- United States

- /

- Industrial REITs

- /

- NYSE:EGP

How EastGroup’s (EGP) Raleigh Expansion and Resilient Occupancy Are Shaping Its Investment Story

Reviewed by Sasha Jovanovic

- EastGroup Properties recently reported strong second quarter 2025 results, achieving 7.8% FFO per share growth year-over-year and maintaining high occupancy rates near 96%, while modestly reducing its development pipeline amid slower leasing of larger spaces.

- An interesting insight is that the company expanded in Raleigh with two new property investments, highlighting its ongoing focus on portfolio quality, geographic and tenant diversity, and financial strength in the face of macroeconomic uncertainties.

- We'll explore how EastGroup's continued high occupancy and targeted market expansion may impact its investment narrative going forward.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

EastGroup Properties Investment Narrative Recap

To be a shareholder in EastGroup Properties, you need to believe in the continued strong demand for industrial and logistics properties in high-growth Sunbelt markets, as well as the company's track record of maintaining high occupancy and steady rent growth. The recent news of robust Q2 2025 results, including 7.8% FFO per share growth and occupancy holding near 96%, supports this narrative and does not materially alter the biggest short-term catalyst, strong rent mark-to-market and portfolio stability. However, the pace of leasing for larger spaces and development starts remains the top risk in the near term, but the current developments haven't shifted this materially. Among EastGroup's recent announcements, the decision to modestly reduce its 2025 development pipeline to US$215 million stands out. This move reflects the slower leasing environment for larger assets but aligns with the company’s focus on protecting occupancy and rent growth, keeping short-term earnings and financial strength as priorities as it expands selectively into markets like Raleigh. But investors should also keep in mind that, even with resilient occupancy rates, ongoing tenant health risks in markets like California may yet impact earnings...

Read the full narrative on EastGroup Properties (it's free!)

EastGroup Properties is projected to reach $921.3 million in revenue and $339.7 million in earnings by 2028. This outlook assumes a 10.8% annual revenue growth rate and a $103.2 million increase in earnings from the current $236.5 million.

Uncover how EastGroup Properties' forecasts yield a $188.28 fair value, a 8% upside to its current price.

Exploring Other Perspectives

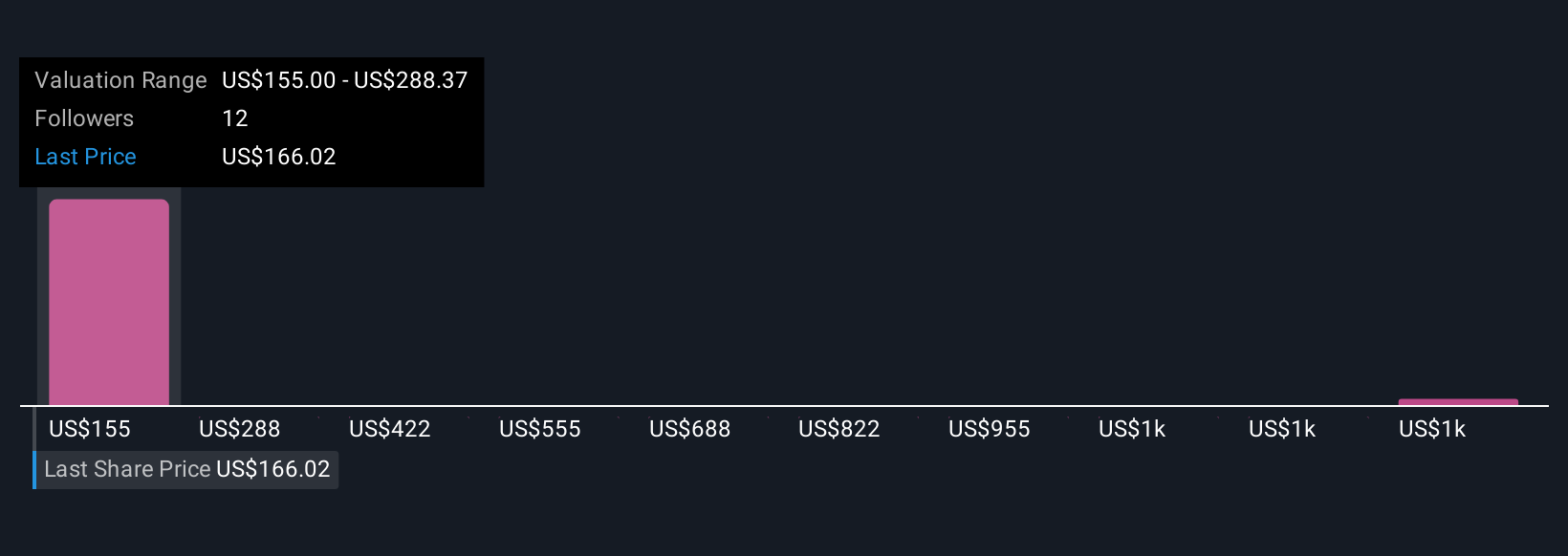

Five distinct fair value estimates from the Simply Wall St Community range from US$155 up to more than US$1,488, showcasing sharp differences in outlook. High occupancy rates continue to support positive sentiment, yet questions remain about larger tenant leasing that could shape future performance, explore how other community members view these issues for your own insight.

Explore 5 other fair value estimates on EastGroup Properties - why the stock might be worth 11% less than the current price!

Build Your Own EastGroup Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EastGroup Properties research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EastGroup Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EastGroup Properties' overall financial health at a glance.

No Opportunity In EastGroup Properties?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EastGroup Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EGP

EastGroup Properties

EastGroup Properties, Inc. (NYSE: EGP), a member of the S&P Mid-Cap 400 and Russell 2000 Indexes, is a self-administered equity real estate investment trust focused on the development, acquisition and operation of industrial properties in high-growth markets throughout the United States with an emphasis in the states of Texas, Florida, California, Arizona and North Carolina.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives