- United States

- /

- Industrial REITs

- /

- NasdaqGS:ILPT

Exploring 3 Undervalued Small Caps With Insider Action In The Global Market

Reviewed by Simply Wall St

The United States market has experienced a flat performance over the last week but has shown a 12% increase over the past year, with earnings forecasted to grow by 15% annually. In this context, identifying stocks that are potentially undervalued can offer opportunities for investors, especially when insider activity suggests confidence in these companies' prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 1.0x | 28.48% | ★★★★★★ |

| Columbus McKinnon | NA | 0.5x | 41.78% | ★★★★★☆ |

| Montrose Environmental Group | NA | 1.1x | 35.83% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.9x | 32.84% | ★★★★★☆ |

| Citizens & Northern | 11.4x | 2.8x | 46.09% | ★★★★☆☆ |

| Southside Bancshares | 10.5x | 3.6x | 39.04% | ★★★★☆☆ |

| S&T Bancorp | 11.1x | 3.8x | 40.90% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 34.99% | ★★★★☆☆ |

| Auburn National Bancorporation | 13.6x | 2.9x | 43.04% | ★★★☆☆☆ |

| Farmland Partners | 9.0x | 9.1x | -9.34% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

AirSculpt Technologies (AIRS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: AirSculpt Technologies is a company that specializes in providing minimally invasive body contouring procedures, with a market cap of approximately $0.33 billion.

Operations: The company's revenue is primarily derived from direct medical procedure services, with the latest reported figure being $172.10 million. Over recent periods, gross profit margins have shown a downward trend, moving from 69.58% to 63.81%. Operating expenses include substantial allocations towards general and administrative costs and sales & marketing efforts, impacting overall profitability.

PE: -19.7x

AirSculpt Technologies, a company recently added to multiple Russell Value Indexes, shows potential as an undervalued investment opportunity. Despite reporting a net loss of US$2.85 million in Q1 2025 and experiencing share price volatility, insider confidence is evident with recent equity offerings totaling US$12 million at US$3.8 per share. The company prepaid US$10 million of its term loan debt in June 2025, indicating financial prudence. Earnings are projected to grow significantly by approximately 92% annually, offering promising prospects for future growth.

- Take a closer look at AirSculpt Technologies' potential here in our valuation report.

Understand AirSculpt Technologies' track record by examining our Past report.

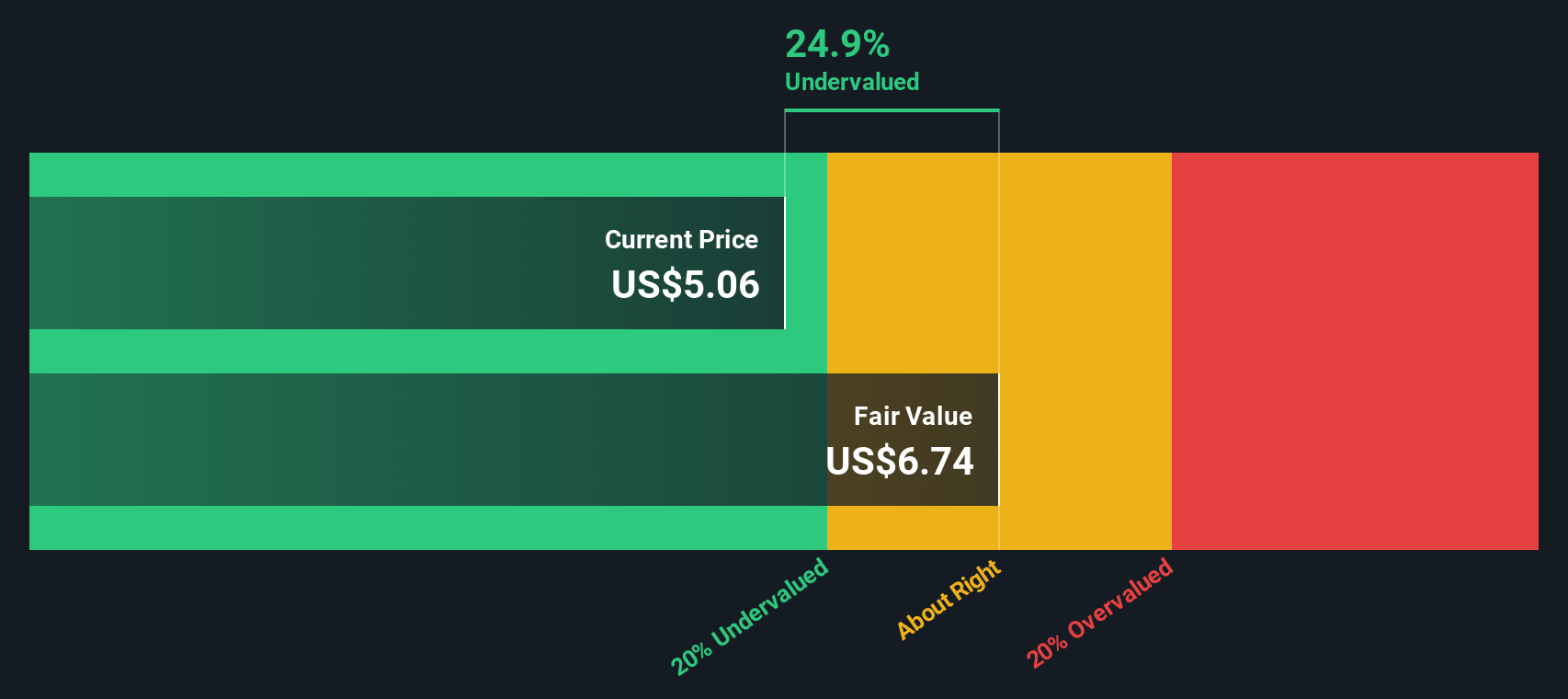

Industrial Logistics Properties Trust (ILPT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Industrial Logistics Properties Trust is a real estate investment trust focusing on the ownership and leasing of industrial and logistics properties, with a market cap of approximately $0.52 billion.

Operations: ILPT generates revenue primarily through the ownership and leasing of properties, with a recent revenue figure of $441.99 million. The company's gross profit margin has shown some variation, reaching 86.23% in the most recent period. Operating expenses include significant depreciation and amortization costs, which were $169.93 million in the latest quarter, impacting overall profitability significantly. Net income margins have been negative recently, reflecting challenges in managing non-operating expenses and other costs effectively.

PE: -4.0x

Industrial Logistics Properties Trust, a smaller player in the market, is navigating financial challenges with strategic moves. Despite a volatile share price recently, they have shown insider confidence through increased quarterly dividends to US$0.05 per share. In June 2025, ILPT secured US$1.16 billion in fixed-rate mortgage financing to refinance existing debt, aiming to cut interest expenses and stabilize finances. While earnings dipped slightly in Q1 2025, efforts are underway for potential long-term value creation.

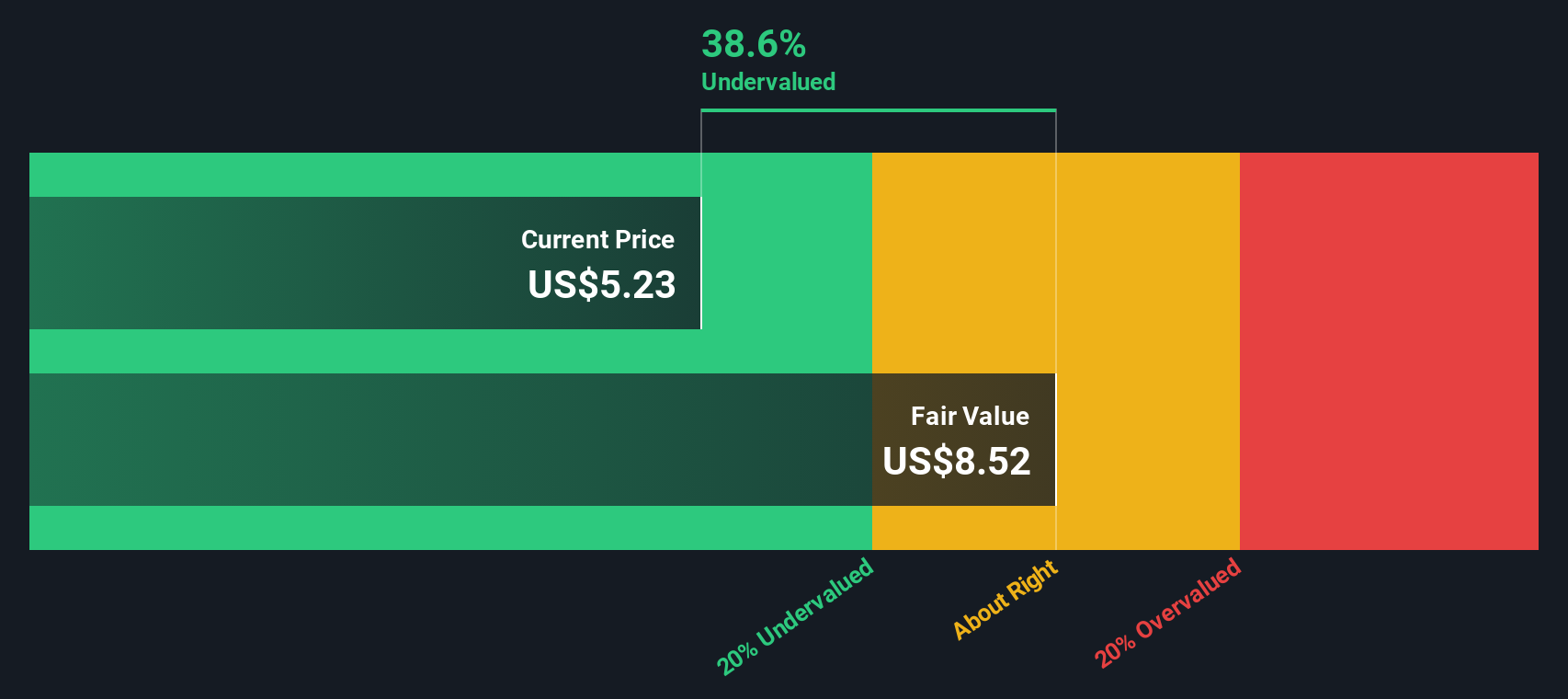

Farmland Partners (FPI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Farmland Partners is a real estate investment trust focused on owning and managing high-quality farmland across North America, with a market cap of approximately $0.77 billion.

Operations: The company generates revenue primarily from its commercial real estate investments, with the most recent revenue reported at $56.54 million. The cost of goods sold (COGS) was $11.11 million, resulting in a gross profit of $45.43 million and a gross profit margin of 80.35%. Operating expenses amounted to $19.79 million, which includes general and administrative expenses totaling $14.43 million, while non-operating activities contributed negatively to net income with an expense of -$31.46 million leading to a net income margin of 100.99%.

PE: 9.0x

Farmland Partners reflects a mix of challenges and opportunities typical for smaller companies. The company reported Q1 2025 earnings with net income rising to US$2.04 million from US$1.37 million year-on-year, despite declining revenue and sales figures. Insider confidence is evident as John Good increased their stake by 24,000 shares worth approximately US$243,574 in early 2025, suggesting belief in the company's potential amidst high-risk funding structures and projected earnings decline. Recent buybacks further indicate management's commitment to enhancing shareholder value within a competitive agricultural sector landscape.

- Click here and access our complete valuation analysis report to understand the dynamics of Farmland Partners.

Examine Farmland Partners' past performance report to understand how it has performed in the past.

Make It Happen

- Reveal the 79 hidden gems among our Undervalued US Small Caps With Insider Buying screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ILPT

Industrial Logistics Properties Trust

ILPT is a real estate investment trust focused on owning and leasing high quality industrial and logistics properties.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion