- United States

- /

- REITS

- /

- NYSE:EPRT

Did Cantor Fitzgerald’s Bullish Call and Rising Short Interest Just Shift EPRT’s Investment Narrative?

Reviewed by Sasha Jovanovic

- Essential Properties Realty Trust recently garnered greater attention after Cantor Fitzgerald initiated coverage with an Overweight rating, citing its appealing valuation, robust projected cash flow, and the completion of US$219 million in third quarter acquisitions, alongside a declared quarterly dividend of US$0.30 per share.

- An interesting development is that the company’s short interest has risen to 8.58% of float, substantially higher than industry peers, highlighting increased market scrutiny even as investor interest grows following its latest acquisitions and consistent dividend policy.

- With Cantor Fitzgerald’s positive analyst initiation and Essential Properties’ significant third quarter acquisitions, we’ll explore how these events influence the company’s investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Essential Properties Realty Trust Investment Narrative Recap

To be a shareholder of Essential Properties Realty Trust, one likely needs to believe in the durability of demand for service-oriented, single-tenant properties and the company’s ability to source accretive leaseback acquisitions. The recent Overweight rating from Cantor Fitzgerald and a substantial round of new acquisitions may reinforce confidence in growth drivers, but elevated short interest draws attention to revenue resilience and credit risk exposure, especially given the company’s concentration in sectors like car washes and restaurants. Ultimately, the news does not materially change the most important near-term catalysts or the principal risks, as the core narrative relies on sustainable occupancy and disciplined execution.

Essential Properties’ recent announcement of a US$0.30 per share quarterly dividend stands out as an affirmation of management’s commitment to consistent shareholder returns. With acquisitive expansion ongoing and dividend stability maintained, this announcement carries weight in the context of sector competition, interest rate risk, and committed payout levels.

Yet, with short interest much higher than peer averages, a signal investors should be aware of, especially if sector-specific challenges begin to weigh on earnings...

Read the full narrative on Essential Properties Realty Trust (it's free!)

Essential Properties Realty Trust is projected to reach $791.7 million in revenue and $320.5 million in earnings by 2028. This outlook is based on an assumed 16.3% annual revenue growth rate and a $97.4 million increase in earnings from the current $223.1 million.

Uncover how Essential Properties Realty Trust's forecasts yield a $35.89 fair value, a 23% upside to its current price.

Exploring Other Perspectives

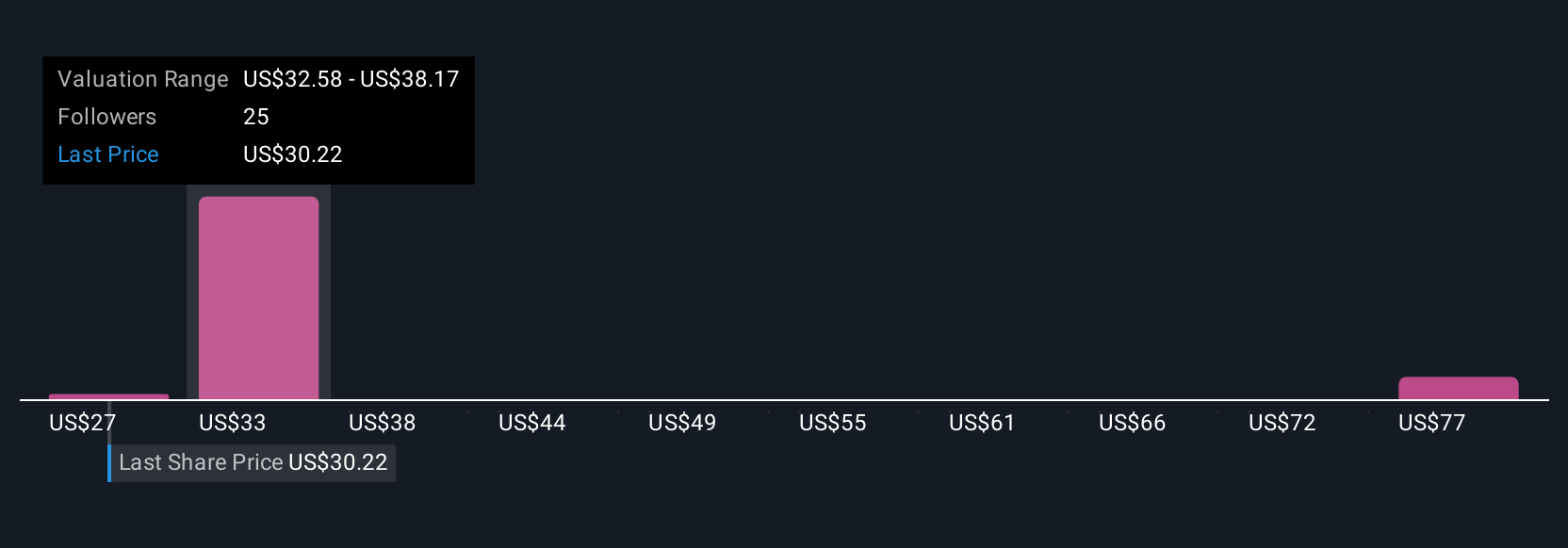

Simply Wall St Community members estimate fair value for Essential Properties Realty Trust between US$27 and US$79.89, with 4 separate perspectives included. While opinions span a wide range, rising sector competition and cap rate pressures could influence how those targets play out, reminding you that outlooks on business risks and rewards vary.

Explore 4 other fair value estimates on Essential Properties Realty Trust - why the stock might be worth over 2x more than the current price!

Build Your Own Essential Properties Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Essential Properties Realty Trust research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Essential Properties Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Essential Properties Realty Trust's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essential Properties Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPRT

Essential Properties Realty Trust

A real estate company, acquires, owns, and manages single-tenant properties in the United States.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives