- United States

- /

- Retail REITs

- /

- NYSE:IVT

How Investors May Respond To InvenTrust Properties (IVT) Dividend Declaration and Analyst Ratings Ahead of Earnings

Reviewed by Sasha Jovanovic

- InvenTrust Properties declared a quarterly dividend on October 15, 2025, yielding 3.3%, and is set to announce its Q3 2025 earnings after market close on October 28.

- Brokerage firms have recently initiated or reiterated analyst coverage with a consensus rating of Moderate Buy, signaling increased attention on InvenTrust Properties ahead of its earnings release.

- With updated analyst ratings taking center stage, we'll explore how this growing market focus impacts InvenTrust's broader investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

InvenTrust Properties Investment Narrative Recap

To be a shareholder in InvenTrust Properties, you need to believe in the resilience of necessity-based, grocery-anchored real estate centers, especially those in high-growth Sun Belt markets. Recent analyst attention and the announced 3.3% dividend may boost sentiment, but with Q3 earnings yet to be released, the biggest near-term catalyst remains ongoing rental income growth, while the major risk continues to be potential revenue volatility tied to Sun Belt economic shifts; recent news is not expected to materially change that calculus.

Among recent announcements, the refinancing of US$400,000,000 in term loans stands out. By extending debt maturities to 2030 and 2031 and securing fixed interest rates, InvenTrust has reduced near-term refinancing risk, which is crucial as investors look ahead to Q3 results and consider future external growth prospects.

However, investors should also remember that, despite these moves, the concentration in Sun Belt markets still poses exposure to regional economic swings that...

Read the full narrative on InvenTrust Properties (it's free!)

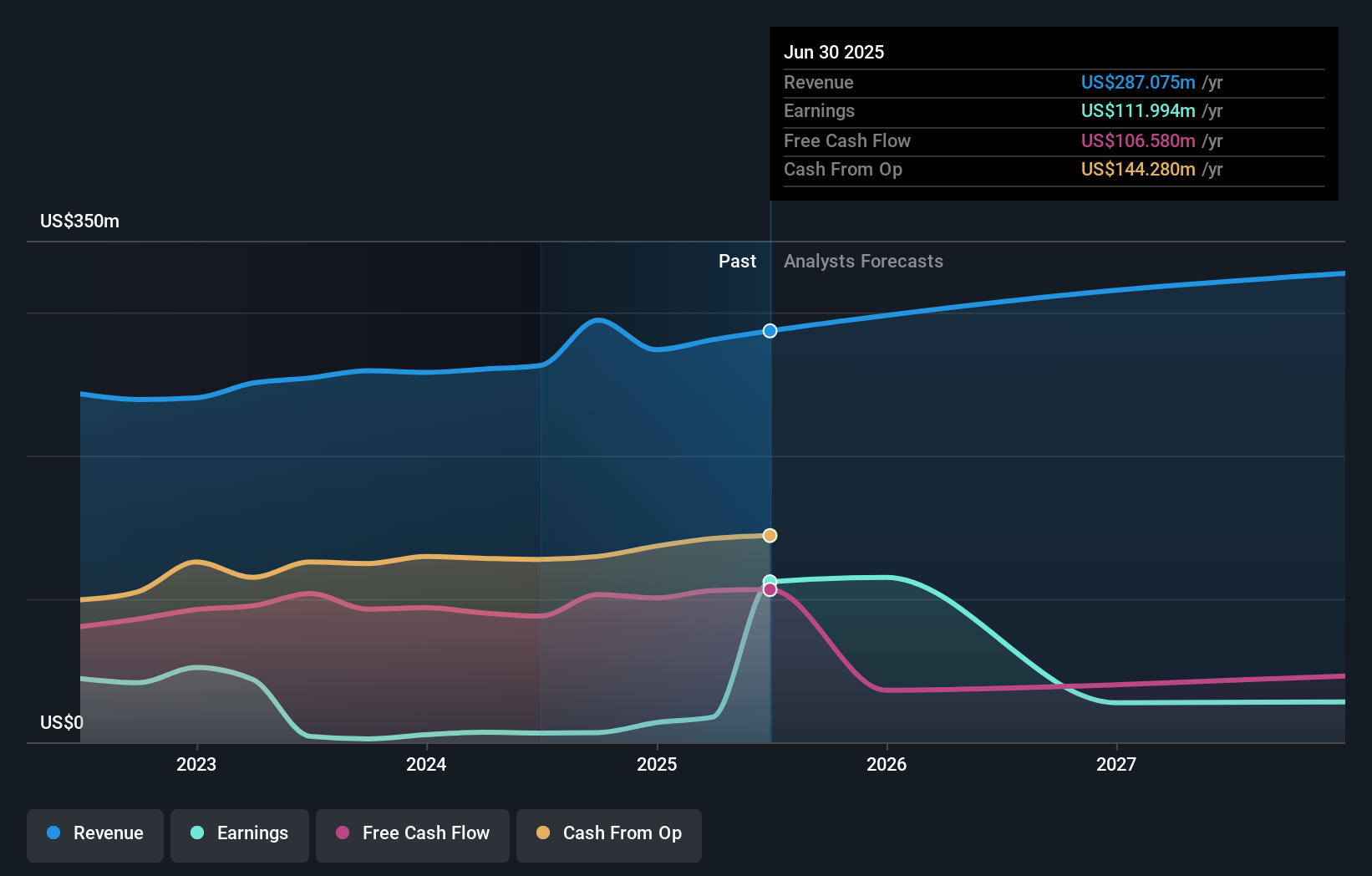

InvenTrust Properties is forecast to reach $361.3 million in revenue and $10.5 million in earnings by 2028. This projection relies on an 8.0% annual revenue growth rate, but earnings are expected to decrease by $101.5 million from the current $112.0 million.

Uncover how InvenTrust Properties' forecasts yield a $32.60 fair value, a 13% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s sole fair value estimate for InvenTrust Properties is US$31.23, compared to a consensus analyst target of US$31.67. As recent events renew focus on Sun Belt performance, consider how portfolio concentration may shape future revenue stability and explore different perspectives for a fuller picture.

Explore another fair value estimate on InvenTrust Properties - why the stock might be worth just $31.23!

Build Your Own InvenTrust Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your InvenTrust Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free InvenTrust Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate InvenTrust Properties' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IVT

InvenTrust Properties

InvenTrust Properties Corp. (the “Company,” "IVT," or "InvenTrust") is a premier Sun Belt, multi-tenant essential retail REIT that owns, leases, redevelops, acquires and manages grocery-anchored neighborhood and community centers as well as high-quality power centers that often have a grocery component.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion