- United States

- /

- Residential REITs

- /

- NYSE:EQR

Negative Rent Growth Could Be a Game Changer for Equity Residential (EQR)

Reviewed by Sasha Jovanovic

- In recent weeks, the U.S. apartment market recorded its first period of negative rent growth since 2009, signaling a cooling economy and presenting new challenges for residential REITs like Equity Residential ahead of their third-quarter earnings releases.

- Despite this slowdown, demand for rentals remains above the decade average, with many tenants choosing to stay, suggesting a normalization of market conditions instead of a crisis.

- With Equity Residential's upcoming earnings report drawing attention, we'll examine how moderating rent growth in the sector influences the company's investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Equity Residential Investment Narrative Recap

To be a shareholder in Equity Residential, you need conviction in the enduring strength of premium urban rental demand, even as short-term rent growth turns negative for the first time since 2009. This recent shift could temper the sector’s near-term optimism, but its impact on the company’s most important catalyst, persistent high occupancy, appears limited, while the biggest risk remains potential pressure on new lease pricing as supply outpaces demand in key markets.

Of the recent company announcements, Equity Residential’s affirmation of same store revenue growth guidance (2.6% to 3.2%) and stable physical occupancy at 96.4% for 2025 is most relevant. This guidance offers perspective as moderating rents and rising concessions test whether the company can sustain robust occupancy and revenue in the months ahead.

Yet in contrast to the confidence of these forecasts, investors should be aware that conditions in supply-constrained coastal cities could shift quickly if...

Read the full narrative on Equity Residential (it's free!)

Equity Residential's outlook anticipates $3.5 billion in revenue and $669.9 million in earnings by 2028. This is based on an annual revenue growth rate of 4.3%, but reflects a projected earnings decrease of $330 million from the current $1.0 billion.

Uncover how Equity Residential's forecasts yield a $74.58 fair value, a 20% upside to its current price.

Exploring Other Perspectives

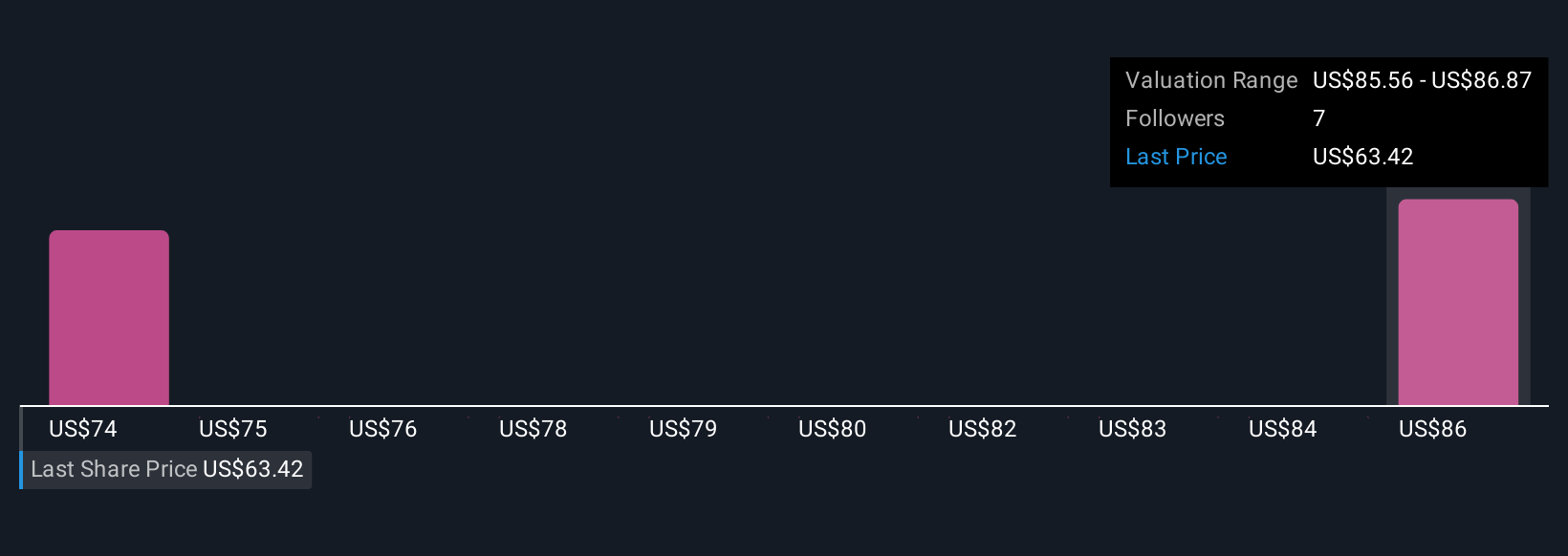

Three Simply Wall St Community estimates place fair value for Equity Residential between US$74.58 and US$86.66. While opinions vary, many are keeping an eye on elevated new multifamily supply as a wildcard that could weigh on returns, explore how others view future risks and opportunities.

Explore 3 other fair value estimates on Equity Residential - why the stock might be worth just $74.58!

Build Your Own Equity Residential Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Equity Residential research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Equity Residential research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Equity Residential's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equity Residential might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQR

Equity Residential

Equity Residential is committed to creating communities where people thrive.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives