- United States

- /

- Office REITs

- /

- NYSE:EQC

US Penny Stocks Spotlight: SPAR Group And 2 Other Promising Picks

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed results with a post-election rally losing momentum, investors are closely watching for opportunities amid shifting economic dynamics. Penny stocks, though an outdated term, continue to represent smaller or emerging companies that can offer significant value under the right conditions. By focusing on those with strong financial health and potential for growth, investors may uncover promising opportunities in this niche segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.63 | $2.03B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $128.29M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.8695 | $6.32M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.96 | $89.78M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.224099 | $8.25M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.48 | $48.84M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.755 | $13.39M | ★★★★★☆ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8405 | $75.59M | ★★★★★☆ |

Click here to see the full list of 720 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

SPAR Group (NasdaqCM:SGRP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SPAR Group, Inc. offers merchandising and brand marketing services across the Americas, Asia-Pacific, Europe, Middle East, and Africa with a market cap of $43.38 million.

Operations: The company's revenue is primarily derived from the Americas at $193.44 million, followed by the Asia-Pacific region at $18.35 million and EMEA at $17.08 million.

Market Cap: $43.38M

SPAR Group, Inc. has demonstrated resilience in the penny stock segment with a market cap of US$43.38 million and significant revenue from the Americas at US$193.44 million. Despite a recent decline in quarterly sales to US$37.79 million, the company reported strong net income for the first nine months of 2024 at US$10.11 million, marking substantial growth from last year. Its financial health is bolstered by short-term assets exceeding both long-term and short-term liabilities, while its return on equity stands out at an impressive 40%. However, earnings are forecasted to decline significantly over the next three years.

- Dive into the specifics of SPAR Group here with our thorough balance sheet health report.

- Assess SPAR Group's future earnings estimates with our detailed growth reports.

Equity Commonwealth (NYSE:EQC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Equity Commonwealth (NYSE: EQC) is a Chicago-based, internally managed and self-advised real estate investment trust (REIT) focused on commercial office properties in the United States, with a market cap of approximately $0.18 billion.

Operations: The company generates its revenue primarily from the ownership and operation of office properties, amounting to $58.43 million.

Market Cap: $181.39M

Equity Commonwealth, a real estate investment trust with a market cap of US$0.18 billion, has faced challenges typical of penny stocks. The company is debt-free and holds substantial short-term assets (US$2.3 billion), comfortably covering its liabilities. Despite this financial cushion, Equity Commonwealth reported a net loss of US$26.19 million in the recent quarter due to significant one-off expenses amounting to US$39.1 million. The company announced an initial liquidating distribution of $19 per share as part of its plan to dissolve and distribute proceeds to shareholders, reflecting strategic shifts amidst declining earnings over the past five years.

- Take a closer look at Equity Commonwealth's potential here in our financial health report.

- Assess Equity Commonwealth's previous results with our detailed historical performance reports.

Offerpad Solutions (NYSE:OPAD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Offerpad Solutions Inc. offers technology-enabled solutions for the residential real estate market in the United States, with a market cap of approximately $109.14 million.

Operations: The company's revenue is primarily generated from its Real Estate Operations & Development segment, amounting to $985.01 million.

Market Cap: $109.14M

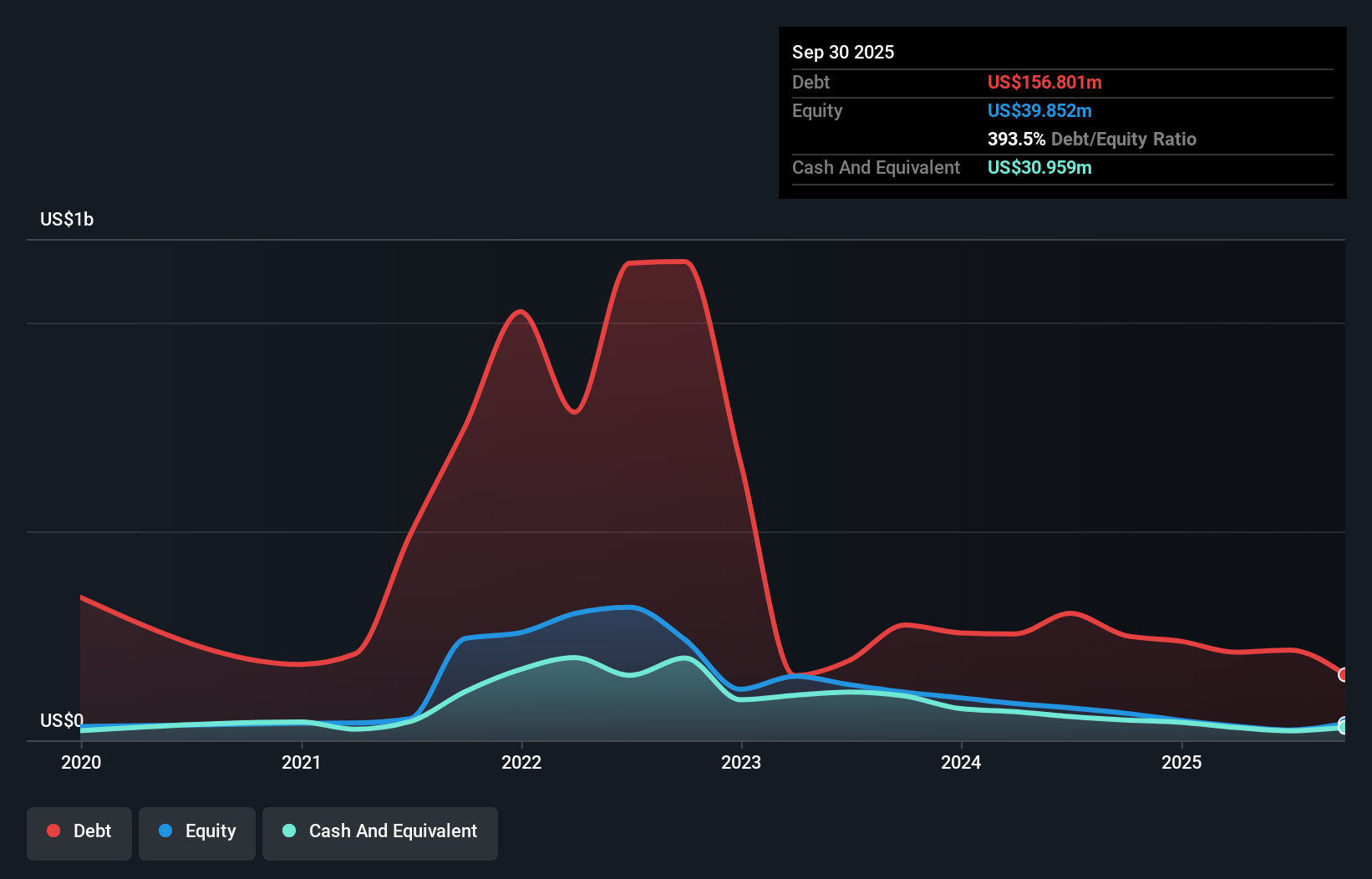

Offerpad Solutions Inc., with a market cap of US$109.14 million, operates in the residential real estate sector and has shown significant revenue generation, reporting US$208.07 million for Q3 2024. Despite this, the company remains unprofitable with a net loss of US$13.54 million for the same period and faces high debt levels with a net debt to equity ratio of 312.7%. Revenue is forecasted to grow by 20.2% annually, yet profitability remains elusive in the near term. Offerpad's short-term assets exceed its liabilities, providing some financial stability amidst ongoing volatility and challenges typical of penny stocks.

- Navigate through the intricacies of Offerpad Solutions with our comprehensive balance sheet health report here.

- Examine Offerpad Solutions' earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Click through to start exploring the rest of the 717 US Penny Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equity Commonwealth might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQC

Equity Commonwealth

Equity Commonwealth (NYSE: EQC) is a Chicago based, internally managed and self-advised real estate investment trust (REIT) with commercial office properties in the United States.

Flawless balance sheet and good value.