- United States

- /

- Industrial REITs

- /

- NYSE:FR

A Fresh Look at First Industrial Realty Trust (FR) Valuation Following Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

First Industrial Realty Trust (FR) has caught investors’ attention this week. After a modest stretch of gains, many are watching the company’s recent price moves, curious whether current valuations reflect its longer-term industrial property outlook.

See our latest analysis for First Industrial Realty Trust.

First Industrial Realty Trust’s 8.7% share price return over the last 90 days has started to turn heads, especially after a recent jump that outpaced its earlier momentum. While the 1-year total shareholder return is slightly negative, the real story lies in its solid multiyear record. This includes a 32.7% total return over three years, which reflects renewed optimism despite a few near-term bumps.

If this pickup in momentum has sparked your curiosity, now might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading just below analyst targets but nearly 21% underneath some intrinsic value estimates, the question remains: is First Industrial Realty Trust currently undervalued, or is the market simply pricing in all future growth?

Most Popular Narrative: 4.7% Undervalued

First Industrial Realty Trust’s most followed narrative suggests its fair value sits just above the recent closing price. Investors using this consensus are watching how robust assumptions about revenue, margins, and future growth might play out over the next few years.

The company is currently benefiting from exceptionally strong rental rate growth (cash rental rate increases of 33 to 38 percent on new and renewal leasing), likely reflecting the ongoing shift toward e-commerce and supply chain reorganization. Investors may be overestimating the sustainability of these double-digit rent spreads given evolving demand and increased tenant caution, which could inflate both current revenue and forward earnings expectations.

Want to know what powers this narrative’s price target? It’s not just headline rental growth. The real engine here: ambitious assumptions on future profits and market-defying margins. Wonder how high conviction forecasts shape this valuation? The story gets even more intriguing when you see what’s expected for earnings and revenue down the line.

Result: Fair Value of $56.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent strong rental rate growth and ongoing supply constraints could lead to positive surprises, potentially challenging expectations of moderating returns.

Find out about the key risks to this First Industrial Realty Trust narrative.

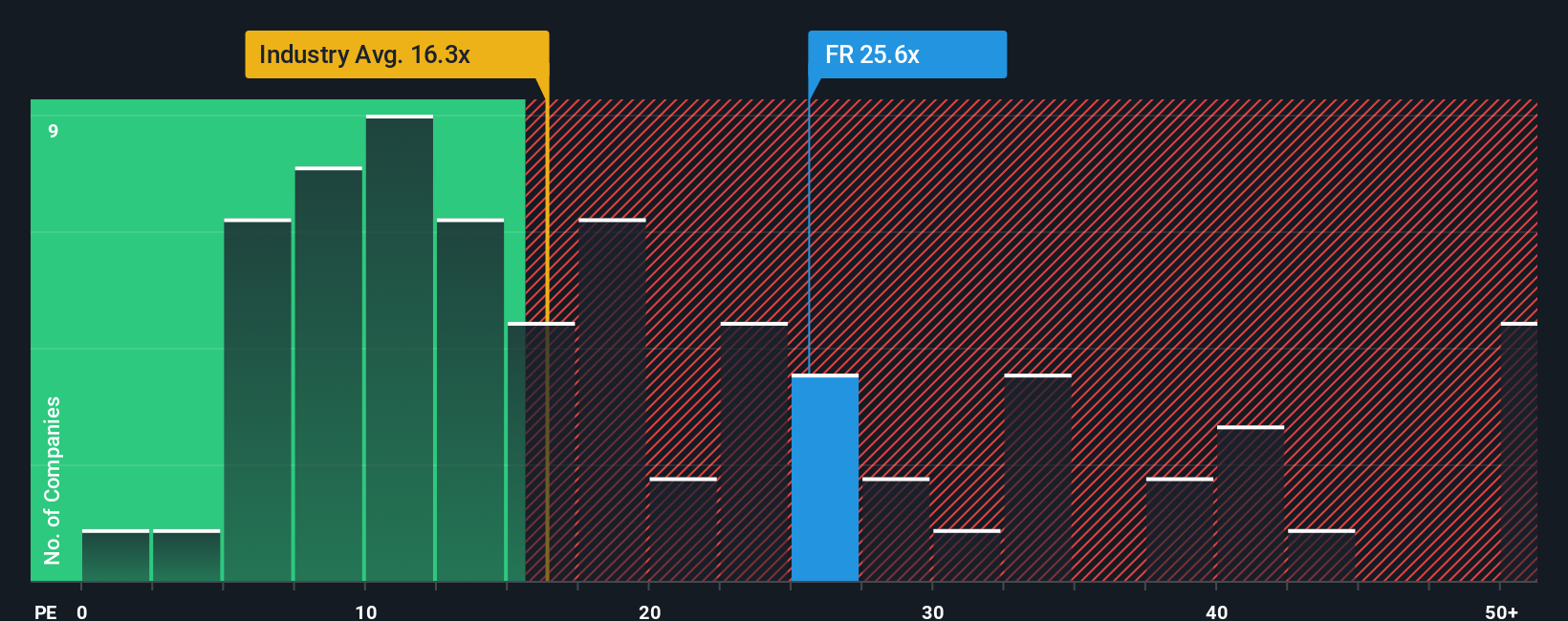

Another View: Market Ratios Paint a Mixed Picture

Looking at price-to-earnings, First Industrial Realty Trust trades at a 26.2x ratio, which is more expensive than the global industry average of 16.4x but below top peer levels at 31.5x. The fair ratio for this stock is estimated at 32.5x, so the current market price may leave some upside, but also signals possible caution. Does the market see more risk than the models suggest?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Industrial Realty Trust Narrative

If you want to challenge the consensus or put your own spin on the data, you can craft a personalized view with just a few clicks. Do it your way

A great starting point for your First Industrial Realty Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your opportunities and get a winning edge with stock ideas built around specific trends and sectors. Don’t let remarkable investments pass you by.

- Capitalize on technological disruption by reviewing these 24 AI penny stocks, which are at the forefront of artificial intelligence innovation and competitive growth.

- Find the potential for long-term gains with high-yield options such as these 18 dividend stocks with yields > 3% that offer robust dividend returns to boost your income.

- Seize the chance to own tomorrow’s leaders before the crowd by researching these 3565 penny stocks with strong financials, which are poised for outsized growth and market buzz.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FR

First Industrial Realty Trust

First Industrial Realty Trust, Inc. (NYSE: FR) is a leading U.S.-only owner, operator, developer and acquirer of logistics properties.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives