- United States

- /

- Specialized REITs

- /

- NYSE:EXR

Does Extra Space Storage Inc.'s (NYSE:EXR) CEO Pay Compare Well With Peers?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

In 2017 Joe Margolis was appointed CEO of Extra Space Storage Inc. (NYSE:EXR). This analysis aims first to contrast CEO compensation with other large companies. Next, we'll consider growth that the business demonstrates. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

View our latest analysis for Extrace Storage

How Does Joe Margolis's Compensation Compare With Similar Sized Companies?

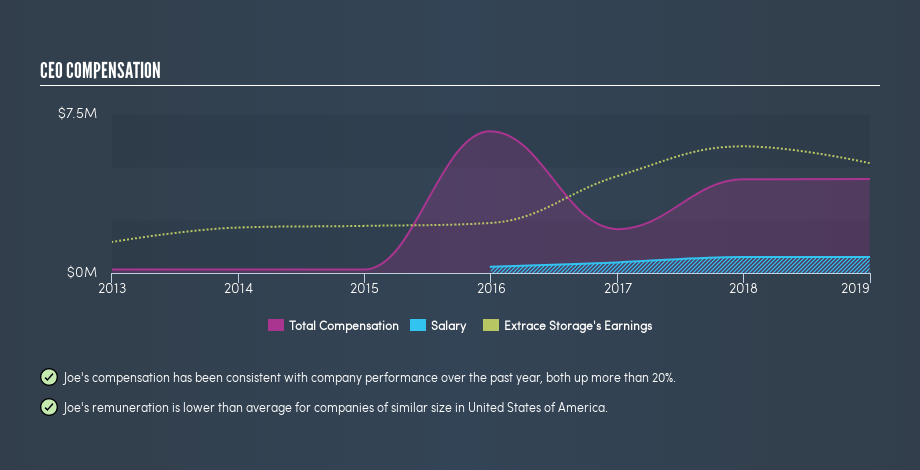

According to our data, Extra Space Storage Inc. has a market capitalization of US$15b, and pays its CEO total annual compensation worth US$4.4m. (This number is for the twelve months until December 2018). While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at US$750k. When we examined a group of companies with market caps over US$8.0b, we found that their median CEO total compensation was US$11m. There aren't very many mega-cap companies, so we had to take a wide range to get a meaningful comparison figure.

A first glance this seems like a real positive for shareholders, since Joe Margolis is paid less than the average total compensation paid by other large companies. While this is a good thing, you'll need to understand the business better before you can form an opinion.

You can see, below, how CEO compensation at Extrace Storage has changed over time.

Is Extra Space Storage Inc. Growing?

Extra Space Storage Inc. has increased its earnings per share (EPS) by an average of 21% a year, over the last three years (using a line of best fit). In the last year, its revenue is up 8.2%.

This demonstrates that the company has been improving recently. A good result. It's also good to see modest revenue growth, suggesting the underlying business is healthy.

Has Extra Space Storage Inc. Been A Good Investment?

Boasting a total shareholder return of 34% over three years, Extra Space Storage Inc. has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

It looks like Extra Space Storage Inc. pays its CEO less than the average at large companies. Considering the underlying business is growing earnings, this would suggest the pay is modest. The strong history of shareholder returns might even have some thinking that Joe Margolis deserves a raise!

Most shareholders like to see a modestly paid CEO combined with strong performance by the company. It would be even more positive if company insiders are buying shares. Shareholders may want to check for free if Extrace Storage insiders are buying or selling shares.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:EXR

Extra Space Storage

Extra Space Storage Inc., headquartered in Salt Lake City, Utah, is a self-administered and self-managed REIT and a member of the S&P 500.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026