- United States

- /

- Residential REITs

- /

- NYSE:MAA

Is Mid-America Apartment Communities (MAA) Undervalued After Recent Share Price Decline?

Reviewed by Kshitija Bhandaru

Mid-America Apartment Communities (MAA) shares have been trending lower over the past month, with the stock slipping 6%. This recent slide has caught the eye of income-focused investors who are looking for value in the real estate space.

See our latest analysis for Mid-America Apartment Communities.

Zooming out, this 6% slide is part of a broader cooling trend for Mid-America Apartment Communities, as momentum has faded over the year. While the latest share price sits at $132.0, the company’s total shareholder return shows a 10.6% decline over the past twelve months. Long-term investors have only seen modest gains in recent years. The recent moves likely reflect shifting sentiment around real estate valuations and interest rates, keeping the stock in value-focused conversations.

If recent ups and downs have you rethinking your strategy, now’s the perfect chance to broaden your search and discover fast growing stocks with high insider ownership

With shares sitting 18% below the average analyst price target and fundamental metrics showing mixed signals, investors are left to wonder: Is MAA trading at a bargain, or has the market already factored in its future prospects?

Most Popular Narrative: 15.8% Undervalued

With the most followed narrative placing Mid-America Apartment Communities' fair value 15.8% above its last close of $132.00, questions are circling about whether recent weakness offers a rare opening. Market watchers are zeroing in on assumptions behind the price gap and sharpening focus on the optimistic viewpoint underpinning this valuation.

Persistent demand and limited new supply in key Sun Belt markets support strong occupancy, stable rent growth, and enhance pricing power for ongoing revenue gains. Rising homeownership barriers and favorable demographics reduce turnover, ensuring predictable income and positioning the company for margin expansion and strategic growth opportunities.

Want to know what powers that bullish outlook? This narrative relies on sustained demand and a crucial change in profit margins. Can the company really reach those financial heights? Explore the surprising details behind the fair value projection.

Result: Fair Value of $156.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent oversupply in Sun Belt markets or continued sluggish lease-up rates could challenge revenue growth and undermine the positive outlook for MAA.

Find out about the key risks to this Mid-America Apartment Communities narrative.

Another View: Market Ratios Paint a Different Picture

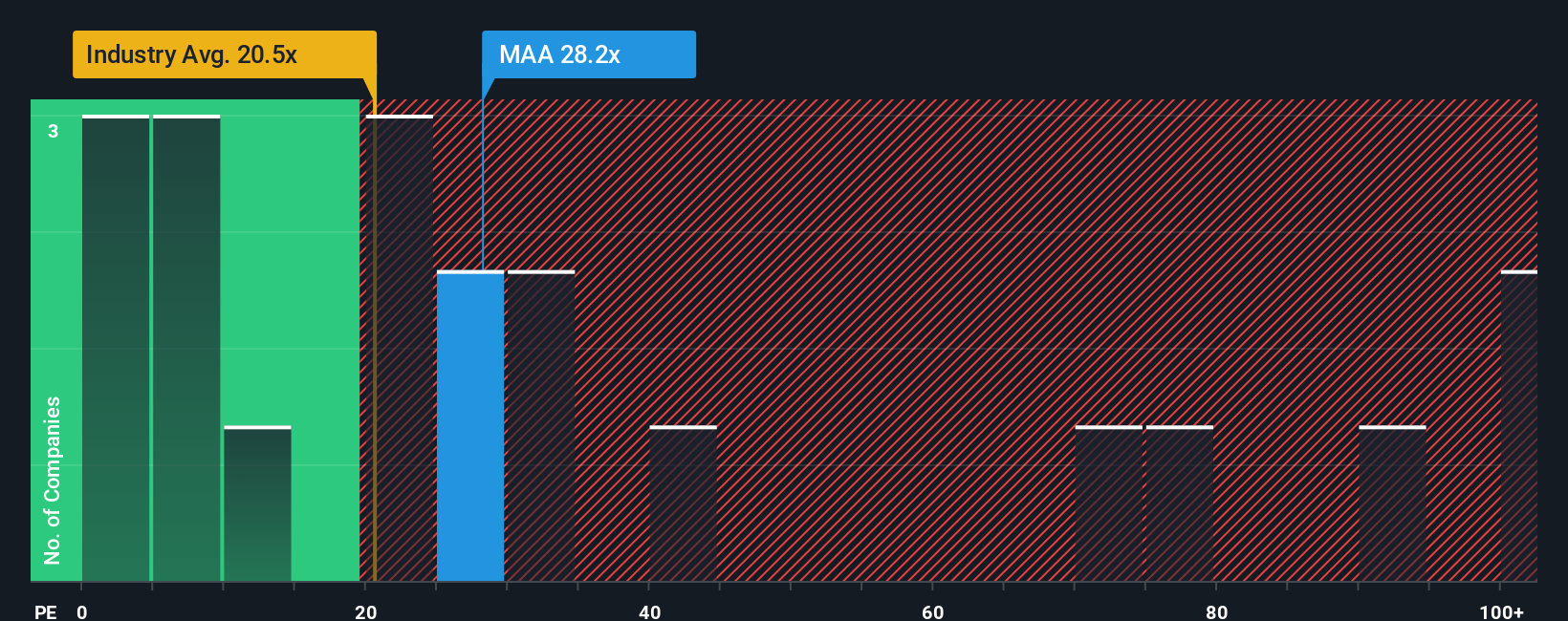

While our previous analysis points to an undervalued outlook, looking at price-to-earnings ratios tells a more cautious story. MAA trades at 27.2 times earnings, considerably higher than the global sector average of 19.9. Yet, it is almost in line with its fair ratio of 28.9. Does this pricing suggest relative safety, or is it masking potential risks if expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mid-America Apartment Communities Narrative

If the story above does not match your view or you prefer to dive into the numbers yourself, you can put together your own perspective in just a few minutes with Do it your way.

A great starting point for your Mid-America Apartment Communities research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Get ahead of the market and avoid missing out on tomorrow’s winning stocks by using Simply Wall Street’s powerful screener to find your next opportunity.

- Unlock potential high-yield income with these 18 dividend stocks with yields > 3% to access top stocks with impressive dividend payouts and resilient cash flows.

- Get a head start on the next wave of healthcare innovation by scanning these 33 healthcare AI stocks and targeting companies pioneering medical breakthroughs with artificial intelligence.

- Ride the momentum in digital finance and blockchain by checking these 79 cryptocurrency and blockchain stocks for companies that are shaping the future of money and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAA

Mid-America Apartment Communities

MAA, an S&P 500 company, is a real estate investment trust (REIT) focused on delivering full-cycle and superior investment performance for shareholders through the ownership, management, acquisition, development and redevelopment of quality apartment communities primarily in the Southeast, Southwest and Mid-Atlantic regions of the United States.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives