- United States

- /

- Retail REITs

- /

- NYSE:MAC

Macerich (MAC): Reassessing Valuation After REITWorld Update on Leasing Momentum and Asset Sales Progress

Reviewed by Simply Wall St

Macerich (MAC) just gave investors a meaningful business update at the Nareit REITWorld conference, highlighting record leasing momentum, more than 300 new store openings, and sizable mall asset sales that reshape its long-term portfolio mix.

See our latest analysis for Macerich.

Despite the upbeat operational story, Macerich’s share price has drifted, with the stock now at $17.40 and a year to date share price return of around negative 14 percent. Its three year total shareholder return of roughly 61 percent suggests longer term momentum is still very much intact.

If this kind of leasing and redevelopment story has your attention, it may be worth exploring fast growing stocks with high insider ownership as a way to spot other potential compounders early.

With Macerich’s shares down double digits this year despite robust leasing, asset sales, and a sizeable intrinsic discount to estimates, is the market missing a recovering mall REIT, or is it already baking in the next leg of growth?

Most Popular Narrative: 10.9% Undervalued

With Macerich last closing at $17.40 against a narrative fair value near $19.53, the valuation story hinges on a sharp profitability turnaround.

Ongoing asset dispositions and disciplined portfolio refinement are concentrating capital in top-performing, high-barrier, urban and coastal assets, enhancing pricing power, stabilizing cash flows, and allowing for continued improvements in balance sheet strength and lower interest expense, positively impacting net earnings.

Want to see how shrinking revenues can still support a higher value per share? The narrative leans on a dramatic margin swing and a bold earnings multiple. Curious which assumptions have to hit perfectly for that math to work? Read on to unpack the full blueprint behind this pricing logic.

Result: Fair Value of $19.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy leverage and ongoing exposure to challenged brick and mortar markets could quickly pressure margins and undercut the optimistic turnaround embedded in today’s valuation.

Find out about the key risks to this Macerich narrative.

Another Lens on Value

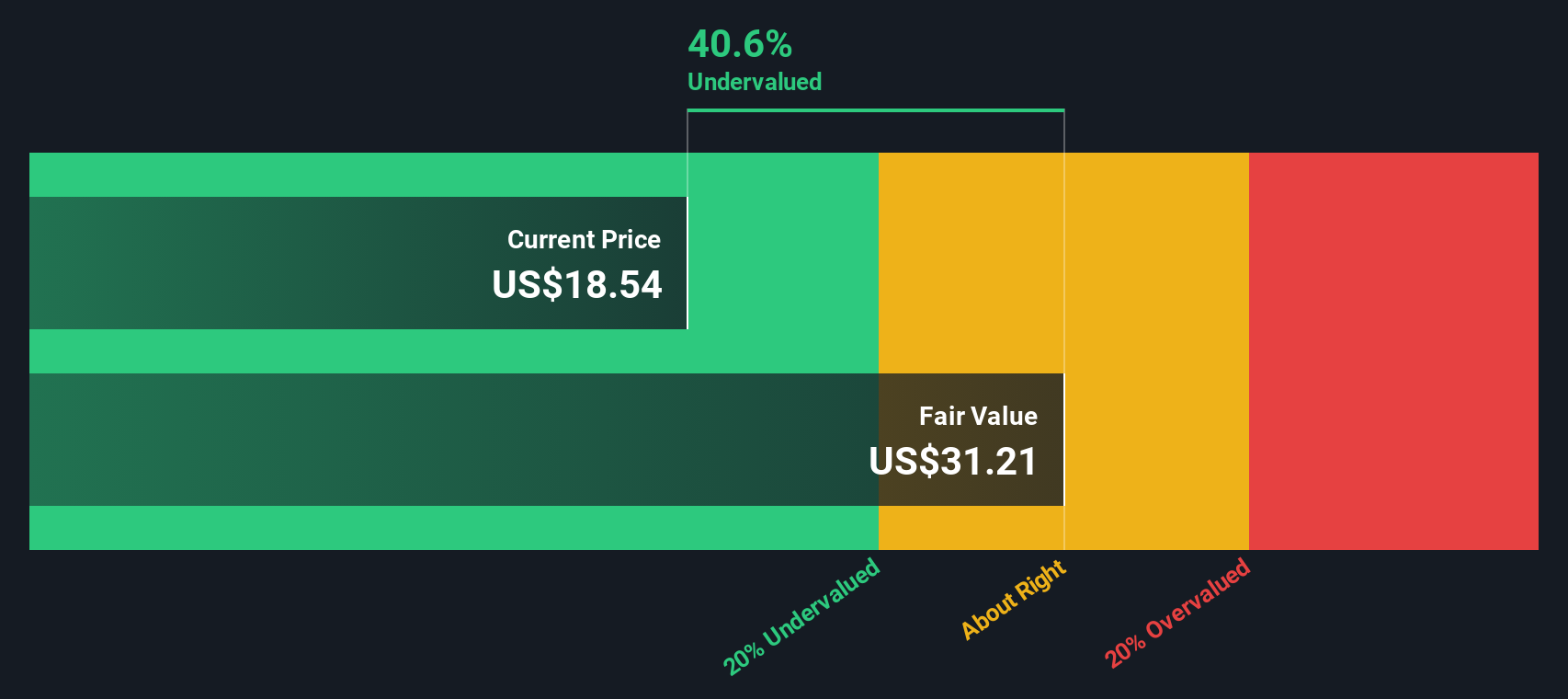

While the narrative fair value implies modest upside, our SWS DCF model is far more optimistic, suggesting Macerich trades at roughly a 44 percent discount to its estimated fair value of about $31.01 per share. Is this a genuine mispricing or just a very demanding long term bet on a turnaround?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Macerich Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a fresh take in just a few minutes: Do it your way.

A great starting point for your Macerich research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you wrap up, use the Simply Wall St Screener to uncover fresh opportunities that match your strategy so you do not leave potential returns on the table.

- Target reliable income by reviewing these 15 dividend stocks with yields > 3% that may strengthen your portfolio’s cash flow without chasing speculative stories.

- Capitalize on market mispricing by scanning these 909 undervalued stocks based on cash flows that could offer solid upside if the market eventually catches up.

- Position yourself for the next wave of innovation by assessing these 27 AI penny stocks that are pushing the boundaries of what artificial intelligence can achieve.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAC

Macerich

Macerich is a fully integrated, self-managed, self-administered real estate investment trust (REIT).

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)