- United States

- /

- Specialized REITs

- /

- NYSE:EXR

Extra Space Storage (EXR): Assessing Valuation After Q2 Miss and Lowered Outlook Ahead of Q3 Earnings

Reviewed by Kshitija Bhandaru

Extra Space Storage (EXR) has been under the microscope after its Q2 update revealed lower-than-expected core FFO and a drop in same-store NOI. This has prompted management to tighten its 2025 outlook. With the company now forecasting flat-to-negative revenue growth and potential NOI declines, investors are keeping a close eye on the upcoming Q3 earnings.

See our latest analysis for Extra Space Storage.

Extra Space Storage’s share price took a sharp hit in late July after the company reported disappointing Q2 results and trimmed its 2025 guidance, but the stock has since regained some ground, with a notable 6.7% share price return in the past week. Despite these recent swings, momentum remains mixed. While the share price is up just 2.5% year-to-date, the one-year total shareholder return stands at -7.6%, highlighting lingering investor concerns even as long-term returns remain solidly positive.

If storage’s bumpy ride has you looking for fresh opportunities, now’s the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

After a string of disappointing updates and trimmed forecasts, all eyes are on whether Extra Space Storage’s current share price reflects these headwinds or if the recent pullback presents a compelling buying opportunity.

Most Popular Narrative: 3.9% Undervalued

With Extra Space Storage trading at $151.54, the most widely followed narrative points to a fair value of $157.75. This suggests a modest upside, with the market viewing shares as just slightly below their estimated worth. The discount rate applied in deriving this valuation is 7.6%, reflecting a moderate risk-adjusted approach.

Discipline in M&A and capital allocation (for example, strategic focus on JV buyouts, accretive Life Storage integration, and optimizing the portfolio through selective dispositions) enables Extra Space to scale efficiently and respond quickly to new supply and demand headwinds, potentially enhancing margins and driving long-term EBITDA growth.

Want to know the logic powering this valuation signal? It’s not all about top-line growth. The narrative hinges on margin expansion, savvy dealmaking, and future profit multiples more common in fast-moving industries. Intrigued which quantitative moves drive that price tag? Dig in for the details and see what else experts expect in the years ahead.

Result: Fair Value of $157.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently high property taxes or flat revenue growth in key markets could limit near-term upside and challenge the bullish outlook for Extra Space Storage.

Find out about the key risks to this Extra Space Storage narrative.

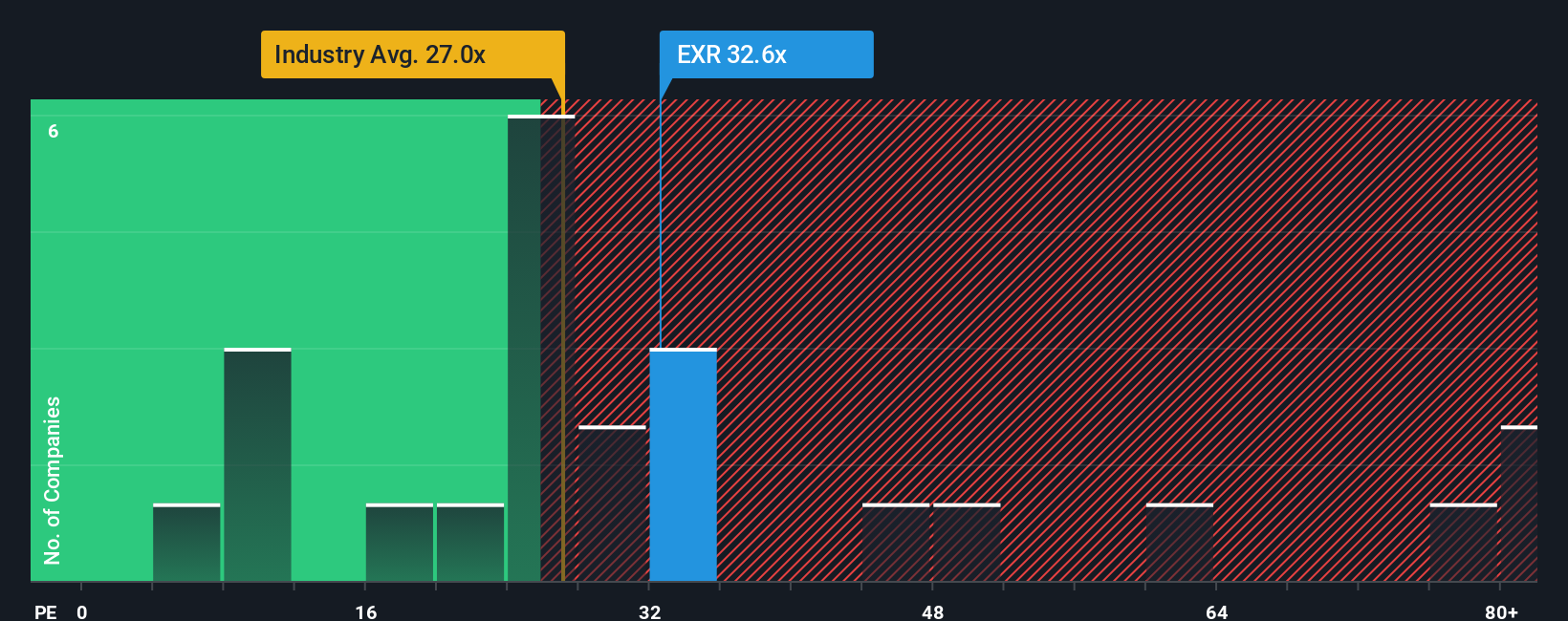

Another View: Multiples Signal a Premium

While the most popular narrative suggests Extra Space Storage is modestly undervalued, a look at market multiples complicates the picture. The company trades at a ratio of 33x, which is higher than its peer group average of 30.8x and the broader US Specialized REITs industry at 28.8x. However, this remains below the calculated fair ratio of 35x, suggesting there may still be room for upside, but also increasing valuation risk if market sentiment shifts. Is there enough margin for safety here, or are investors paying up for stability?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Extra Space Storage Narrative

If this perspective doesn’t fit your view or you’d rather analyze the numbers on your own, you can quickly craft your own take in just a few minutes, and Do it your way

A great starting point for your Extra Space Storage research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Expand your portfolio with targeted stock picks driven by powerful data. Don’t wait and let top opportunities pass. See what’s grabbing attention now.

- Capture rising yields by scanning for market leaders with strong payouts using these 18 dividend stocks with yields > 3% and watch your income potential grow.

- Spot game-changing companies making advances in artificial intelligence with these 24 AI penny stocks to get ahead of the next wave of innovation.

- Seize untapped value in overlooked stocks by jumping into these 878 undervalued stocks based on cash flows and uncovering deals before the crowd notices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Extra Space Storage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EXR

Extra Space Storage

Extra Space Storage Inc., headquartered in Salt Lake City, Utah, is a self-administered and self-managed REIT and a member of the S&P 500.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives