- United States

- /

- Office REITs

- /

- NYSE:HPP

Hudson Pacific Properties (HPP): Fresh Analyst Support Sparks New Interest—Is the Stock Undervalued?

Reviewed by Kshitija Bhandaru

Recent analyst updates have put Hudson Pacific Properties (HPP) back in the spotlight, as Wells Fargo maintained its Buy rating and several others issued supportive recommendations. This growing consensus is sparking fresh interest among investors.

See our latest analysis for Hudson Pacific Properties.

Hudson Pacific Properties saw renewed interest this week as upbeat analyst commentary followed solid quarterly results and a modest 3.2% 7-day share price gain. Despite these encouraging signals, the stock’s 1-year total shareholder return is still down nearly 48%, reflecting both lingering uncertainty and the long path to recovery. Momentum may be stirring from recent lows; however, investors remain cautious as the valuation resets.

If you’re considering what else is gaining traction, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

The key question now, as analyst optimism rises, is whether Hudson Pacific Properties is truly undervalued at these levels or if recent gains have already accounted for the company’s future prospects. Is there a compelling buying opportunity left, or is the market already pricing in any turnaround ahead?

Most Popular Narrative: 19.9% Undervalued

With Hudson Pacific Properties closing at $2.59 and the most popular narrative estimating fair value near $3.23, the current price sits well below analysts’ consensus. This gap underpins the argument for hidden upside, even as caution persists after a challenging year. The narrative suggests that recent business shifts and sector tailwinds could be transformative.

Accelerating office leasing momentum, particularly driven by AI and tech sector expansion in West Coast markets, is resulting in rising tour activity, increasing average deal size, and a strong leasing pipeline. This trend should drive higher occupancy and ultimately top-line revenue growth as well as improved earnings visibility over the next several years.

What bold forecasts justify this sharp disconnect between price and potential? Get ready to discover the ambitious revenue and profit assumptions that anchor this narrative’s valuation. The answer is anything but typical for an office REIT. Peel back the layers to see what might power a true turnaround.

Result: Fair Value of $3.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent hybrid work trends and HPP's heavy West Coast tech exposure could limit office demand and weaken the anticipated rebound.

Find out about the key risks to this Hudson Pacific Properties narrative.

Another View: Caution From Market Multiples

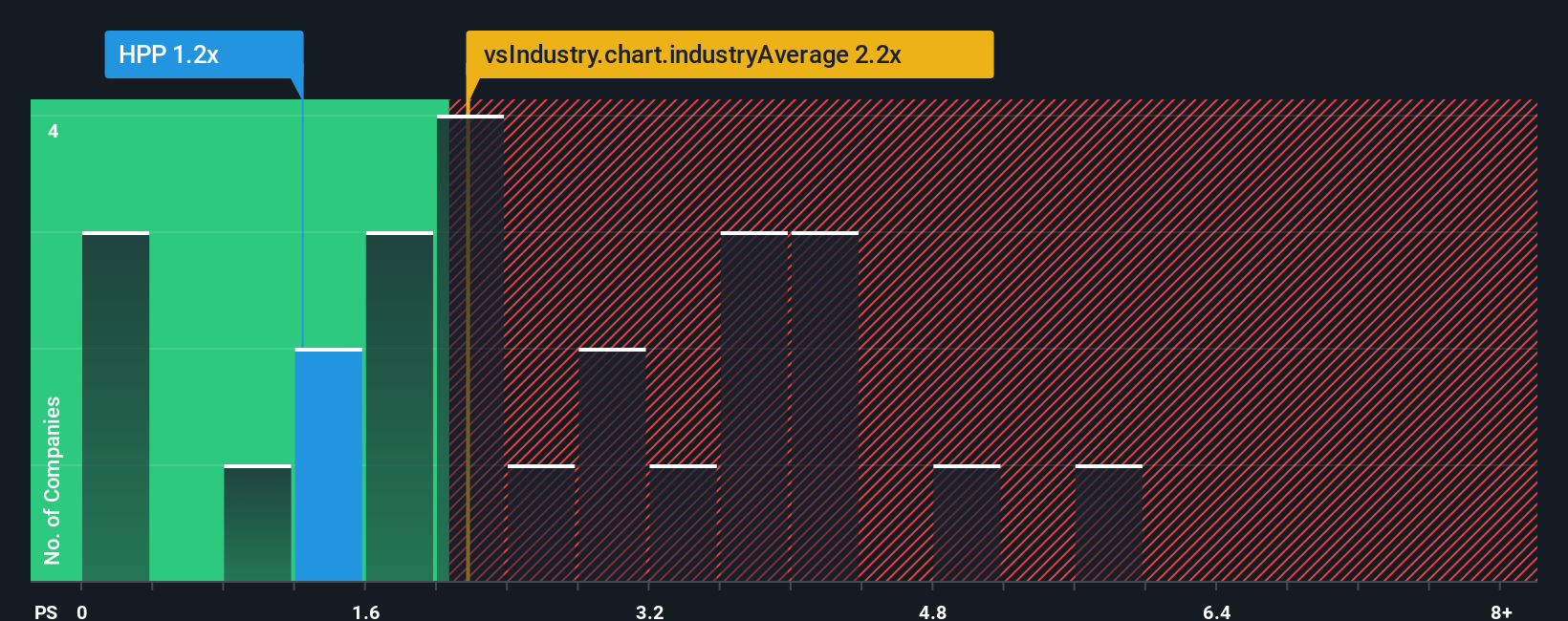

Looking at Hudson Pacific Properties through the lens of price-to-sales, the company trades at 1.2 times sales, which is cheaper than both the US Office REITs industry average of 2.2x and the peer average of 2.3x. However, it is slightly above its fair ratio of 1x, suggesting that while there is value compared to peers, underlying risks may remain. Could this small premium be justified, or does it indicate a potential concern for buyers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hudson Pacific Properties Narrative

If you have a different perspective or want to dig into the details yourself, it takes under three minutes to build your own view. Do it your way

A great starting point for your Hudson Pacific Properties research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize your chance to spot tomorrow’s standout stocks before everyone else. Simply Wall Street’s handpicked filters make it easy to target the best opportunities right now.

- Boost your passive income by tapping into these 18 dividend stocks with yields > 3% which offer yields above 3% and a steady track record of shareholder rewards.

- Tap into bold breakthroughs with these 24 AI penny stocks that are leading the market in artificial intelligence innovation and automation trends.

- Capitalize on value opportunities by targeting these 878 undervalued stocks based on cash flows that are deeply discounted based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hudson Pacific Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPP

Hudson Pacific Properties

A real estate investment trust, or REIT, and the sole general partner of our operating partnership.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)