its investment narrative and future earnings outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Macerich Investment Narrative Recap

To be a Macerich shareholder right now, you have to believe that the company can translate its improving rental revenues into sustainable profitability, despite rising costs and sector headwinds. The Q2 results, showing higher revenue but a return to net loss, underscore that while leasing momentum is promising, the biggest near-term catalyst remains the ability to backfill vacant anchor spaces at higher rent levels, while the greatest risk is still the company’s high leverage and refinancing needs. This latest earnings print does not meaningfully change the short-term risk/catalyst balance, but it draws attention to how margin pressure could linger if top-line growth isn’t enough to offset higher expenses.

Among Macerich's recent updates, the continued dividend payout of US$0.17 per share, declared in July, stands out. While it signals management’s intent to maintain shareholder rewards even amid net losses, this commitment must be weighed against the company’s ongoing need to deploy capital for property improvements and to manage a heavy debt load in the face of tightening net margins and continued unprofitability.

Yet, despite encouraging sales trends, investors should be aware that refinancing risk and elevated debt levels could quickly become...

Read the full narrative on Macerich (it's free!)

Macerich's outlook anticipates $1.0 billion in revenue and $204.9 million in earnings by 2028. This projection assumes a 2.8% annual revenue decline and a $616.2 million increase in earnings from the current level of -$411.3 million.

Uncover how Macerich's forecasts yield a $19.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community place Macerich between US$19 and US$27.75 per share. Recent net losses and refinancing demands remain top of mind for many, so consider a range of views before deciding where you stand.

Explore 2 other fair value estimates on Macerich - why the stock might be worth as much as 53% more than the current price!

Build Your Own Macerich Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Macerich research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Macerich research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Macerich's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAC

Macerich

Macerich is a fully integrated, self-managed, self-administered real estate investment trust (REIT).

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026