- United States

- /

- Industrial REITs

- /

- NYSE:LXP

LXP Industrial Trust (LXP): Exploring Current Valuation Following Recent Share Price Changes

Reviewed by Kshitija Bhandaru

See our latest analysis for LXP Industrial Trust.

Over the past year, LXP Industrial Trust’s share price has experienced both rallies and setbacks, with recent declines hinting at shifting sentiment after a solid start to the year. While the 1-year total shareholder return is slightly negative, returns remain up over longer periods. This suggests momentum has cooled but has not vanished entirely.

If market turns like this have you thinking about what's next, it could be the right time to broaden your sights and discover fast growing stocks with high insider ownership

With the stock currently trading below analyst price targets and at a notable discount to intrinsic value, investors may wonder if LXP Industrial Trust is undervalued at these levels or if the market is already anticipating future growth.

Most Popular Narrative: 14.7% Undervalued

With LXP Industrial Trust last closing at $8.81 and the current fair value pegged at $10.33, the most popular narrative sees the stock as meaningfully discounted, capturing investor attention amid sector shifts.

The sharp decline in new industrial property deliveries (down nearly 75% from 2022 peaks) in LXP's core target markets, combined with a sizable mark-to-market rent opportunity (in-place rents 17% below market, with upcoming lease expirations 30 and 35% below market), presents a significant tailwind for future revenue as new leases are signed or renewed at meaningfully higher rental rates.

Curious what projections and financial leaps support that double-digit premium? The narrative leans on bold future rental assumptions and surprising margin moves to back this upside. Want to see the numeric drivers behind this bullish view? Dive into the full story and weigh for yourself just how those top-line catalysts shape up.

Result: Fair Value of $10.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising vacancy risk from tenant consolidations or increased competition in key markets could quickly limit LXP's expected upside and rental growth momentum.

Find out about the key risks to this LXP Industrial Trust narrative.

Another View: Market Multiple Sends a Caution Signal

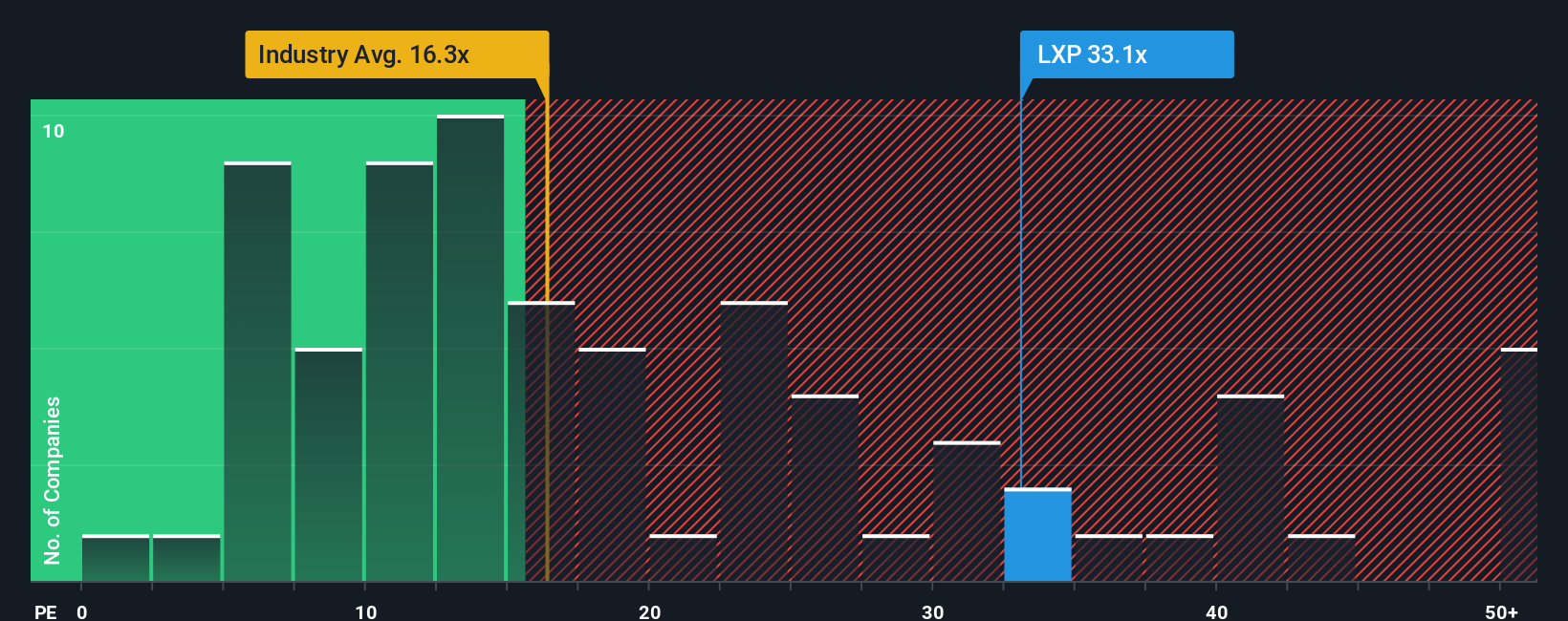

While analyst narratives suggest LXP is undervalued, a quick look at the price-to-earnings ratio tells a different story. LXP trades at 32.2x earnings, higher than both the industry average of 16.3x and the peer average of 17.7x. It is also well above its fair ratio of 12x, which hints that investors may be paying a premium. Does the market see unique strength, or is there more risk than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LXP Industrial Trust Narrative

If you see things differently or want to dig into the details yourself, you can easily craft your own take in just a few minutes, so Do it your way.

A great starting point for your LXP Industrial Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their options open. Want to stay ahead? Use these handpicked tools below to spot the next wave of opportunities before the crowd.

- Uncover future tech leaders by tapping into these 24 AI penny stocks, where artificial intelligence drives competitive edge and rapid growth.

- Get ahead of Wall Street on potential deep-value gems with these 891 undervalued stocks based on cash flows, built around real cash flow insights others may overlook.

- Maximize your income and stability with these 19 dividend stocks with yields > 3%, featuring top choices for consistent, high-yield dividends backed by solid financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LXP

LXP Industrial Trust

LXP Industrial Trust (NYSE: LXP) is a publicly traded real estate investment trust (REIT) focused on Class A warehouse and distribution investments in 12 target markets across the Sunbelt and lower Midwest.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026