- United States

- /

- Residential REITs

- /

- NYSE:ESS

Essex Property Trust (NYSE:ESS) Declares US$2.57 Quarterly Dividend Payment

Reviewed by Simply Wall St

Essex Property Trust (NYSE:ESS) has declared a regular quarterly cash dividend of $2.57 per share, reflecting a commitment to shareholder return amid a recent 4% price move over the past month. This price change occurred alongside mixed first-quarter earnings, where the company saw growth in sales and revenue, but a decline in net income and earnings per share. With no share repurchases completed earlier this year, these financial updates present a nuanced picture. Although these events unfolded during broader market gains, with major indexes rising, they likely added weight rather than significantly differing from broader market trends.

The recent dividend declaration by Essex Property Trust, coupled with mixed first-quarter earnings, could influence the company's revenue and earnings forecasts. With revenue at US$1.86 billion and earnings at US$671.90 million, the dividend reflects Essex's commitment to shareholder returns despite declining net income. The focus on reallocating capital to Northern California may drive future revenue growth, aligning with the company's strategy of enhancing net margins and reducing rent delinquency. These actions could stabilize long-term revenue, but macroeconomic uncertainties might pose risks, particularly in Southern California and the tech sector reliance.

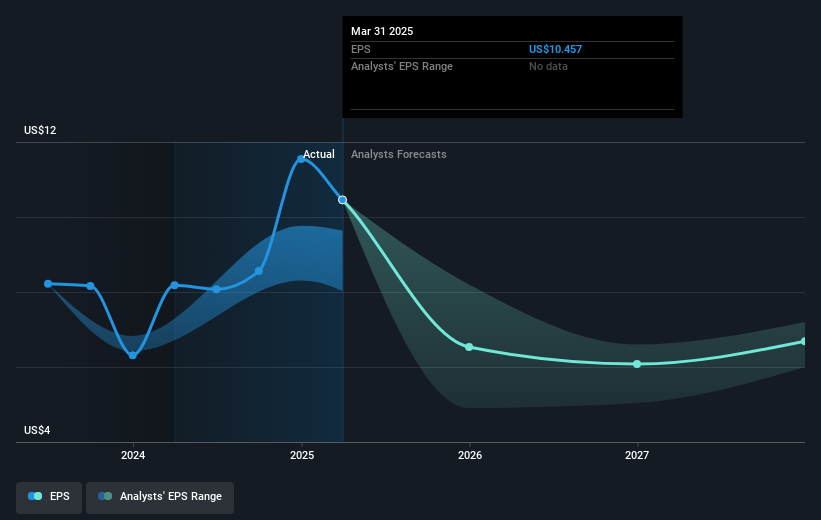

Over the past five years, Essex's total shareholder return, including dividends, delivered 44.47%, highlighting its longer-term performance despite recent challenges. In contrast, Essex's 1-year return was less favorable relative to the US market's 10.6% return, although it did outperform the 2.2% return of the US Residential REITs industry. The company is currently trading at a share price of US$275.16, representing a 11.3% discount to the consensus price target of US$310.08. This suggests a potential undervaluation relative to analyst expectations, even as forecasts predict a decline in earnings by 2028, with projected earnings of US$427.8 million and shrinking profit margins.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Essex Property Trust, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Essex Property Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESS

Essex Property Trust

An S&P 500 company, is a fully integrated real estate investment trust (“REIT”) that acquires, develops, redevelops, and manages multifamily residential properties in selected West Coast markets.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives